What just happened? A lot of tech companies might be concerned about the economy and the looming threat of a recession, but TSMC certainly isn't worried. The world's biggest chip manufacturer expects its revenue to increase by around 30% this year, more than the 24.9% growth it experienced in 2021.

Inflation reaching a 40-year high, the rising cost of living and China's Covid restrictions impacting manufacturing have contributed to price rises and a slowdown in consumer spending. It recently led to Elon Musk wanting to pause hiring at Tesla and reduce "salaried headcount" by 10% over his "super bad feeling about the economy."

TSMC, however, is unlikely to share Musk's sentiments. As per Bloomberg, the Taiwanese giant admits smartphones, TVs, and PCs have seen their sales decline but said other areas, such as electric cars (ironically), have increased. As for inflation, Chairman Mark Liu believes it has little effect on TSMC's business, and that price rises are now slowing.

"The current inflation has no direct impact on the semiconductor industry as the demand drop is mainly for consumer devices like smartphones and PCs while EV demand is very strong and partially exceeds our supply capacity so we are making inventory adjustments," Liu said. "Utilization rate is full for the rest of the year."

TSMC

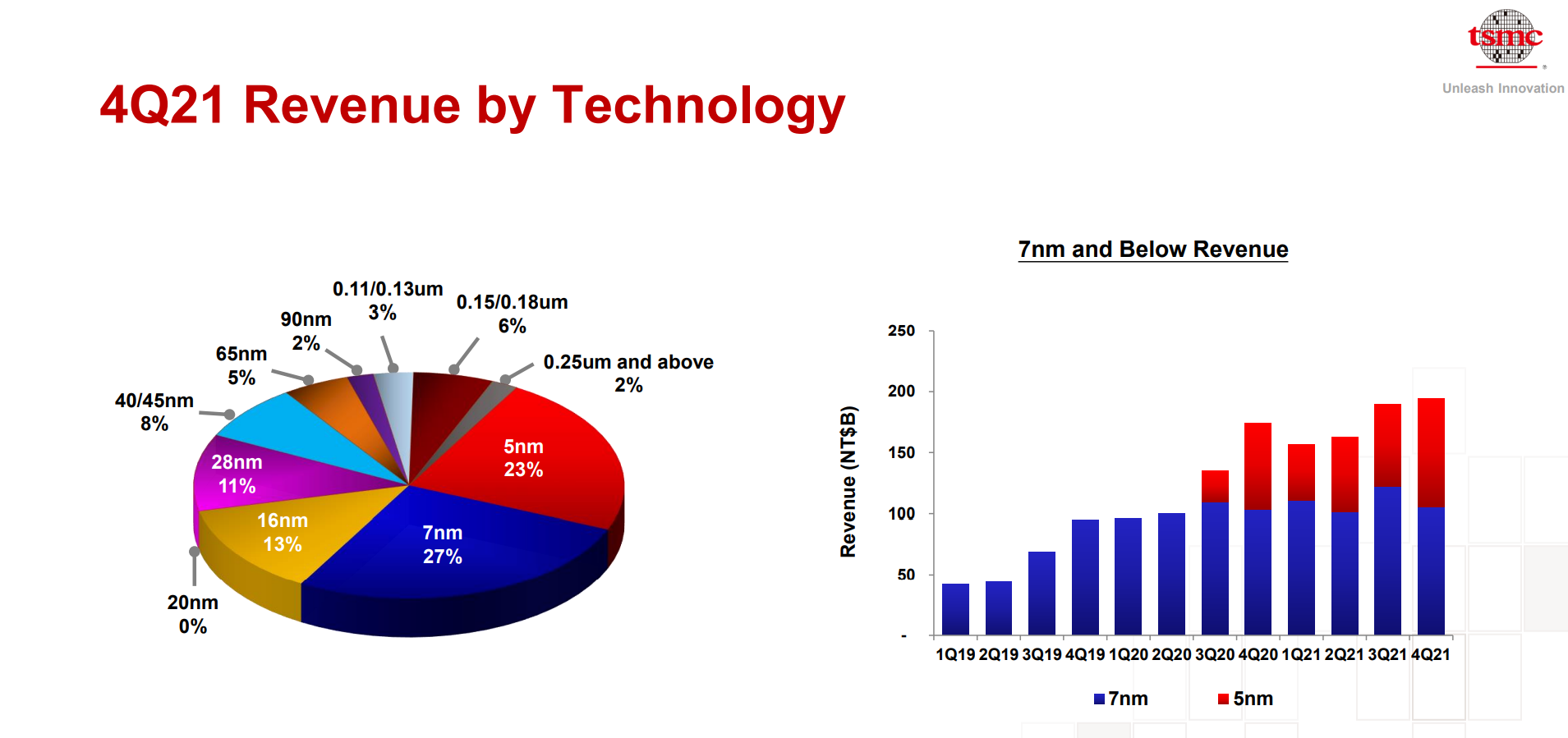

TSMC reported record quarterly profits of just over $6 billion back in January. It also raised growth projections and announced it would spend between $40 billion to $44 billion on upgrading capacity this year, $10 billion more than it spent in 2021 and 43% higher than the $25 billion to $28 billion Intel plans to spend on chip manufacturing in 2022. Next year will see TSMC spend another $40 billion on its expansion plans.

"TSMC has entered a period of structural high growth," Liu said. "Technology leadership is key to our growth."

TSMC made headlines yesterday after a top Chinese economist urged Beijing to seize the chipmaker should the US and the West ever impose sanctions on the country similar to those placed on Russia.

https://www.techspot.com/news/94869-tsmc-plays-down-economic-concerns-predicts-30-sales.html