In brief: If you are an Apple Card owner and you're looking to buy one or more of Apple's latest devices, you can get a cashback of 6 percent until December 31, even with an instalment plan. That means that if you want to buy a maxed-out or even a mid-range Mac Pro, you can get enough money back to buy an iPad Pro or a MacBook Pro 16.

If the Apple Card wasn't appealing enough for you before, the company is now offering 6 percent Daily Cash cash back if you decide to purchase new Apple products. This means you get double cash back through the holiday season, as long as you live in the US and are looking to get your hands on the company's latest devices.

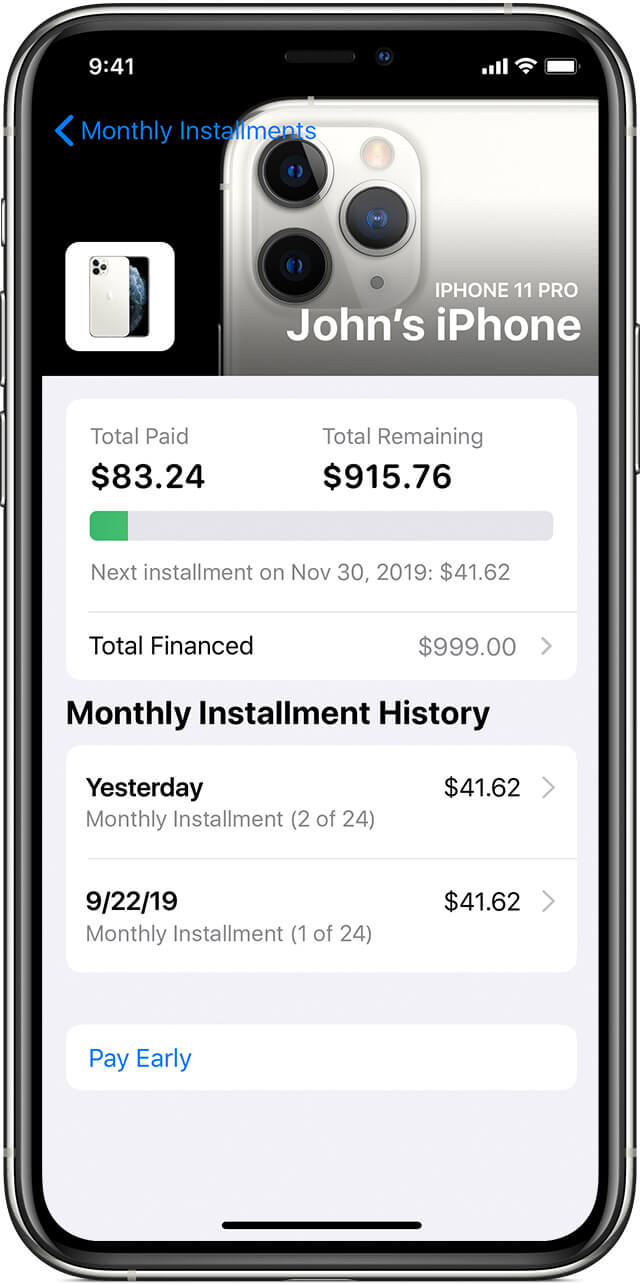

Apple first introduced the ability for customers to set up an interest-free financing plan through Apple Card back in October, during an investor call. This is the same 24-month instalment loan the company offers through the iPhone Upgrade Program, which now applies to purchases made on Apple.com, the Apple Store app, or in physical Apple Stores.

The new plan is the company's latest effort to sway customers towards direct purchases as opposed to going through carriers or retailers. However, it doesn't apply to services like Apple Music or even AppleCare. You can only get the standard 3 percent cash back on purchasing iCloud storage and Apple Music.

You can manage payments directly through the Wallet app on your iPhone, and the company says the minimum payment is automatically adjusted to take your monthly instalment plans into account, so you only have to make one payment on the last day of the month.

Apple CEO Tim Cook told investors in October that monthly instalment plans are meant to bring the up-front cost of iPhone down. And this would also explain why the company told suppliers to prepare for more than 100 million orders of the iPhone 12, which is expected to feature 5G connectivity.

https://www.techspot.com/news/83129-apple-card-owners-can-now-buy-apple-products.html