The big picture: Nvidia came within striking distance of setting a new record for the most valuable company in history on Thursday, as its market capitalization soared to $3.92 trillion during intraday trading, just shy of the $4 trillion mark. The chipmaker's rapid ascent, fueled by relentless demand for its advanced AI chips, briefly pushed it past Apple's previous record closing value of $3.915 trillion set in late 2024. By the end of the trading session, Nvidia's value settled at $3.89 trillion, slightly below the all-time high but still underscoring its extraordinary run.

"When the first company crossed a trillion dollars, it was amazing. And now you're talking four trillion, which is just incredible. It tells you that there's this huge rush with AI spending and everybody's chasing it right now," Joe Saluzzi, co-manager of trading at Themis Trading, told Reuters.

The surge in Nvidia's stock reflects a broader wave of optimism on Wall Street about the future of AI. The company's latest chips have become essential for training and running the largest and most sophisticated AI models, fueling a race among technology giants to build powerful data centers and dominate the next era of computing. Microsoft, Amazon, Meta, Alphabet, and Tesla are all competing to expand their AI infrastructure, and Nvidia's specialized hardware sits at the heart of this transformation.

According to LSEG data, Nvidia's current valuation now exceeds the combined market capitalization of all publicly listed companies in Canada and Mexico, and even surpasses the total value of all publicly traded firms in the United Kingdom.

Four years ago, the company was valued at $500 billion and was largely known for its graphics technology used in video games. Since then, its market capitalization has grown nearly eightfold, propelled by the explosive growth in AI applications and the company's ability to deliver the high-performance chips that power them.

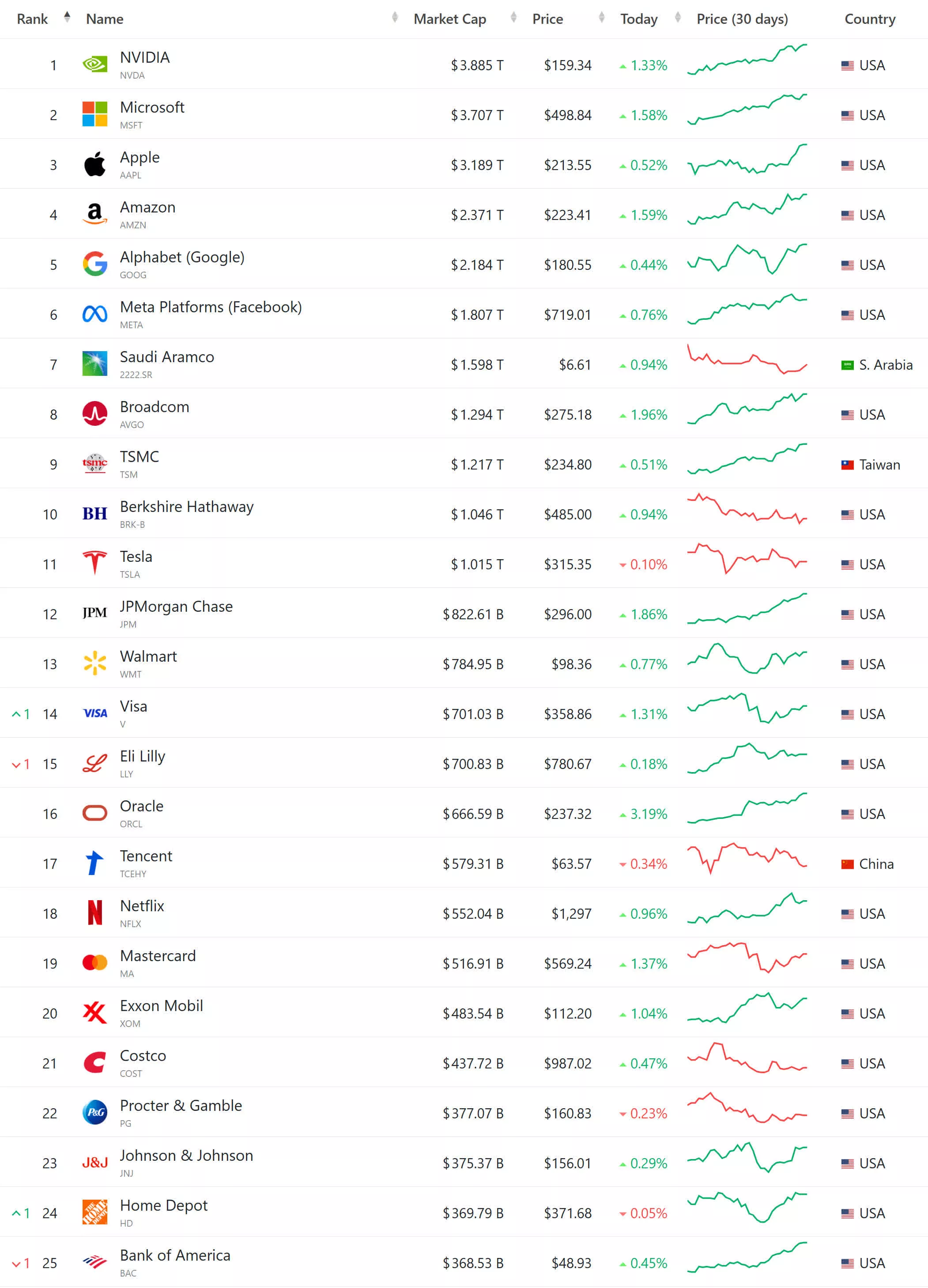

Credit: Companies by Marketcap

The company's financial performance has been equally impressive. In the most recent quarter, Nvidia reported $44.1 billion in revenue, a 69 percent increase from the previous year, with data center sales alone contributing $39.1 billion. This puts Nvidia on track to approach $170 billion in annual revenue for fiscal 2026, up from $130.5 billion in 2025.

Analysts expect the company's next-gen Blackwell Ultra GPUs to further accelerate growth, with Wall Street anticipating that Nvidia could soon reach, and potentially surpass, the $4 trillion market cap milestone.

Nvidia's rise has also reshaped the broader stock market. The company now represents a significant portion of the S&P 500 index, and its performance has left many investors, including those saving for retirement through index funds, increasingly exposed to the fortunes of the AI sector.

Microsoft, currently valued at $3.7 trillion, and Apple, at $3.19 trillion, round out the top three most valuable companies. But Nvidia's momentum has set a new benchmark for what is possible in the technology industry.

Despite its dominance, Nvidia faces challenges, including ongoing trade restrictions that limit the sale of its most advanced chips to China, as well as rising competition from rivals developing custom AI hardware. However, the company's innovation pipeline remains robust, with expansion into new markets such as autonomous vehicles and physical AI systems, signaling that its influence in the tech world is likely to persist.

Nvidia closes in on $4 trillion valuation, surpasses Apple's record