Recap: Nvidia CEO Jensen Huang's recent visit to Washington seems to have paid off in more ways than imagined. The company successfully convinced the Trump administration to loosen recent export controls, and the president reconsidered breaking up Nvidia after learning more about the chip-making business.

President Donald Trump said he briefly considered splitting up Nvidia, the world's largest chipmaker and most valuable company. Trump initially thought doing so might intensify competition in the artificial intelligence and chipmaking industries, but later learned that any new players would take years to catch up.

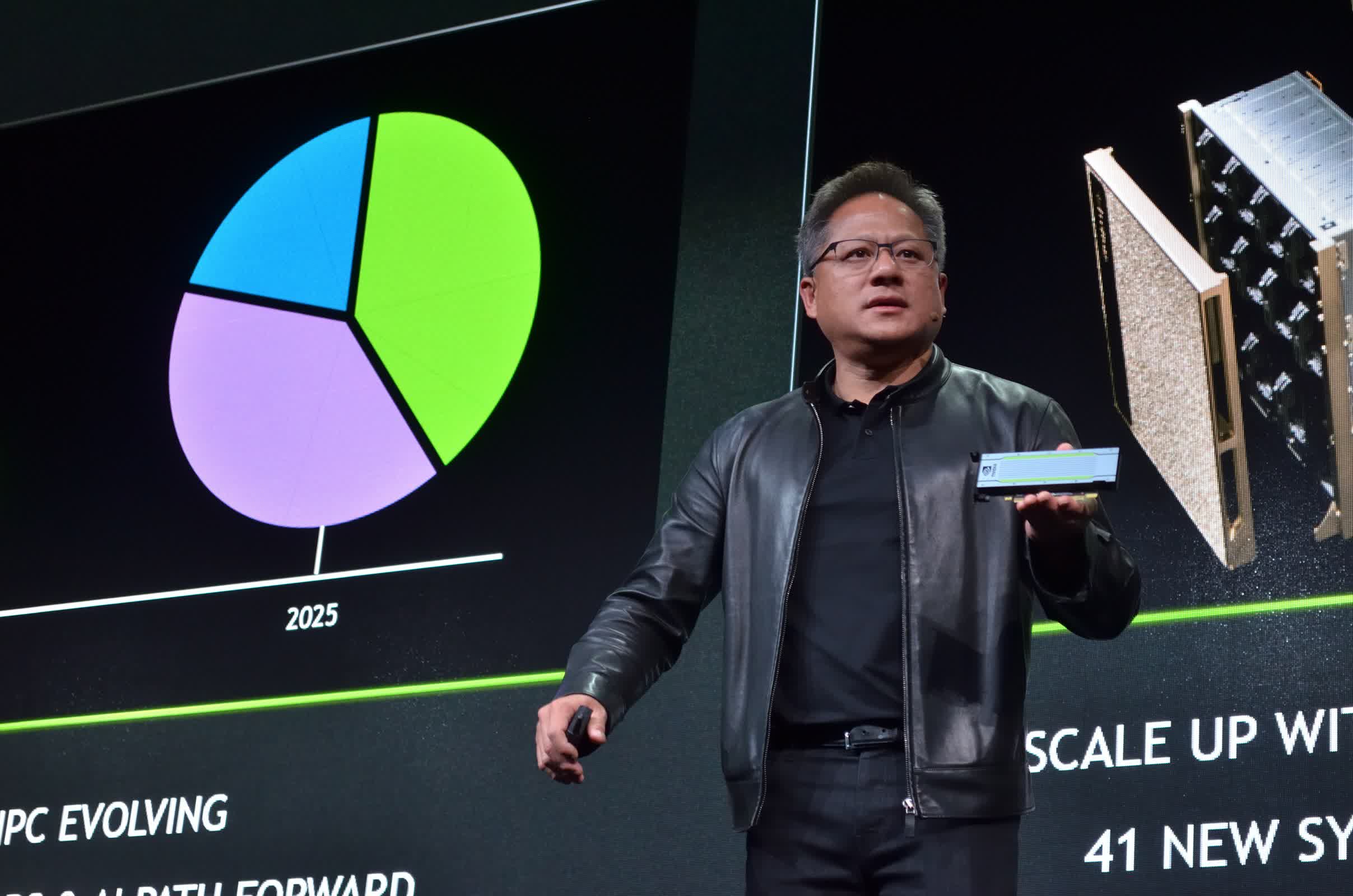

The president made the comments at a recent AI summit in Washington while praising CEO Jensen Huang, who was in attendance. Aides told Trump, who hadn't heard of Nvidia or Huang until recently, that a breakup would be tough.

Nvidia's biggest victory from the visit came from gaining permission to resume sales of H20 data center GPUs in China. The company was forced to cancel orders and halt sales following the Trump administration's April export controls, halving its Chinese market share and causing billions in losses.

The US is concerned about potential military applications for Nvidia's advanced chips, but Huang said China's military wouldn't need American technology. Commerce Secretary Howard Lutnick told CNBC that the Trump administration allowed the export ban reversal because the H20 is no longer Nvidia's fastest product.

US officials also hope to maintain China's reliance on US chips and delay the development of homegrown solutions, such as DeepSeek. Huang explained that the US can remain a leader in the AI market if other countries build upon American technology, favoring open-source research and development.

However, restarting H20 sales in China will take time. Nvidia will fulfill orders until remaining stocks are depleted, but manufacturing more could take nine months, according to The Information. TSMC's semiconductor production facilities are fully occupied, and Nvidia shifted production capacity to other products following the ban.

The AI boom has increased the chipmaker's value by more than an order of magnitude over the past three years, turning it into the world's first $4 trillion public company. Nvidia's stock has increased by around 20% since the start of this year.

However, some warn that the market has become dangerously overhyped. A top economist recently demonstrated that AI has created a bubble larger than the turn-of-the-millennium dot-com bubble. Another analyst claims that rising stocks of other tech giants, which represent most of the S&P 500's recent growth, depend almost entirely on sales of Nvidia GPUs.

Trump briefly considered breaking up Nvidia to spur competition, then backed off