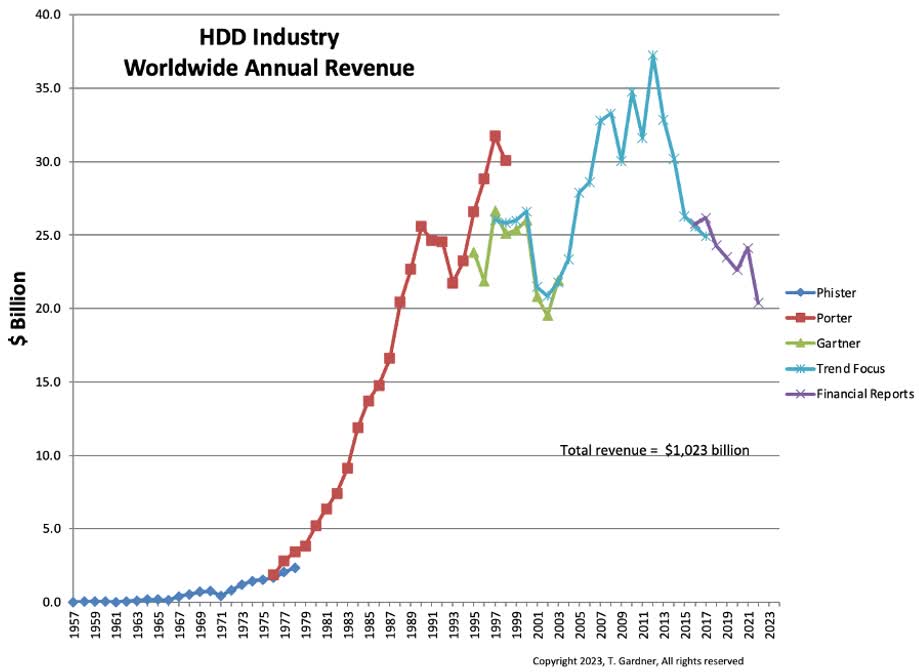

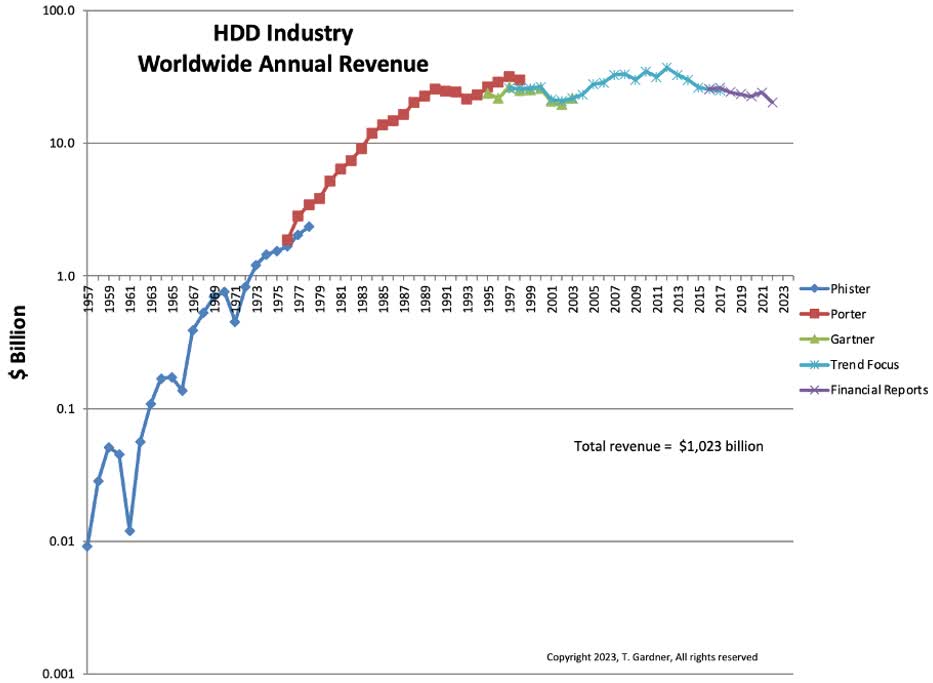

The big picture: It has been nearly 70 years since IBM introduced what many consider to be the world's first digital hard drive. Since that time, annual revenue generated by traditional HDDs has mostly followed a predictable path albeit with a few deviations.

Digital storage analyst Tom Coughlin, along with industry associated Tom Gardner, recently put together a fascinating set of charts outlining HDD industry revenue dating back to the late 50s. It utilizes multiple data sources from over the years including more than 20 years of information from Montgomery Phister.

As you can see, hard drive industry revenue did not achieve breakneck growth until the 1980s. During that decade, annual revenue increased from around $4 billion to over $20 billion. The 90s also saw its fair share of growth, but revenue was far less predictable and way more volatile.

Both Gartner and TrendFocus observed a decline in industry revenue in the first half of the 2000s, but the market stabilized by mid-decade and grew consistently before hitting a peak in 2012 of around $37 billion. This, Coughlin noted, was likely related to widespread flooding in Thailand the year before that drove HDD prices through the roof in 2012.

According to Coughlin, the hard drive industry hit its peak in terms of shipment volume in 2010 with 651 million units moved. For comparison, only 172 million hard drives shipped in 2022 and unit shipments for 2023 are expected to be around 127 million, with total capacity of less than 900 exabytes.

Fun fact: From 1957 through 2022, roughly 10 billion hard drives have shipped totaling over $1 trillion in revenue

Since 2012, hard drive revenue has been trending downward thanks to the rise of solid-state drives but that could change this year as Coughlin believes increasing demand for storage for AI could drive HDD revenue growth. Coughlin expects the industry to ship 127 million spinning drives this year as well, which would match last year's projection should it pan out.

Image credit: Pixabay