Two big research firms have released their regular reports showing the state of the global PC market this past quarter—and the news isn’t great. IDC’s more positive data shows YoY shipments completely flat, while Gartner says the industry has declined for the fourteenth quarter in a row.

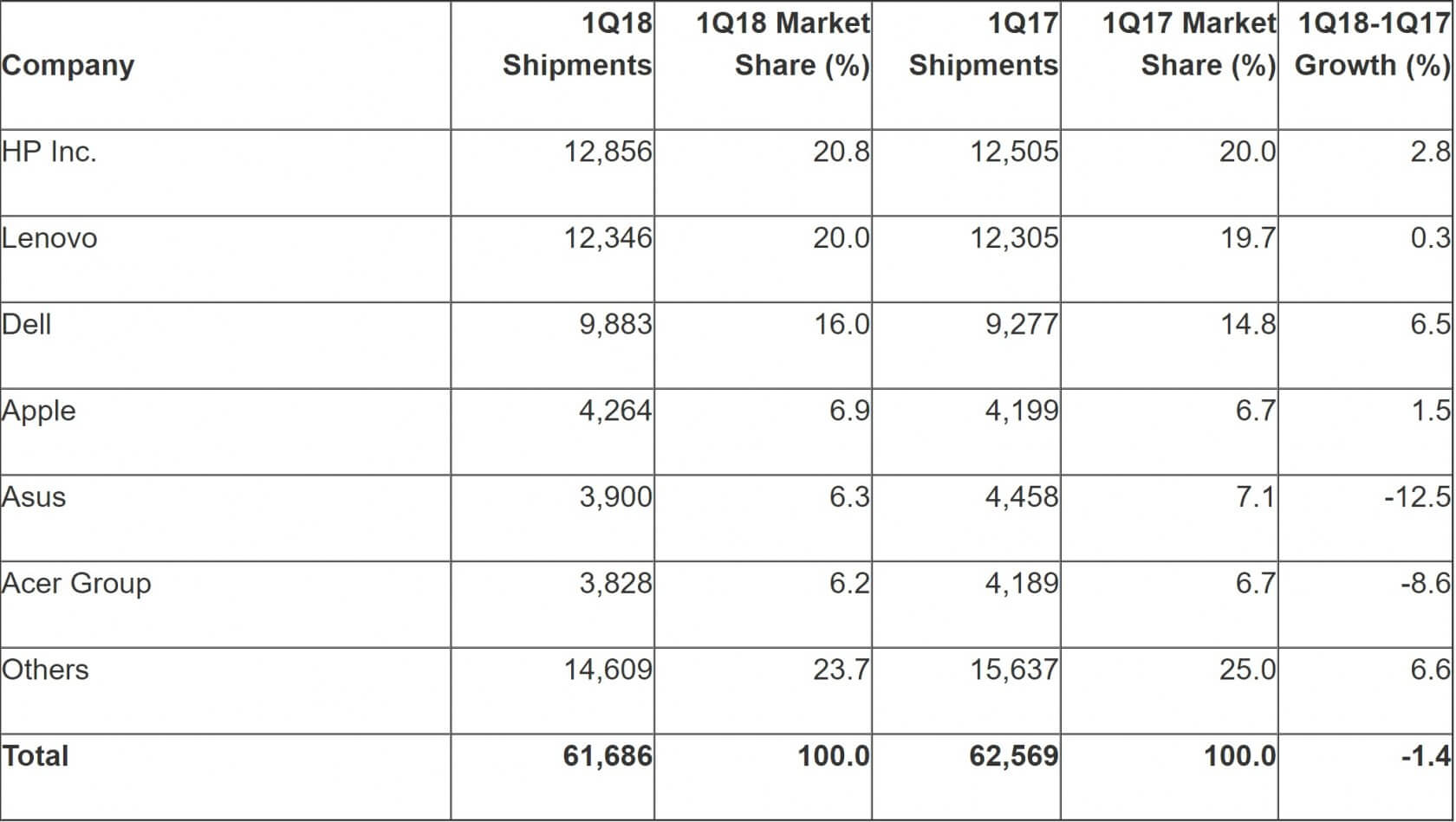

Gartner has PC shipments falling 1.4 percent to 61.7 million units in Q1 2018. Out of the top six companies, it was only Asus and Acer that saw declines, but their drops were so high that they dragged the total into negative figures. A couple of bright spots came from Dell, which was up 6.5 percent, and an ‘others’ section that went up 6.6 percent.

Gartner notes that the top three vendors—HP, Lenovo, and Dell—accounted for 56.9 percent of all shipments. It’s thought that updates to Dell systems such as the excellent XPS 13 contributed to its impressive growth, as did the popularity of its Alienware gaming line.

HP continues to lead the pack, with Lenovo close behind. Apple, which had growth of 1.5 percent, sits above the two companies with negative growth. It’s worth noting that Gartner’s data includes desktops, notebooks, and ultramobile premiums (including Microsoft Surface) but not Chromebooks or iPads.

There are a few differences in IDC’s report, including the overall market being flat instead of in decline. The top three remain the same, though HP has higher growth and Lenovo is flat. But the most significant change is Apple, which IDC claims has seen its YoY shipments fall 4.8 percent. The ‘others’ section is also in negative figures—minus 3.9 percent.

Analysts blame several factors on the declines. China was a major contributor: government agencies and big businesses have put off new purchases and upgrades following the National People’s Congress and the resulting new policies and reassignments. Unsurprisingly, component shortages and spiraling material prices also played a part.

“The component shortage that initially impacted portions of 2017 led some vendors to stock up inventory to avoid expected component price hikes, and that led to some concerns of excess stock that would be hard to digest in subsequent quarters,” said IDC research manager Jay Chou, in a statement. “However, the market is continuing on a resilient path that should see modest commercial momentum through 2020.”

https://www.techspot.com/news/74125-global-pc-shipments-continue-fall-but-dell-shows.html