What just happened? Intel is preparing to lay off as much as one-fifth of its factory workforce in a move that will reshape one of the company's core business units. The layoffs, set to begin in July, are expected to affect more than 10,000 employees worldwide, marking one of the largest workforce reductions in Intel's history.

In a memo to employees, Intel Manufacturing Vice President Naga Chandrasekaran acknowledged the gravity of the decision. "These are difficult actions but essential to meet our affordability challenges and current financial position of the company. It drives pain to every individual," Chandrasekaran wrote, according to The Oregonian. The company is targeting job reductions between 15 percent and 20 percent, with most of the cuts taking place next month.

Intel declined to comment directly on the memo, but reiterated its commitment to "treat people with care and respect as we complete this important work." The company emphasized that "removing organizational complexity and empowering our engineers will enable us to better serve the needs of our customers and strengthen our execution. We are making these decisions based on careful consideration of what's needed to position our business for the future."

The layoffs will primarily impact Intel's foundry division, which includes a wide range of roles from technicians on the factory floor to researchers developing future generations of microprocessors. While Intel has not disclosed the exact number of factory workers, estimates suggest that about half of its 109,000 employees work in production or related services, meaning the cuts could eliminate between 8,000 and 11,000 jobs globally.

This round of layoffs comes after Intel eliminated 15,000 jobs across the company in 2024. The company is responding to a prolonged decline in sales and a challenging outlook, driven by stiff competition in the PC and data center markets and missed opportunities in artificial intelligence chips.

Intel reported an $821 million loss in the first quarter of 2025 and has steadily reduced its headcount from nearly 125,000 in 2023.

Unlike last year, when job reductions included buyouts and early retirement offers, Intel does not plan to offer voluntary departures this time. Instead, the company will select which workers to let go based on investment priorities and individual performance. "These reductions will be based on a combination of portfolio changes, level and position elimination, skill assessment for remaining positions, and some hard decisions around our project investments. We are also taking into consideration factory operations impact," Chandrasekaran stated in the memo.

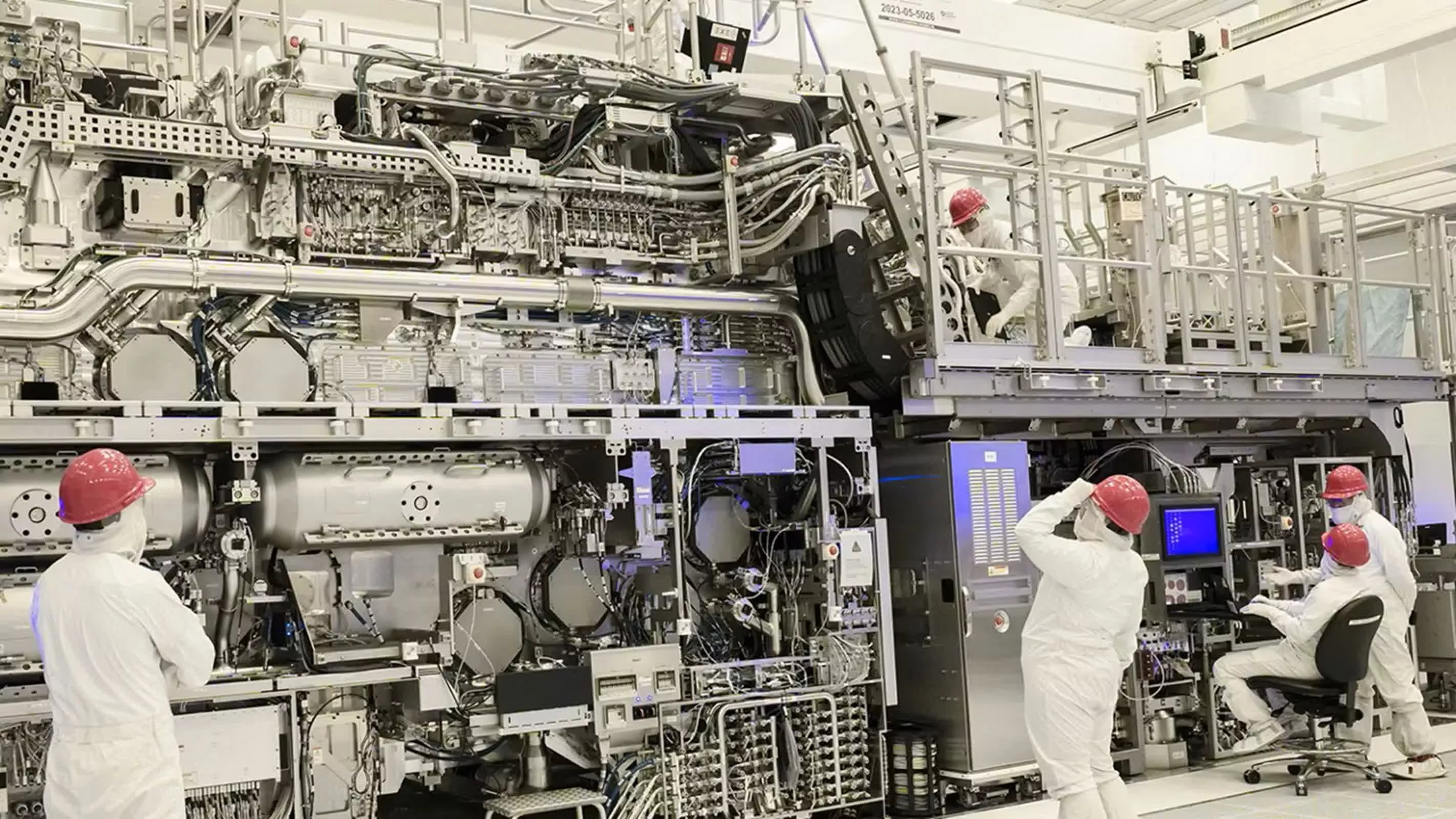

The cuts will be felt across the company's 15 wafer fabrication plants at 10 locations worldwide. Key roles such as engineers working on advanced process technologies and skilled technicians managing critical lithography equipment are considered vital and are unlikely to be affected, while positions made redundant by automation or efficiency initiatives may be trimmed.

Intel's restructuring comes amid uncertainty over federal and state subsidies. The company received $1 billion from the federal CHIPS Act last year as part of a larger $7.9 billion package, but much of the remaining funding is in limbo as the Trump administration reviews ongoing awards.

New CEO Lip-Bu Tan, who took the helm in March, has repeatedly stressed the need to streamline Intel's operations, reduce management layers, and accelerate the deployment of new technologies. "I'm a big believer in the philosophy that the best leaders get the most done with the fewest people," Tan said in an April memo. The company's challenge now is to convince its workforce and investors that it can chart a growth path, even as it makes deep cuts to its operations.

Intel to cut as many as 10,000 factory jobs, one of its largest-ever layoffs