In brief: PayPal late last year started allowing users in the US to buy, sell and hold select cryptocurrencies for the first time. Now, the financial services company is doing more to bolster the security of digital assets on its platform through an acquisition of crypto security startup Curv.

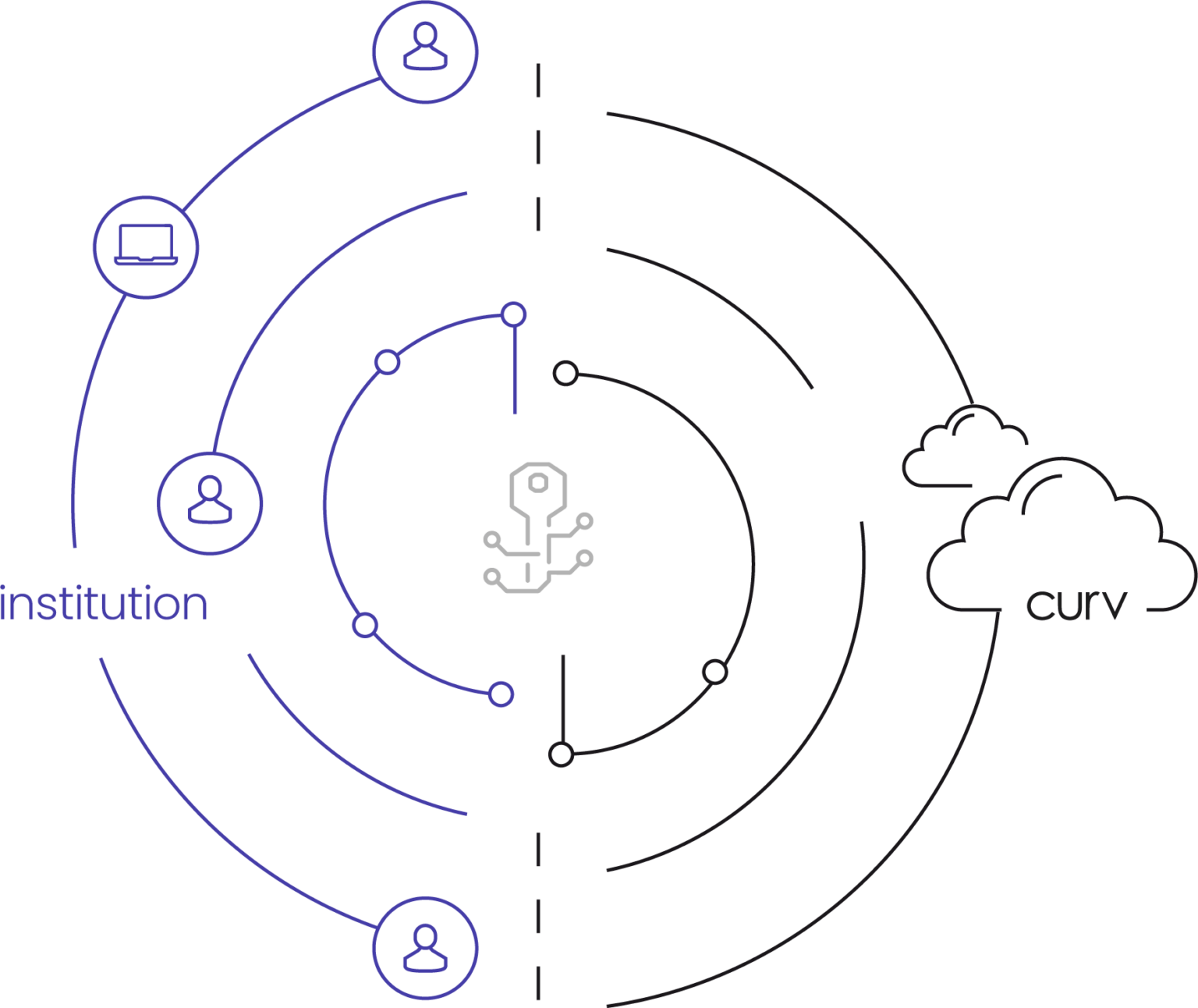

Shoring up rumors last week on the subject, PayPal on Monday formally announced that it has agreed to acquire Curv, a Tel Aviv-based security infrastructure firm that specializes in digital assets. Curv will join a newly formed PayPal business unit that was created to focus on blockchain, crypto and digital currencies.

Financial terms of the deal were not disclosed although when rumors first broke of the acquisition last week, sources told CoinDesk that the purchase price could be anywhere between $200 million and $300 million although one person put the figure as high as $500 million.

Curv is more geared for large institutions and enterprise clients, rather than a wallet for end-users. Jose Fernandez da Ponte, VP and GM of PayPal’s blockchain, crypto and digital currencies business, said the acquisition is part of their effort to “invest in the talent and technology to realize our vision for a more inclusive financial system.”

The integration could also ease concerns that some players have about PayPal serving as a middleman when dealing in crypto.

PayPal is still planning to let users use crypto to fund purchases at its 26 million merchant partners sometime later this year. As it stands today, there’s not a whole lot you can do with crypto on PayPal outside of using it as a store of value.

PayPal said it expects the deal to close sometime in the first half of 2021.

Masthead courtesy Maxx-Studio

https://www.techspot.com/news/88854-paypal-buying-cryptocurrency-startup-curv-harden-security.html