The big picture: As tech giants pour more money into AI, some warn that a bubble may be forming. Drawing comparisons to the dot-com crash that wiped out trillions at the turn of the millennium, analysts caution that today's market has become too reliant on still-unproven AI investments.

Torsten Slok, chief economist at Apollo Global Management, recently argued that the stock market currently overvalues a handful of tech giants – including Nvidia and Microsoft – even more than it overvalued early internet companies on the eve of the 2000 dot-com crash. The warning suggests history could soon repeat itself, with the buzzword "dot-com" replaced by "AI."

In the late 1990s, numerous companies attracted venture capital in hopes of profiting from the internet's growing popularity, and the stock market vastly overvalued the sector before solid revenue could materialize. When returns failed to meet expectations, the bubble burst, wiping out countless startups. Slok says the stock market's expectations are even more unrealistic today, with 12-month forward price-to-earnings ratios now exceeding the peak of the dot-com bubble.

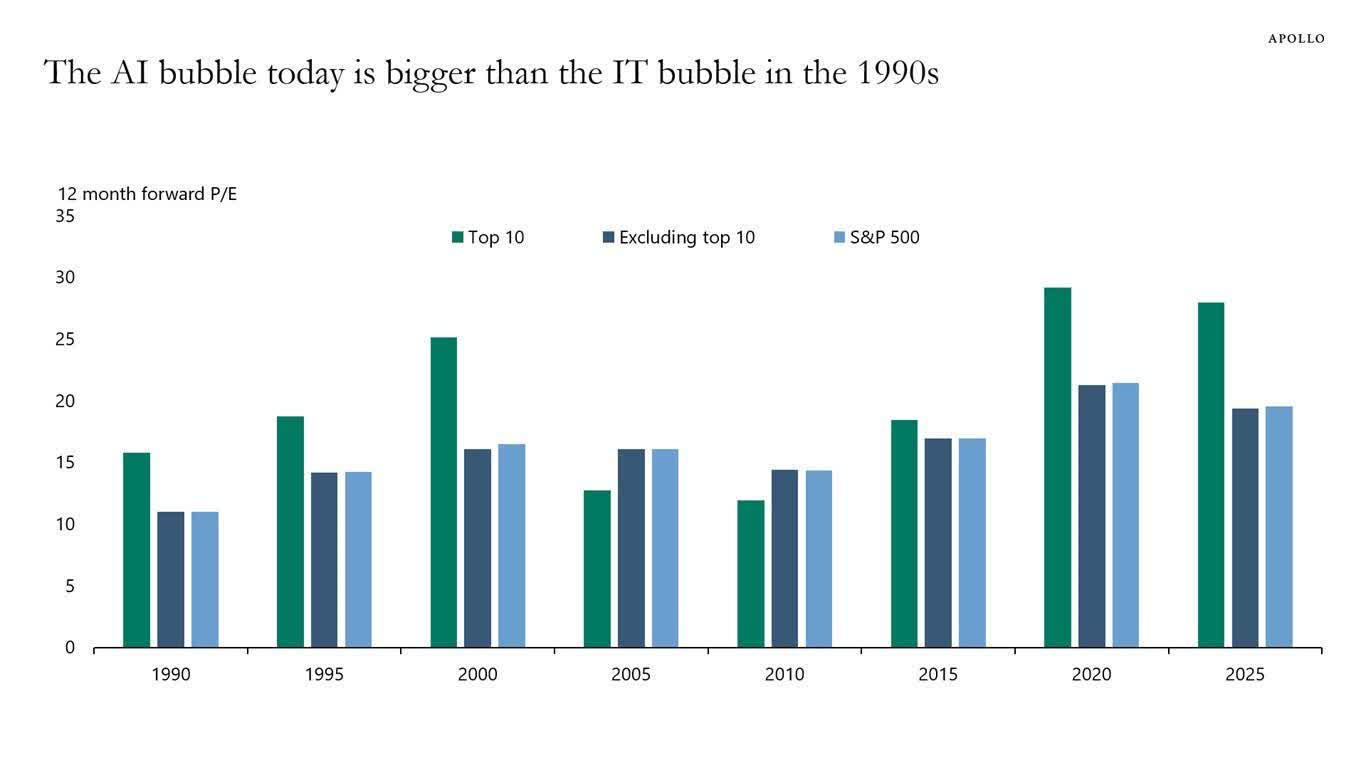

A company's P/E ratio measures the relationship between its stock price and the profit it generates, with a high ratio reflecting optimism about future returns. Comparing S&P 500 ratios at five-year intervals from 1990 to 2025 clearly shows the dot-com spike in 2000. Similar spikes in 2020 and 2025 suggest the AI bubble may be even more pronounced.

What's more concerning is that in each spike, the top 10 companies' ratios far exceed the rest of the index. Such disparity suggests investments in those firms – mostly tech giants heavily betting on AI – have detached from reality before their newest technology can generate real profits. Companies like Nvidia, Microsoft, Apple, Amazon, Meta, Alphabet (Google), and Tesla account for most of the S&P 500's recent growth.

Slok's warning echoes concerns from other industry leaders about the risks facing AI companies. Robin Li, CEO of Chinese internet giant Baidu, predicted that only about one percent of AI firms will survive if and when the bubble bursts. He said this will eventually lead to a more stable market with more realistic AI applications.

Tech giants continue to make massive investments as AI's popularity grows, underscoring the high stakes in this rapidly evolving field. OpenAI is developing an AI-powered web browser to challenge Google Chrome's dominance. Meta is spending over $60 billion to build new AI data centers. Microsoft recently cut 9,000 jobs to offset costs from its new AI infrastructure, estimated at $80 billion. Amazon has unveiled plans for agentic AI, signaling that the race for AI leadership shows no signs of slowing.