Bottom line: Intel's latest quarterly earnings were nothing short of ugly, prompting restructuring plans. It is quite the change for a company that was once among the 30 best stocks in the world. Analysts are increasingly skeptical about CEO Pat Gelsinger's ability to execute a successful turnaround, especially as Intel struggles to keep pace with AMD and Nvidia.

Intel is facing its most significant crisis in decades. The company's recent quarterly earnings report paints a grim picture, with revenue falling far short of expectations and a bleak forecast for the coming months.

It reported revenue of $12.83 billion, down 1% from the previous year, missing analyst expectations of $12.94 billion. It also lowered its forecast for the current quarter to between $12.5 billion and $13.5 billion, down from estimates of $14.35 billion.

"Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones," CEO Pat Gelsinger said. "Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies."

In response to these financial challenges, Intel also announced a sweeping cost-reduction plan. The company aims to cut its workforce by over 15 percent by year-end, restructure operations, and slash operational expenses by more than $10 billion in the upcoming year. This plan includes a 20-percent reduction in capital expenditures, significant cuts to R&D, and discontinuing underperforming products.

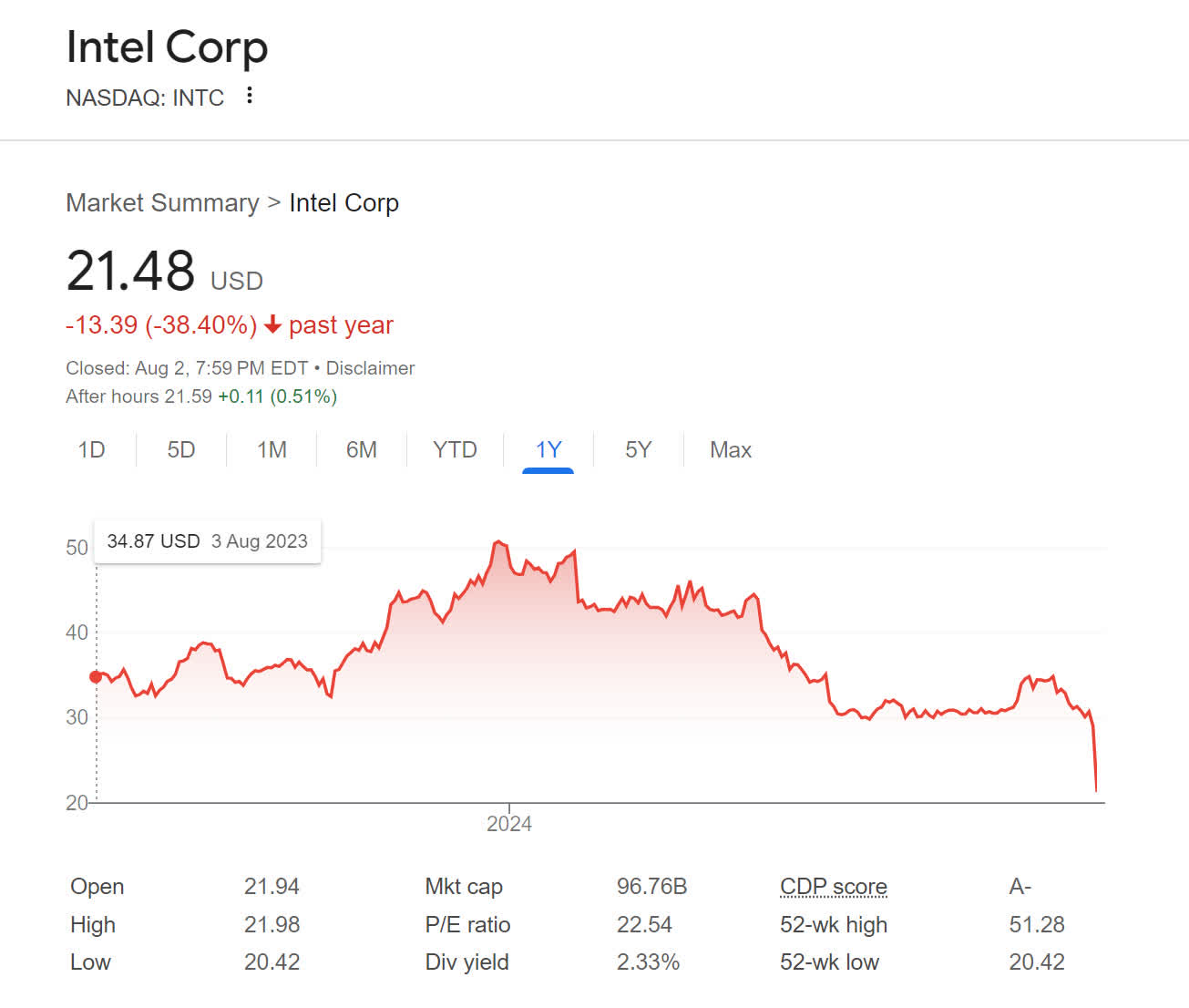

The market reaction was swift and severe. Intel's shares plummeted 26 percent in a single day – the worst trading day for the company since 1974 – wiping out over $30 billion in market value. The stock closed at $21.48, its lowest point since 2013, raising questions about the company's ability to attract investors in the future.

It remains questionable whether investors will return, considering the stock has barely budged over the past 25 years. Kiplinger is calling it a "catastrophe" for long-term investors.

Intel's struggles stem from its failure to capitalize on major technological shifts. The company notably missed the mobile revolution and now lags behind Nvidia in the burgeoning field of generative AI.

"Intel's issues are now approaching the existential in our view," Bernstein analyst Stacy Rasgon said.

For example, Intel's Foundry division, responsible for over two-thirds of Intel's products and producing chips for third parties, saw its revenue slightly rise to $4.3 billion in the second quarter, compared to $4.2 billion in the same period last year. However, the unit's losses deepened to $2.8 billion, up from $1.9 billion in Q2 2023 and $2.5 billion in Q1 2024. These are substantial losses for a vital division and contributed significantly to Intel's financial struggles.

More to the point, the Foundry division is crucial to Intel's IDM 2.0 strategy and its efforts to compete with TSMC in the semiconductor foundry market. Its losses indicate challenges in this strategic transformation. Even worse, Intel expects the operating losses of its foundry business to peak in 2024 and aims to reach break-even operating margins by around 2027.

Perhaps not surprisingly, some investors and analysts now doubt whether CEO Pat Gelsinger can execute the expensive restructuring of Intel's operations that he initiated upon taking the helm in early 2021 when he vowed to restore the former prestige of the already faltering company. These plans significantly expand Intel's chip-manufacturing footprint by constructing new factories in Arizona, Oregon, Ohio, and Europe, costing tens of billions each. Concurrently, Intel aims to establish a business for contract chip manufacturing for external circuit designers, a field in which it had previously struggled to gain a foothold.

"Turnarounds in tech are not very easy," said Ivana Delevska, chief investment officer of asset manager Spear. "You really need to have a lot of things going for you, and it needs to come from the technology side. Leadership changes can only do so much."

Gelsinger says he is resolute in steering Intel back on course.

"We must improve our execution, adapt to new market realities and operate as a more agile company," he wrote in an email to employees after Thursday's earnings report. "That's the spirit of the actions we are taking – knowing that the choices we make today, as difficult as they are, will strengthen our ability to serve our customers and grow our business for years to come."

Intel faces crisis as revenue misses and a bleak forecast shakes investor confidence