In a nutshell: While most tech insiders believe the chip shortage will alleviate in the second half of next year, automotive analysts are worried their industry will not see a recovery phase until the first half of 2023.

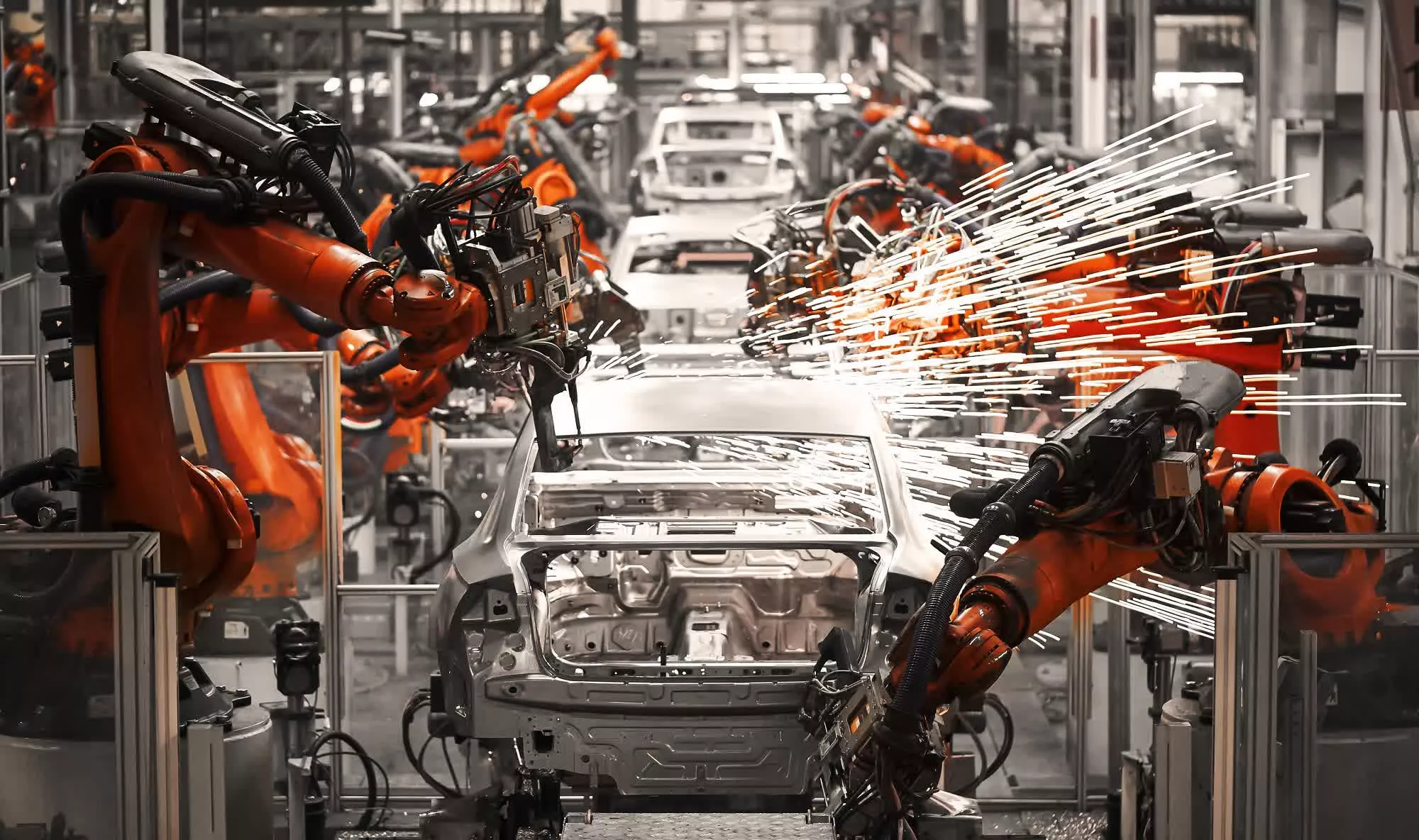

The global semiconductor shortage has been felt by many, from those whose jobs have been directly impacted to consumers wondering when they’ll be able to buy a new graphics card/console/anything with a chip in it. One of the hardest hit has been the automotive industry, which consulting firm AlixPartners believes will suffer a $210 billion hit in 2021 alone—double the amount predicted in May.

According to a new forecast from IHS Markit (via Automotive News), inventory shortages and higher prices will likely be plaguing car makers until the first half of 2023, at which point it will enter a recovery phase.

Part of the problem is that car manufacturers cut back production and reduced their chip orders at the start of the pandemic, and were unable to secure supplies a few months later when sales started picking up again.

The one piece of good news is that IHS predicts chip supplies will stabilize in the second half of 2022. That timeframe aligns with what Lisa Su, Acer, Xbox Boss Phil Spencer, and analyst firm IDC believe. Sadly, it means we’ve got several more months of this unprecedented crisis to endure.

CNET writes that many people looking to buy a new car are simply giving up because of the challenges brought about by the chip shortage, including low stock and higher costs—something those looking to buy a new graphics card can relate to. It’s also led to frustrated brand loyalists looking elsewhere for new vehicles. IHS forecasts that automakers’ production capacity will fall 6.2% this year, equal to 5 million fewer cars being created.

The latest revelation related to the chip shortage came from TSMC, whose chairman claims that some companies are stockpiling chips.

https://www.techspot.com/news/91626-auto-industry-could-feeling-effects-chip-shortage-until.html