Why it matters: Lyft submitted their Initial Public Offering application to the Securities and Exchange Committee on Friday, revealing everything but the actual share price. While that’s a bummer, the public application has lifted the veil on the company’s finances, upcoming plans and how they’re going to pay drivers as stock sells.

Unsurprisingly, Lyft is deep in the thralls of debt and is completely unprofitable now. In 2016, they realized losses of $682 million on $343.3 million in revenue. In 2017, it was losses of $688 million on $1.1 billion, and last year, the company lost $911 million on $2.2 billion in revenue. They don’t really have a clear path towards profitability which is why they’re focusing on growth to convince investors to part with their cash.

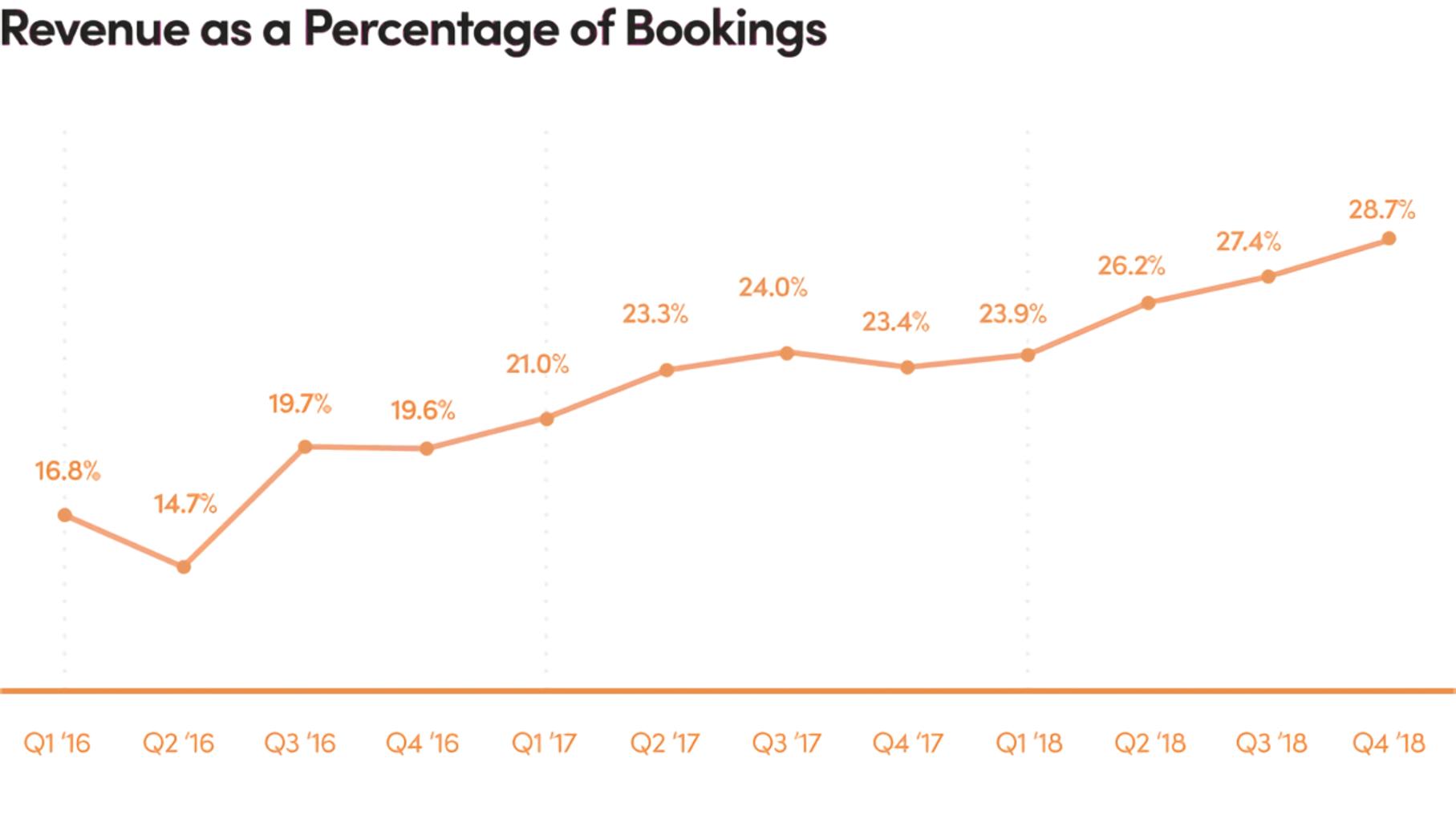

Admittedly, however, their growth is very impressive. In December 2016 they had just 22 percent market share, now they have 39 percent. That same year, Lyft generated bookings of $1.9 billion followed by $4.6 billion in 2017 and $8.1 billion last year. That’s at the courtesy of 18.6 million active riders among a total of 30.7 million, and 1.1 million regular drivers from a pool of 1.9 million.

Unfortunately, Securities and Exchange Committee policy prohibits ride-sharing services from giving shares to their drivers as a normal employer would do in the case of an IPO. In replacement, Lyft is giving out cash bonuses to some drivers with “good standing,” which can be (but doesn’t have to be) spent on shares.

Drivers with over 20,000 rides by February 25th, 2019, will get up to $10,000. Drivers with over 10,000 rides will get up to $1,000, as will past and present members of the Driver Advisory Council. Payments are expected to land on or about March 19, around the time of the IPO.

Regarding future growth, Lyft foresees a world relying almost entirely on transportation services like ride-sharing, self-driving cars, and short-range electric bikes and scooters.

“We believe that the world is at the beginning of a shift away from car ownership to Transportation-as-a-Service, or TaaS. Lyft is at the forefront of this massive societal change. Our ridesharing marketplace connects drivers with riders and we estimate it is available to over 95% of the U.S. population, as well as in select cities in Canada.

In 2018, almost half of our riders reported that they use their cars less because of Lyft, and 22% reported that owning a car has become less important. As this evolution continues, we believe there is a massive opportunity for us to improve the lives of our riders by connecting them to more affordable and convenient transportation options.”

The largest threats Lyft expects to face include competition from market leader Uber, an unpredictable market, autonomous technology, more aggressive regulations, and liabilities regarding driver and passenger behavior. They’re prepared to tackle these challenges head-on, however, and see their business model as one that’s still young and constantly evolving.

https://www.techspot.com/news/78998-lyft-upcoming-ipo-reveals-losses-nearly-1-billion.html