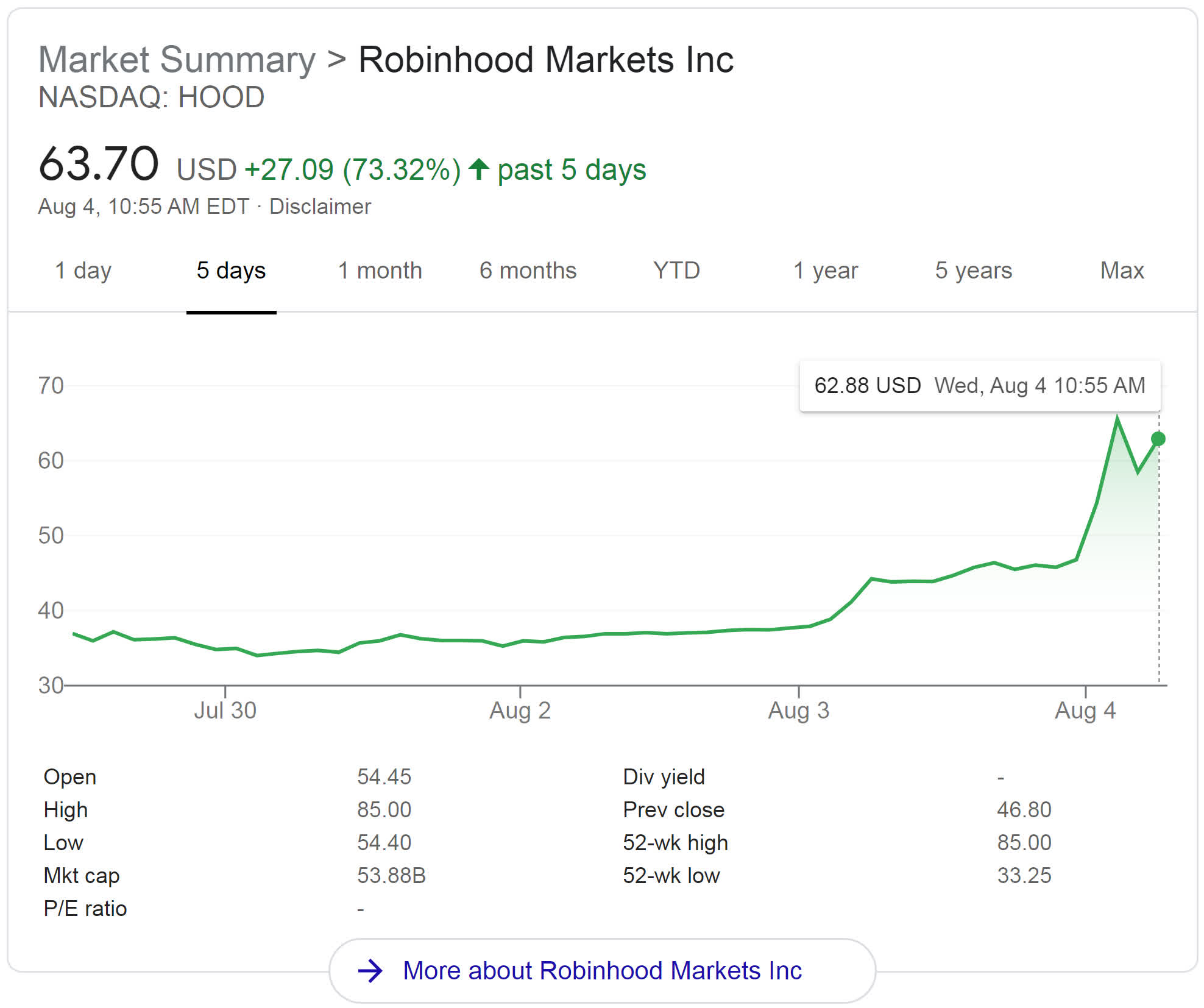

Why it matters: Robinhood Markets went public on the Nasdaq on July 29 but failed to make much of a splash. After opening at $38 per share, the stock closed down around eight percent and didn’t make much headway in subsequent days. That all changed this week, however, as the stock embarked on a wild rally that’s reminiscent of what we saw earlier this year with GameStop, BlackBerry and AMC.

The rally started on Tuesday when shares gained nearly 25 percent. Excitement spilled over into today with shares hitting a high of more than $80 but things have since cooled a bit as trading was halted multiple times due to volatility.

CNBC said it was unsure exactly what was driving the activity, but suggested it might have something to do with recent attention from investor Cathie Wood.

The Ark Invest CEO reportedly purchased 89,622 Robinhood shares on Tuesday through the firm’s ARKF Exchange Traded Fund (ETF), which was worth around $4.2 million at yesterday’s closing price of $46.80. At its current value (around $62 as of writing), the position is now worth roughly $5.6 million.

Robinhood also appears to be quite popular among retail traders as evident by comment volume via Swaggy Stocks.

https://www.techspot.com/news/90668-robinhood-having-own-gamestop-moment.html