What just happened? AMD's continuing success isn't showing any signs of slowing down. Team red has just released its earnings report for the third quarter, and it's another record-breaker that beat expectations. Not only was it the company's most successful Q3, but it was also AMD's best quarter ever.

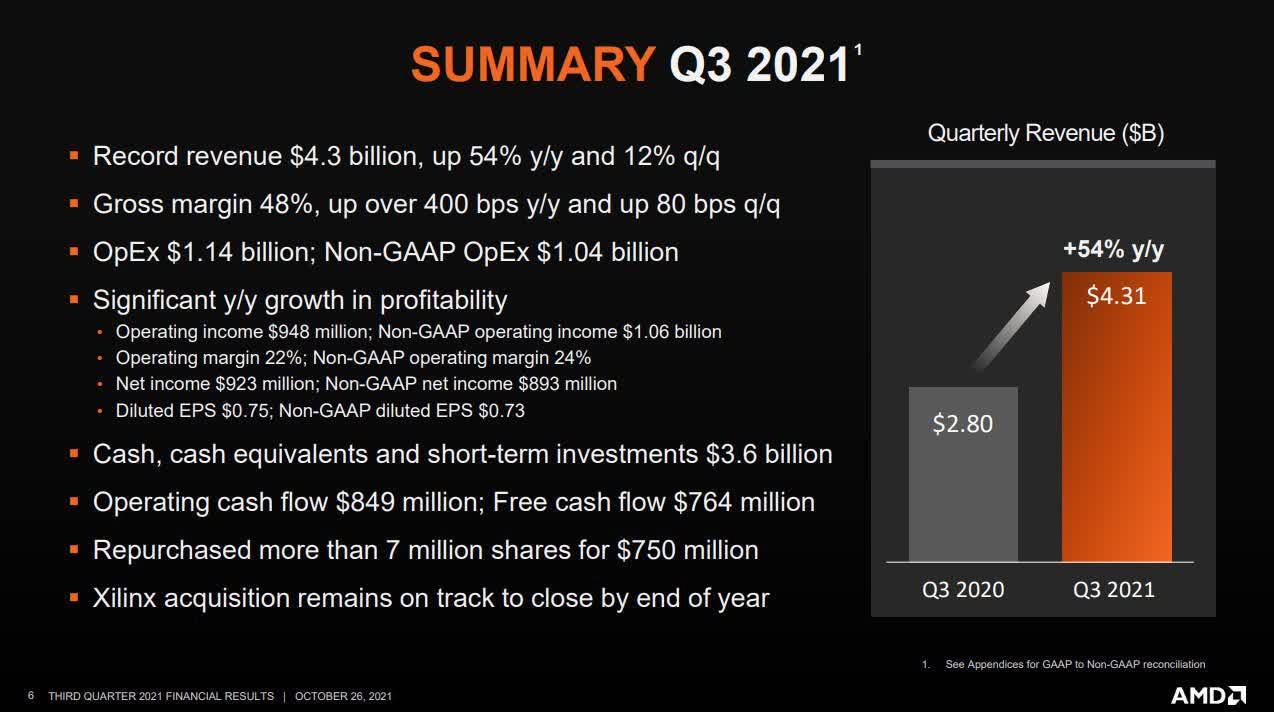

AMD generated $4.3 billion in revenue for the three months ending in September with operating income of $948 million, net income of $923 million, and diluted earnings per share of $0.75, beating analysts' expectations of $4.11 billion in revenue and net profit of 66 cents per share.

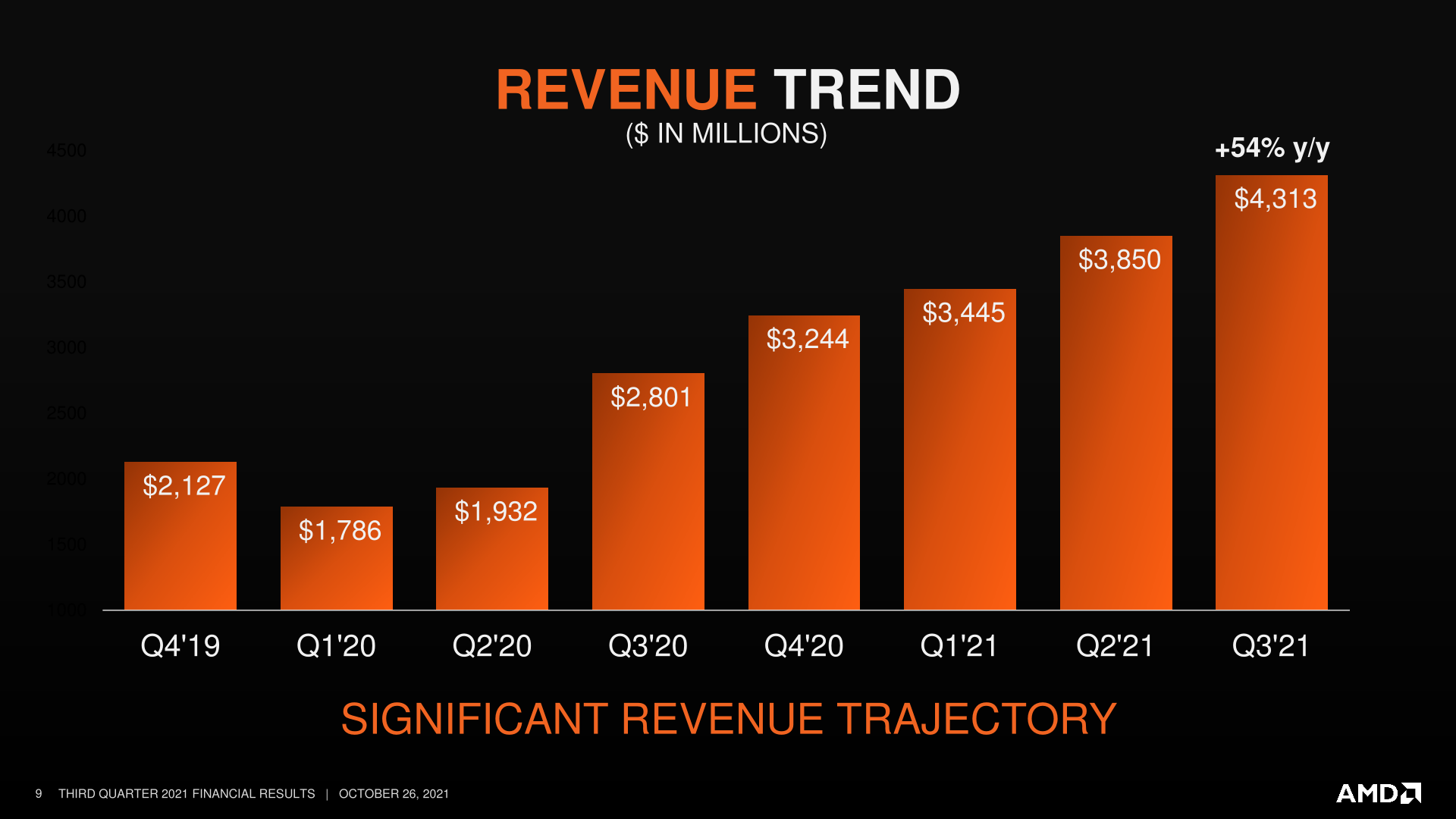

Revenue is up 54% compared to last year, making it the company's best-ever quarter and marking yet another quarterly report to show growth, a trend that stretches back to the second quarter of 2020.

"We delivered our fifth straight quarter of greater than 50 percent year-over-year revenue growth with each of our businesses growing significantly year-over-year and data center sales more than doubling," said AMD CEO Lisa Su. "3rd Gen Epyc processor shipments ramped significantly in the quarter as our data center sales more than doubled year-over-year. Our business significantly accelerated in 2021, growing faster than the market based on our leadership products and consistent execution."

The company's Computing and Graphics segment, which includes AMD's desktop and laptop CPU sales and its GPU sales, brought in $2.4 billion in revenue, up 44% year-over-year and 7% quarter-over-quarter, while operating income was up by $129 million YoY to $513 million, though higher operating expenses meant that figure was down slightly compared to the previous quarter.

Elsewhere, the Enterprise, Embedded and Semi-Custom segment revenue was up 69% YoY to $1.9 billion, thanks to Epyc sales and huge demand for the AMD-powered latest consoles from Microsoft and Sony.

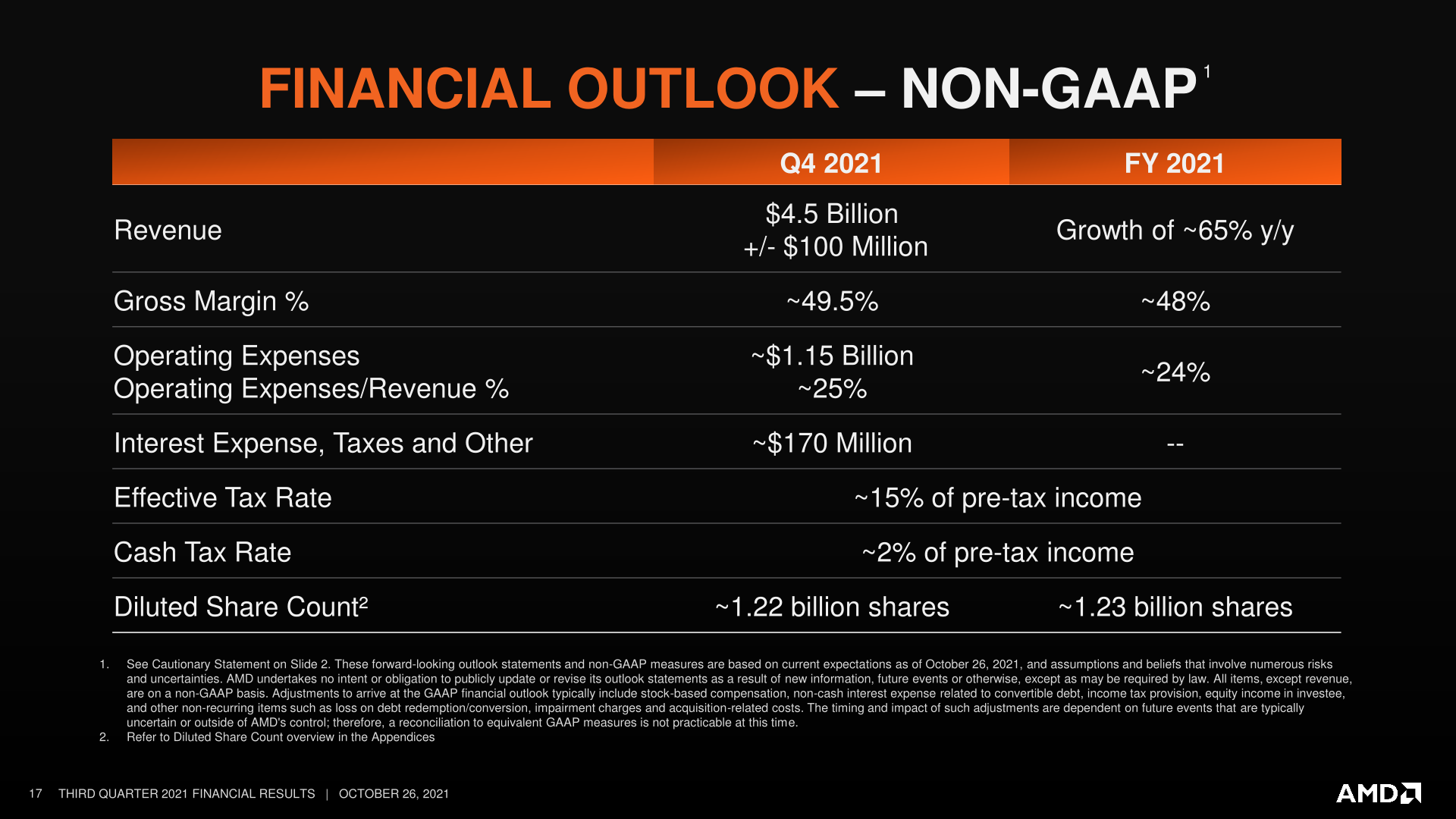

Despite Su's belief that the chip shortage will last into the second half of 2022—more optimistic than Intel CEO Pat Gelsinger's 2023 prediction—AMD has improved its forecasts for the fourth quarter and the year. It expects a record $4.5 billion in Q4 2021, which would be up 41% YoY, while full-year 2021 growth is predicted to be up 65% compared to 2020's $9.8 billion. Intel, in contrast, is concerned that its sales could slow in Q4, even though Alder Lake is about to drop.

"Our supply chain team has executed extremely well in a challenging environment, delivering incremental supply throughout the year supporting our strong revenue growth," Su added. "We are also investing significantly to secure additional capacity to support our long-term growth."

Su also said AMD is on track to complete its acquisition of field-programmable gate array (FPGA)-maker Xilinx by the end of this year as it is making good progress toward securing the required regulatory approvals.

https://www.techspot.com/news/91955-amd-had-best-quarter-ever.html