What just happened? It is no secret that Intel is struggling. The tech giant's stock price has plummeted in recent years, making it a viable takeover target. An offer from Qualcomm is now on the table, and if it materializes, it could significantly alter the semiconductor industry's trajectory. But first, the companies will have to pick their way through a minefield of financial, regulatory, and strategic considerations.

In a development that could reshape the semiconductor industry, Qualcomm has made a takeover offer to rival Intel, sources familiar with the matter have told The Wall Street Journal. A successful acquisition of Intel, given its $90 billion market value, would rank as the largest technology M&A deal ever, topping Microsoft's $69 billion acquisition of Activision Blizzard.

The proposed merger would combine Qualcomm's expertise in mobile chip technology with Intel's strong presence in personal computer and server processors. Acquiring Intel would represent a major strategic shift for Qualcomm, diversifying its portfolio and strengthening its position in the evolving tech landscape.

The WSJ's report follows a Reuters story that Qualcomm executives have been examining Intel's various design units to determine whether any would fit their product portfolio.

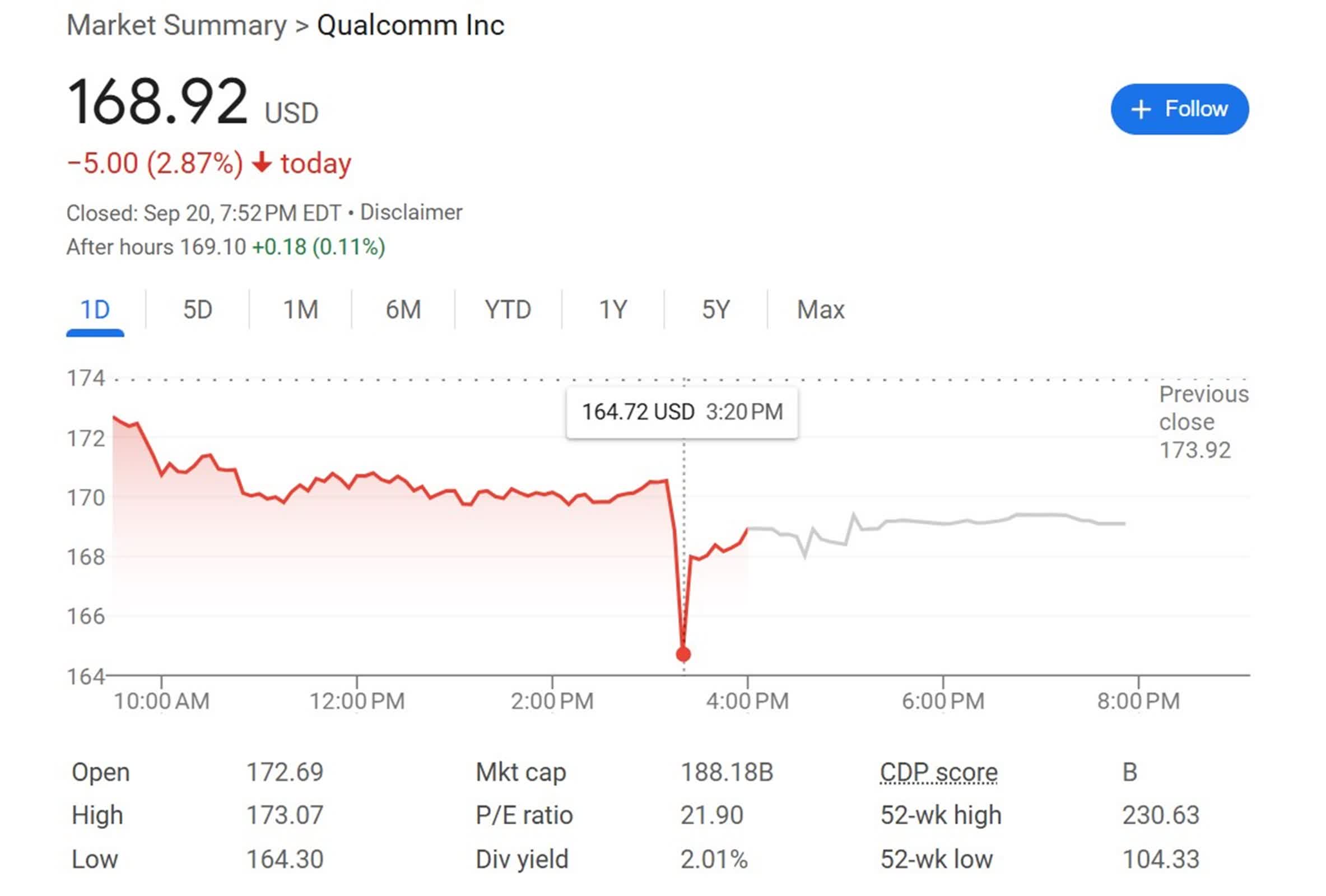

Qualcomm's worth is nearly twice that of Intel, boasting a market cap of $184 billion, making a takeover or acquisition of its various divisions financially feasible for the mobile chip giant.

Intel, once the undisputed leader in chip manufacturing, has faced significant challenges in recent years. Its market value has plummeted from a peak of $290 billion in 2020, making it a viable acquisition target.

The company's recent quarterly earnings report painted a grim picture, with revenue falling far short of expectations and a bleak forecast for the coming months. Under CEO Pat Gelsinger, Intel has been working to revitalize its business. As part of its turnaround efforts, Intel has initiated a sweeping cost-reduction plan to reduce its workforce by over 15 percent by year-end, restructure operations, and slash operational expenses by more than $10 billion in the upcoming year. This plan includes a 20-percent reduction in capital expenditures, significant cuts to R&D, and discontinuing underperforming products.

Earlier this month, Intel CEO Pat Gelsinger informed employees that the company is transforming its foundry arm into an independent subsidiary, confirming rumors that had been circulating since August.

"Collectively, these changes are critical steps forward as we build a leaner, simpler and more efficient Intel," Gelsinger said of the move to separate the foundry. "And they build on the immediate progress we have made since announcing our plan on August 1 to create a more competitive cost structure."

Qualcomm's acquisition of Intel is hardly a given and Intel has made no comment about the proposal. It had reportedly been considering selling certain assets as part of its efforts to streamline the company, but an Intel spokesperson also clarified that it is "deeply committed" to its PC business.

Additionally, such a deal would face intense scrutiny from antitrust regulators. The combined entity would wield significant power across multiple chip markets, raising concerns about competition and market dominance.

On the other hand, the move could be viewed as an opportunity to shore up the US chip manufacturing capabilities. A merger between these two giants could bolster America's competitive edge in the global chip market, particularly against rising competition from Asia.