Forward-looking: Thanks to its potent processing units for AI training, Nvidia recently reported record revenue results and an astonishing 1,259 percent increase in net income year-over-year. The CEO of TSMC is now confidently wagering that the American company will soon ascend to become the new leader in the semiconductor business.

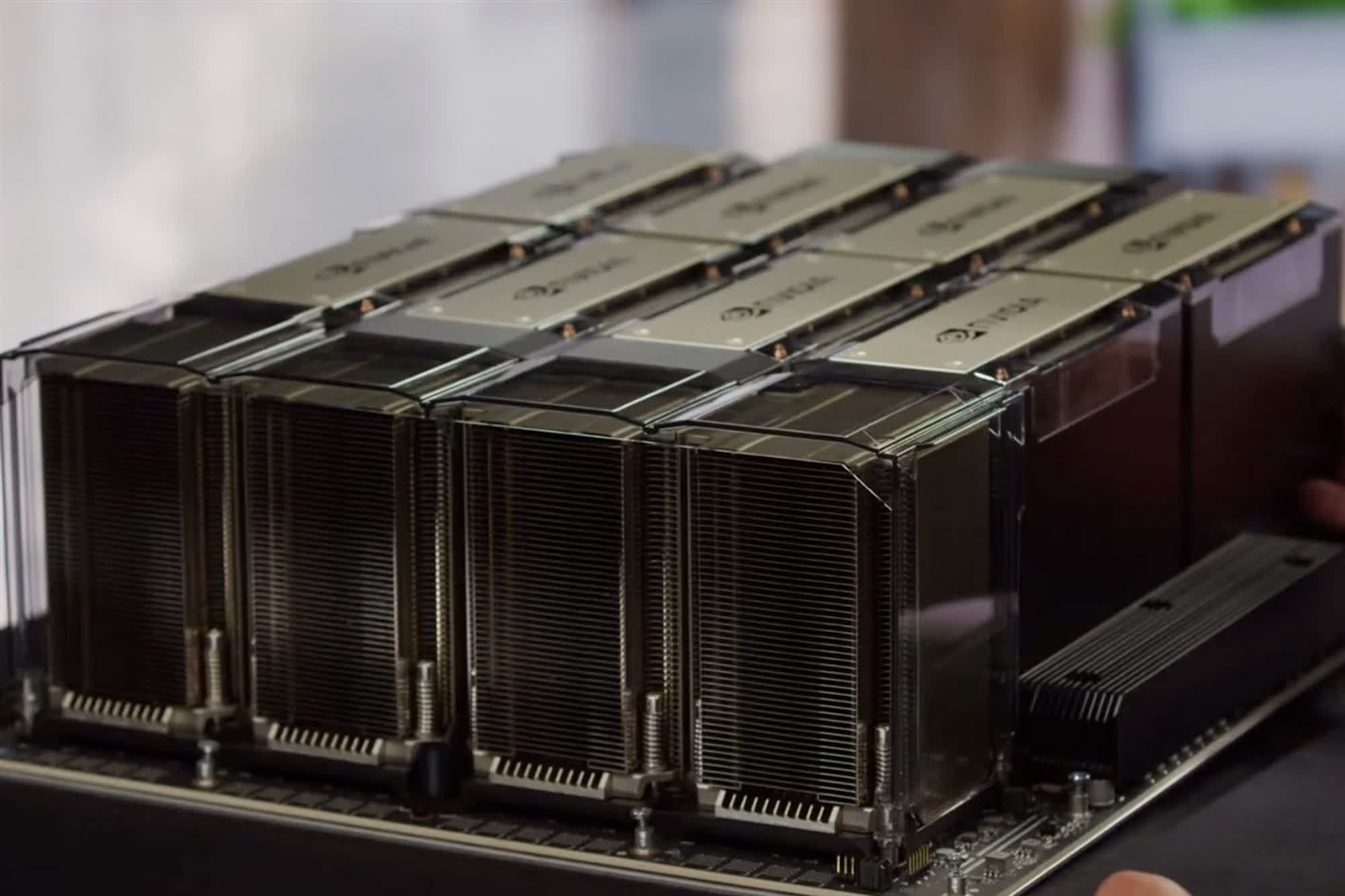

Nvidia recently reported revenue of $18.12 billion for the third quarter of its fiscal year, marking a 206 percent increase compared to the same quarter last year and a 34 percent rise over this year's second quarter. The GPU company is now officially an AI-driven company, even though there are no actual "Nvidia factories" printing out chips to build powerful gaming GPUs or server AI accelerators.

Nvidia's fabless business involves GPU designs, which are then manufactured into physical microchips by TSMC, the world's largest independent semiconductor foundry. Despite this key role, TSMC's chairman, Mark Liu, believes that Nvidia will emerge as the world's largest semiconductor company by the end of this year.

Speaking at a lecture hosted by the Chinese National Association of Industry and Commerce, Liu emphasized TSMC's crucial role as a global chip manufacturer in the current AI era. Nvidia stands as one of TSMC's major clients, and Liu predicts it will soon lead the semiconductor industry in revenue, surpassing giants like Intel, Samsung, and others.

Also read: Goodbye to Graphics: How GPUs Came to Dominate AI and Compute

Fueled by the AI boom, Nvidia has achieved unprecedented growth, outpacing other chip manufacturers contending with their own challenges. In Q3, Nvidia not only outperformed its competitors but also reported a net income of $9.24 billion, while Intel incurred a loss of $8 million, and Samsung faced a $2.86 billion loss due to the NAND flash crisis and other factors.

The ascent of Nvidia as a dominant force in the semiconductor industry aligns with the rapid progress of fabless companies, which are projected to grow by 10 percent in the next five years. Traditional tech giants like Apple, Google, Amazon, and Microsoft are now venturing into chip design, signaling that Nvidia's supremacy may be transient before a new champion emerges. Microsoft, with a Q3 revenue of $52.9 billion, stands as a testament to this trend.

When considering both fabless and manufacturing chip companies, the semiconductor industry is currently in a robust growth phase. The market saw a 6.3 percent increase in the third quarter compared to the preceding three months, and projections for the fourth quarter anticipate three percent growth. Data analysis suggests double-digit year-over-year growth for each quarter of 2024, indicating a favorable trajectory for the industry.