What just happened? Even by Elon Musk's standards, a lot has happened to the billionaire over the last few days: positive and negative Covid-19 tests, the launch of four astronauts into space inside a vehicle built by one of his companies, and now a $15 billion boost to his personal fortune, putting the CEO ahead of Mark Zuckerberg as the third-richest person in the world.

Musk's extra wealth comes after Tesla was accepted into the S&P 500, which measures the stock performance of 500 large companies listed on the US stock exchanges. Tesla failed to make the cut back in September but will now enter the index on December 21 as the largest new entrant in the group's history with a valuation of $386 billion. That amount puts it above Nvidia, Mastercard, Walt Disney, and Verizon.

After reporting losses for much of its existence, Tesla has experienced five consecutive quarters of profit, helping it meet the criteria for entry into the S&P 500.

"(Tesla) will be one of the largest weight additions to the S&P 500 in the last decade, and consequently will generate one of the largest funding trades in S&P 500 history," a spokesman for S&P Dow Jones Indices said, via the BBC.

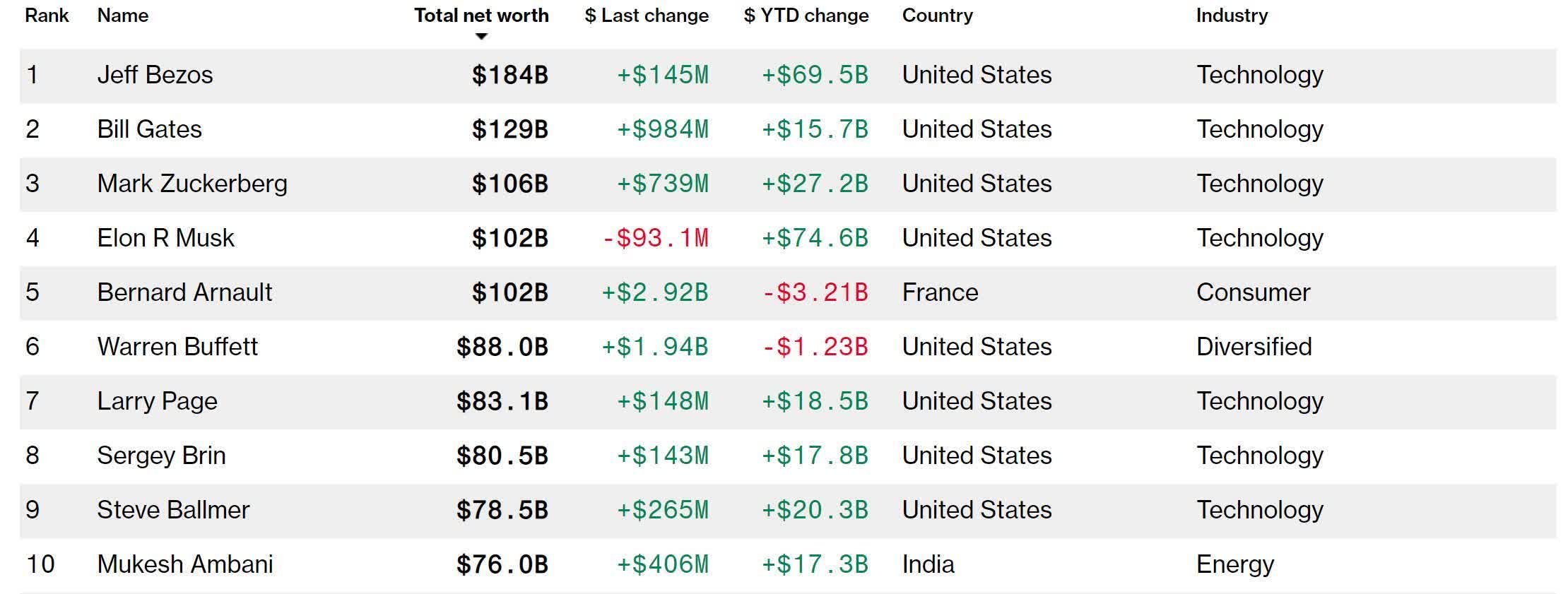

Bloomberg reports that Tesla's stock closed at $408 yesterday. With his 20 percent share in the company, Musk's net worth increased to $117.5 billion. The Bloomberg Billionaires Index currently has him in fourth place with $102 billion as the recent jump has yet to be added. When it is, Musk will be ahead of Zuckerberg ($106 billion) while sitting behind Bill Gates ($129 billion), and Jeff Bezos ($184 billion). Musk does top the list when it comes to year-on-year wealth gains, though, having added $90 billion (the list still states $74.6 billion) to his personal fortune over the last 12 months.

Musk is actually above Zuckerberg with a $117 billion fortune

Musk, who has long downplayed the seriousness of coronavirus, last week tweeted that he'd taken four Covid-19 tests, receiving two negative and two positive results on the same day. There was better news to follow: NASA launched a crew into orbit on a mission to the International Space Station using a commercial spacecraft built and operated by Musk's SpaceX company.

https://www.techspot.com/news/87632-elon-musk-wealth-increases-15-billion-set-pass.html