Cutting corners: A new report has reignited the debate over how much tax the world's largest technology companies pay, revealing that the so-called "Silicon Six" – Amazon, Apple, Alphabet, Meta, Microsoft, and Netflix – have paid nearly $278 billion less in corporate income tax over the past decade than would be expected if their profits were taxed at the average statutory rate for US companies.

The analysis, conducted by the Fair Tax Foundation (FTF), scrutinizes the financial records and tax strategies of these digital giants, whose combined market capitalization now exceeds $12.9 trillion, making them collectively more valuable than the entire FTSE 100 and Euro Stoxx 50 indices.

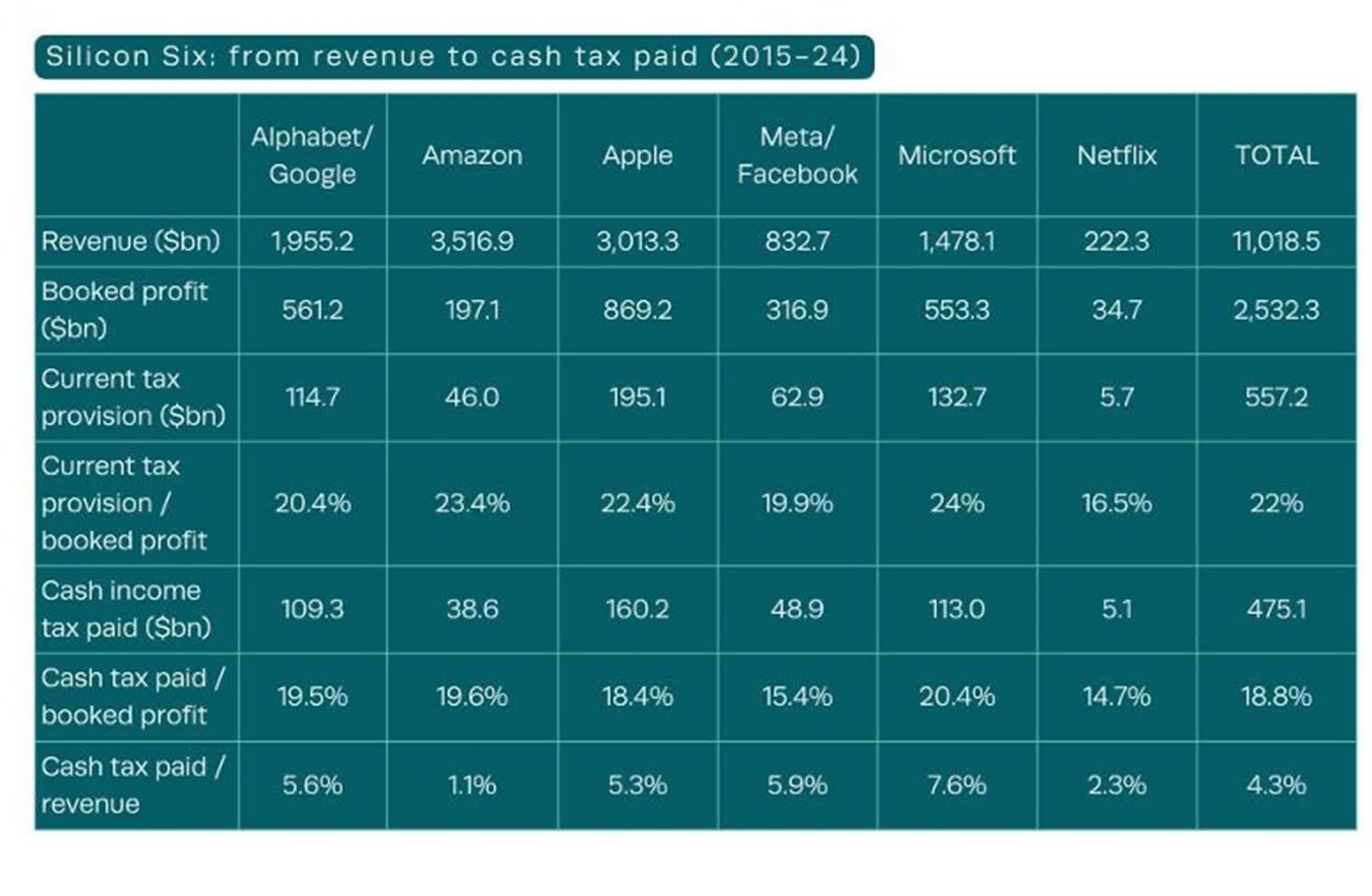

According to the FTF, the Silicon Six generated $11 trillion in revenue and $2.5 trillion in profits over the last ten years. Despite these staggering figures, their average effective corporate tax rate was just 18.8 percent, well below the U.S. average of 29.7 percent during the same period and the global average of 27 percent.

If one-off repatriation tax payments related to historical tax avoidance are excluded, their effective rate drops further to 16.1 percent. The report also highlights that these companies have inflated their reported tax payments by $82 billion by including tax contingencies – amounts set aside for potential future tax liabilities that they do not expect to pay.

Paul Monaghan, chief executive of the Fair Tax Foundation, argues that tax avoidance remains "hardwired" into these firms' business models. He points to aggressive tax practices, such as booking profits in low-tax jurisdictions and leveraging tax breaks like the US Foreign-Derived Intangible Income (FDII) deduction, which allows companies to pay as little as 13 percent tax on certain overseas profits.

The FDII has been particularly lucrative: in 2024 alone, it yielded $12 billion in tax relief for the Silicon Six, and over the past three years, the benefit has totaled $30 billion. For Meta, Alphabet, and Netflix, the deduction reduced their effective tax rates by five percentage points each last year.

The FTF's report ranks Amazon as having the "worst tax conduct," citing its profit-shifting practices, such as booking a significant portion of its UK income in Luxembourg, a low-tax jurisdiction. However, Amazon's average corporate tax rate over the decade was 19.6 percent, higher than Netflix (14.7 percent), Meta (15.4 percent), and Apple (18.4 percent). Microsoft paid the highest rate at 20.4 percent.

Despite nearly half of their revenue being generated overseas, only 36 percent of profits were booked outside the United States, and just 30 percent of current tax provisions were reported as foreign, suggesting that much of their international income is subject to lower tax rates due to profit-shifting and lower margins.

The report also draws attention to the growing gap between the taxes these companies actually pay and what is reported in their financial statements. Over the decade, the difference between headline tax rates and cash taxes paid reached $277.8 billion, while the gap between reported tax provisions and cash taxes paid was $82.1 billion.

The FTF notes that the Silicon Six's reported uncertain tax positions – essentially, claims for tax benefits that may not withstand scrutiny – have more than tripled in the past ten years, now totaling $82.5 billion. These positions and an additional $10.1 billion in potential interest and penalties may further inflate the companies' reported tax charges, giving a misleading impression of their actual contributions.

In response to the report, Amazon, Meta, and Netflix representatives emphasized their compliance with existing tax laws and regulations. Amazon highlighted its significant investments in jobs and infrastructure, arguing that these, combined with low-profit margins, naturally result in a lower cash tax rate. Meta and Netflix similarly stated that they follow all relevant tax rules in every country where they operate.

The influence of the Silicon Six extends beyond their financial might. In 2024, they spent $115 million lobbying governments in the United States and the European Union, underscoring their substantial political clout. At the same time, their tax strategies are drawing increasing scrutiny from policymakers worldwide, prompting a patchwork of responses such as digital services taxes in countries like the UK, France, Austria, and Turkey. While not ideal, these unilateral measures are seen as necessary steps in the absence of a global consensus on how to tax digital multinationals fairly.

Big Tech avoided $278 billion in corporate tax over the past decade, says watchdog