Rumor mill: AMD is reportedly in the advanced stages of buying field-programmable gate array (FPGA)-maker Xilinx for more than $30 billion. Should the talks be successful, a deal could be reached as early as next week.

The Wall Street Journal notes in its report that discussions between the two companies regarding a takeover have stalled in the past, so there’s no guarantee we’ll see AMD acquiring Xilinx. If it does happen, though, it would be another massive deal in the consolidating chip industry—Nvidia is in the process of buying chip designer ARM for $40 billion.

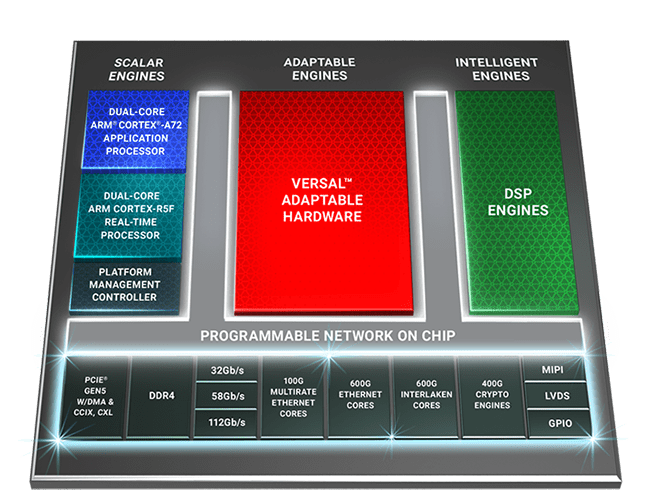

Xilinx has been focusing heavily on the data center in recent years. A buyout by AMD would give team red an arsenal of new products to compete against Nvidia and its data center GPUs. Xilinx’s Versla Premium line—its next-gen 7nm Adaptive Compute Acceleration Platform (ACAPs) products—is designed for high bandwidth networks and boasts features including 123TB/s bandwidth across its network-on-chip (NOC) and PCIe 5.0 support.

Xilinx products are found beyond the data center. They’re also used in wired & wireless communications, AI, Machine Learning, automotive, industrial, consumer, aerospace, and defense industries.

A Xilinx acquisition would help AMD in its battle against Intel. Back in 2015, Chipzilla acquired Xilinx rival Altera for $16.7 billion, integrating the firm into its Programmable Solutions Group (PSG) and acquiring its FPGA line. Intel will have been watching the Ryzen 5000 reveal last night, which included “the fastest gaming CPU,” and AMD could soon be giving its rival new headaches in other markets.

Image credit: michelmond

https://www.techspot.com/news/87045-amd-reportedly-talks-acquire-xilinx-30-billion.html