Pete Flint

Posts: 40 +7

A hot potato: GameStop's stock spiked on Friday when hedge funds sensed a drop in stock price and attempted to "short" the market. A group of redditors bolstered enthusiasm for the stock however and forced traders to quickly buy back the stock for fear of losses, leading to a massive 69 percent rise in stock price in just one day.

Video game retailer GameStop's stock rose by nearly 70 percent on Friday causing a halt in trading. The price spike in the company’s market value was attributed in part to a group of day traders on the subreddit r/wallstreetbets, which led to a scramble by investment firms to capitalize on the pricey stocks.

Update (1/27): Craze is far from over. The virtual inflation of GameStop's stock has the company now valued at $22 billion as the share price escalated to over $320 on Wednesday. Meanwhile, the same r/wallstreetbets reddit group is now targeting other stocks like AMC Theatres and Blackberry.

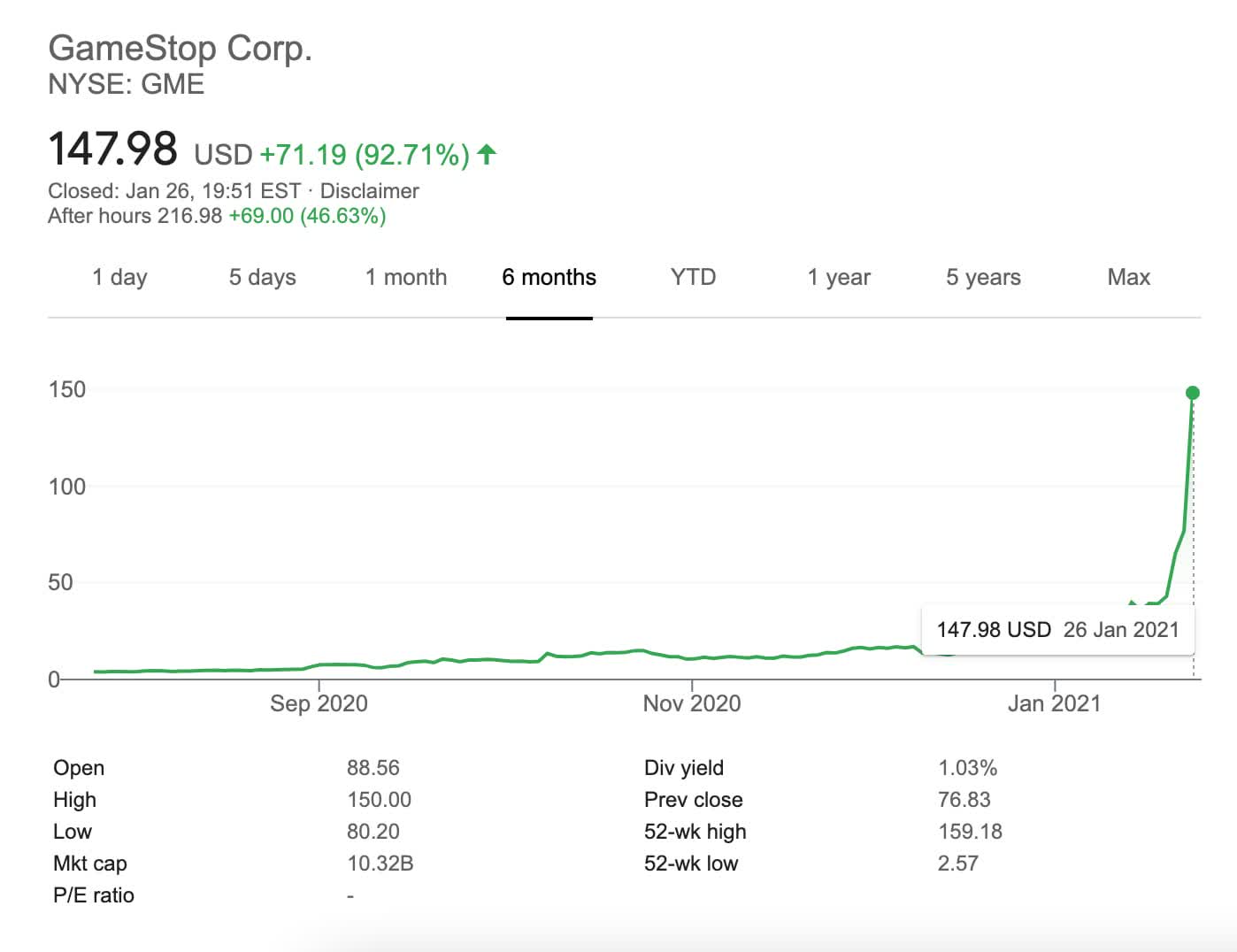

Update (1/26): At the market closing Tuesday, GameStop's stock was valued at $147.98 per share, climbing 92% in a single day's trading. By most metrics, it's unsustainable and not reflecting reality, however if for any reason you owned some GameStop stock, congratulations. Time to sell.

Update (1/25): As of market opening on Monday, GameStop's stock soared again to over $115, not ceasing to amaze, even though it's clear this is the result of price manipulation.

The video game retailer's stock price is up more than 250 percent compared with this time last year following to appointment of GameStop’s newest board member, Chewy co-founder Ryan Cohen.

Hedge fund Citron Research aimed to short GameStop’s stock following Cohen’s appointment, expecting stock prices to fall, however the Reddit's traders quickly led to what is called a “short squeeze.”

For fans of the film The Big Short, it is difficult to compete with Margot Robbie market-splaining investment strategies from a bubble bath with a glass of champagne, but here is a valiant effort.

When traders sense that a company’s stock will fall, they can “short” the market by borrowing stocks from other investors and sell it at a high price. When the stock falls, they buy it back for profit. Other firms will typically see this trend and follow suit. The activity of this avid Reddit group however led to an upward trend in the stock that caused the shorts to quickly buy back their stock to make up for their losses, often to the detriment of their competitors.

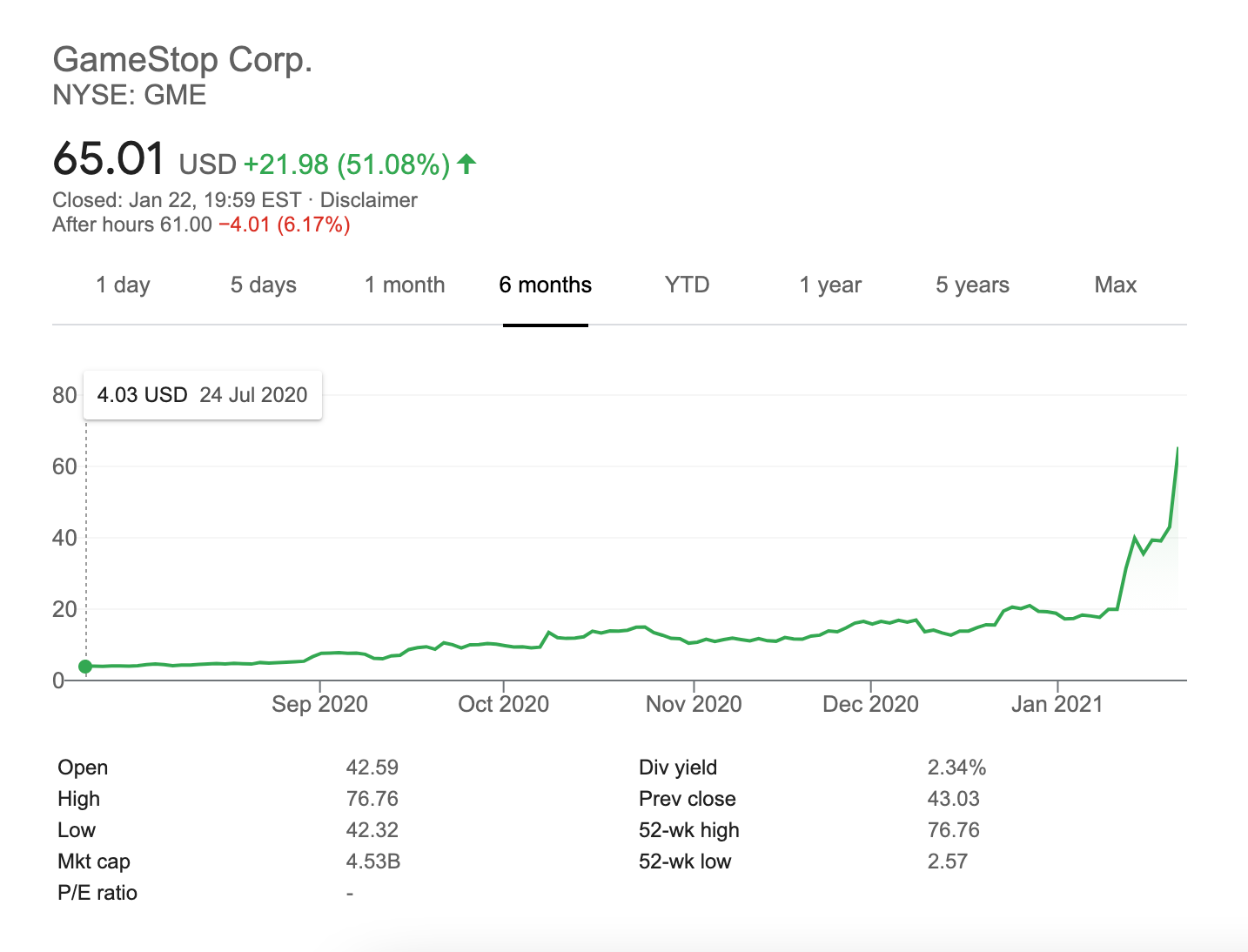

Before long, GameStop’s stocks were priced at $76.76, a massive climb from the $20 price tag on January 12.

A Bloomberg article deemed GameStop the most actively-traded and most-shorted stock on the market. The stock market froze trading in GameStop multiple times due to high instability on Friday when it rose 69 percent, though it has since resumed.

When trading ceased on Friday, GameStop’s stock was up more than 50 percent within 24 hours, with a market value at $4.5 billion.

Tomorrow am at 11:30 EST Citron will livestream the 5 reasons GameStop $GME buyers at these levels are the suckers at this poker game. Stock back to $20 fast. We understand short interest better than you and will explain. Thank you to viewers for pos feedback on last live tweet

— Citron Research (@CitronResearch) January 19, 2021

Citron responded to the recent activity by warning those investing in the stock that it would soon fall back to $20, tweeting that “buyers at these levels are the suckers at this poker game.”

https://www.techspot.com/news/88390-gamestop-stock-hits-record-high-reddit-group-causes.html