Editor's take: PayPal has made it incredibly easy for people to buy and hold cryptocurrency, especially those that may have been intimidated by the process up to now. If ever there was a time for a digital currency to take the next step, now would certainly be it.

PayPal in mid-October announced it would soon allow users in the US to buy, hold and sell cryptocurrency directly from their PayPal accounts. On Thursday, the payments processor made good on its promise.

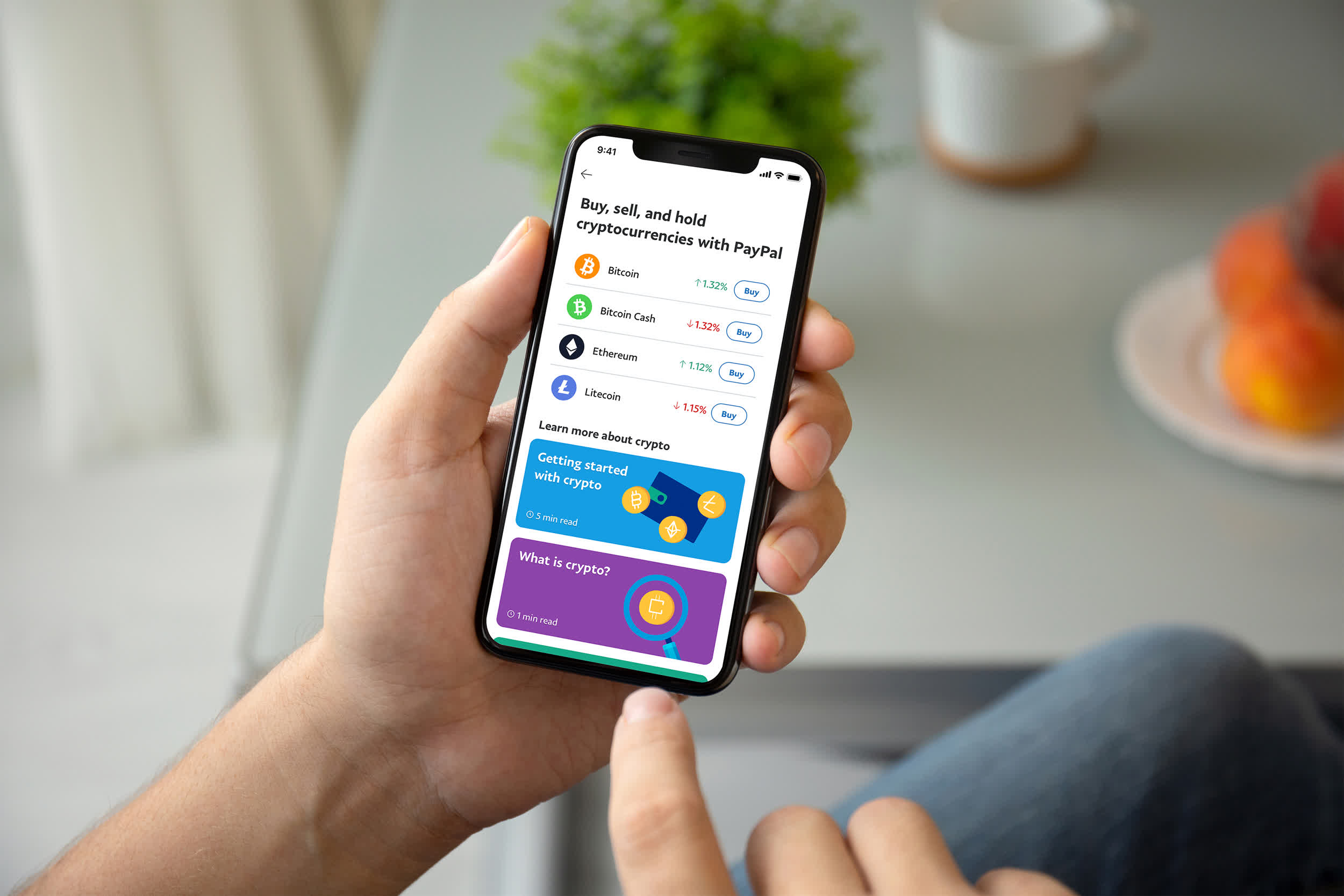

Eligible users in the US can now buy, hold and sell Bitcoin, Ethereum, Bitcoin Cash and Litecoin. To get started, simply log into your account and follow the on-screen instructions.

PayPal will charge a fee of $0.50 on transactions up to $24.99, a 2.3 percent fee for transactions between $25 and $100, a two percent fee on transactions between $100.01 and $200, a 1.8 percent fee for transactions between $200.01 and $1,000 and a 1.5 percent fee on anything over $1,000.01.

Notably, there are no fees for holding crypto in your account.

PayPal also noted that due to initial customer demand, they have increased the weekly crypto purchase limit from $10,000 to $20,000.

Oddly enough, PayPal was rather quiet about the announcement. The company mentioned it over on Twitter but didn't put out a dedicated press release about it, instead opting to update last month's news release with a small blurb.

Before diving head-first into the PayPal crypto waters, I'd recommend checking out the company's FAQ on the matter. Right now, there really isn't a whole lot you can do with crypto on PayPal. For example, you can't use crypto to pay for things or send money on PayPal and the crypto in your account "cannot be transferred to other accounts on or off PayPal."

The payments processor is still planning to allow customers to use crypto to fund purchases at its 26 million merchant partners although that feature isn’t expected to be ready until sometime in 2021.

Image courtesy Marc Bruxelle

https://www.techspot.com/news/87586-paypal-users-us-can-now-buy-hold-sell.html