Those figures did start to get me wondering just how accurate that analysis was. So I dived into

Nvidia's financial reports, and here's a little bit on what they say about sales and marketing:

Our sales strategy involves working with end customers and various industry ecosystems through our partner network. Our worldwide sales and marketing strategy is key to achieving our objective of providing markets with our high performance and efficient GPU and embedded system-on-a-chip, or SOC, platforms. Our sales and marketing teams, located across our global markets, work closely with end customers in each industry. Our partner network incorporates each industry's respective OEMs, original device manufacturers, or ODMs, system builders, add-in board manufacturers, or AIBs, retailers/distributors, internet and cloud service providers, automotive manufacturers and tier-1 automotive suppliers, mapping companies, start-ups, and other ecosystem participants.

As NVIDIA’s business has evolved from a focus primarily on gaming products to broader markets, and from chips to platforms and complete systems, so, too, have our avenues to market. Thus, in addition to sales to customers in our partner network, certain of our platforms are also sold through e-tail channels, or direct to cloud service providers and enterprise customers. Sales to Dell Technologies Inc., or Dell, accounted for 11% of our total revenue for fiscal year 2020.

This is what Nvidia themselves have to say about manufacturing and distribution:

We utilize industry-leading suppliers, such as Taiwan Semiconductor Manufacturing Company Limited and Samsung Electronics Co. Ltd, to produce our semiconductor wafers. We then utilize independent subcontractors, such as Advanced Semiconductor Engineering, Inc., Amkor Technology, BYD Auto Co. Ltd., Hon Hai Precision Industry Co., Ltd., JSI Logistics Ltd., King Yuan Electronics Co., Ltd., and Siliconware Precision Industries Company Ltd. to perform assembly, testing, and packaging of most of our products and platforms. We purchase substrates from IbidenCo. Ltd., Kinsus Interconnect Technology Corporation, and Unimicron Technology Corporation, and memory from Micron Technology, Samsung Semiconductor, Inc., and SK Hynix.

We typically receive semiconductor products from our subcontractors, perform incoming quality assurance and configuration, and then ship the semiconductors to contract equipment manufacturers, or CEMs, distributors, motherboard and AIB customers from our third-party warehouse in Hong Kong. Generally, these manufacturers assemble and test the boards based on our design kit and test specifications, and then ship our products to retailers, system builders, or OEMs as motherboard and AIB solutions.

We also utilize industry-leading contract manufacturers, or CMs, such as BYD and Hon Hai Precision Industry Co., and ODMs such as Quanta Computer and Wistron Corporation, to manufacture some of our products for sale directly to end customers. In those cases, key elements such as the GPU, SoC and memory are often consigned by us to the CMs, who are responsible for the procurement of other components used in the production process.

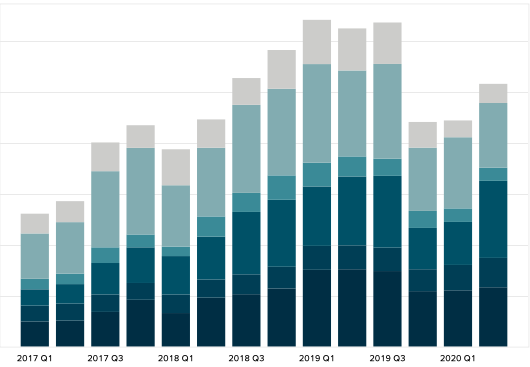

And now the key parts - some revenue figures for the past 3 financial years (ending January) given by Nvidia:

View attachment 87454

So in terms of percentage, it works out as:

Taiwan - 27.7%

China & HK - 25.0%

OAP - 24.6%

Europe - 9.1%

USA - 8.1%

Others - 5.5%

So that analysis was pretty much right, though I'm not sure what data they looked at to get 7.3% for USA.

Anyway, the point is that the reports make it clear that regardless of the market sector (gaming, AI, datacentres, etc), the vast majority of those products are sold by companies based in Taiwan, China, and (probably) Japan. In the case of datacentres, even if the company is US-based, such as Dell or HP, they'll be buying the components for their systems from manufacturers in the aforementioned countries.

Other nice details:

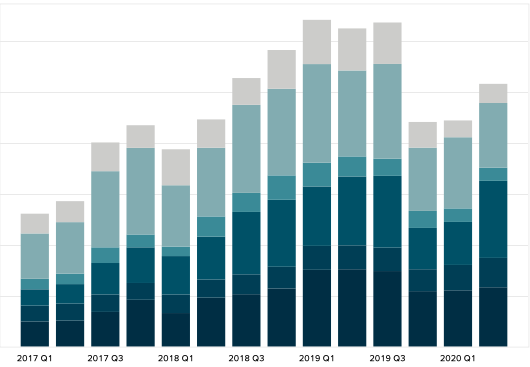

View attachment 87455

So gaming, which covers GPUs and SoCs, accounted for 50.5% of their revenue in FY2020; datacentres was 27.3%, followed by ProVis at 11.%.

My favourite part is the statement that one customer accounted for 21% of their accounts receivable balance - I.e. one particular customer isn't overly forthcoming with paying their bills! I wonder who it could be...

businessquant.com

businessquant.com