The big picture: In our review of the 8GB variant of Nvidia's RTX 5060 Ti, we suggested that the GeForce 50 lineup might go down as the company's worst ever. Yet despite scarcity at more reasonable pricing, fierce competition from AMD, and plenty of criticism, Team Green's latest family of graphics cards has propelled it to unprecedented market dominance (even without taking AI into consideration).

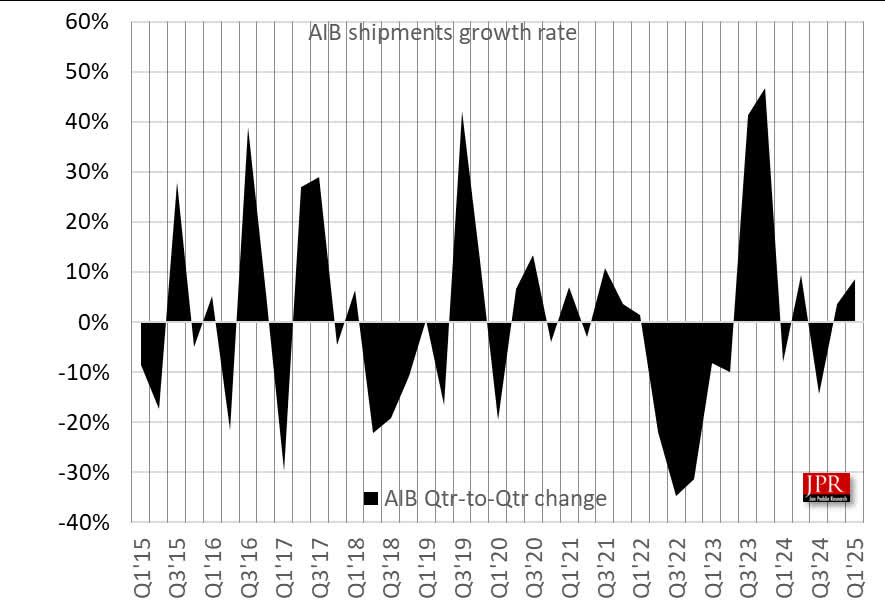

According to Jon Peddie Research, total sales of dedicated desktop graphics cards reached 9.2 million units in the first quarter of 2025 – an increase of more than 8% both year-over-year and quarter-over-quarter. Although both Nvidia and AMD launched new GPU lineups during this period, Nvidia benefited far more.

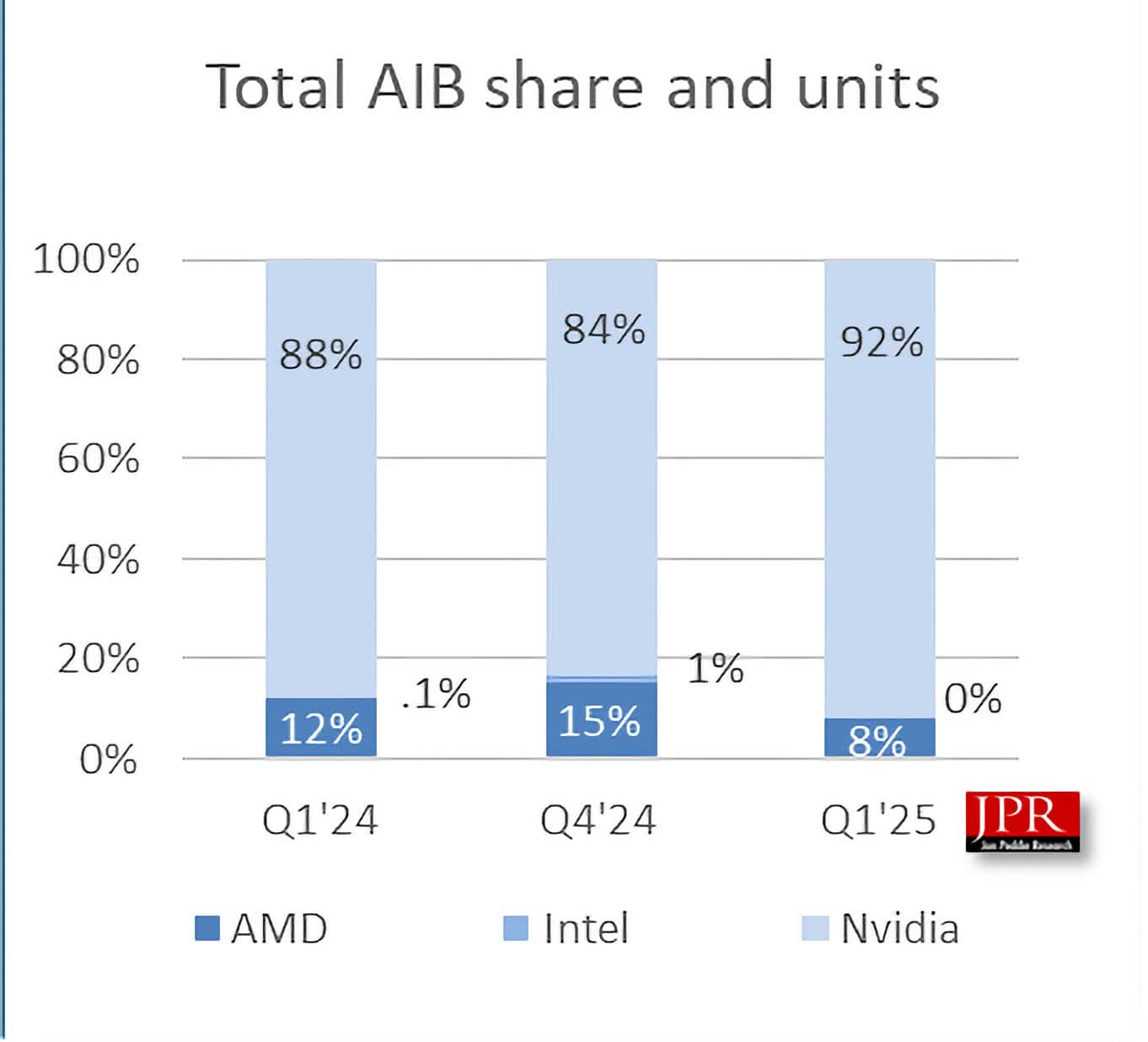

Nvidia sold millions of RTX 50 series GPUs between January and March, while AMD's Radeon 9000 series shipped fewer than 750,000 units. Nvidia's market share surged to a historic 92%, squeezing AMD down to an all-time low of 8% and leaving nothing for Intel. Jon Peddie told Tom's Hardware that underproduction on AMD's side is the primary factor behind this dramatic gap.

AMD reported "unprecedented" demand for the RX 9070 and 9070 XT in March, suggesting that it was caught off guard and is now racing to ramp up supply.

The company also faces the added challenge of balancing its allocation of TSMC semiconductors between Radeon GPUs and Ryzen 9000 CPUs, which have also been in short supply following a strong market response. Interestingly, German GPU sales from last month – outside the scope of the Jon Peddie report – showed AMD ahead of Nvidia, hinting that upcoming financial briefs could reveal growing momentum for AMD's cards if production can catch up.

Nvidia, meanwhile, expanded its already dominant market position despite releasing some of the least exciting graphics products in recent memory. In our reviews, we noted that the RTX 50 series GPUs deliver little performance uplift over the RTX 40 Super lineup.

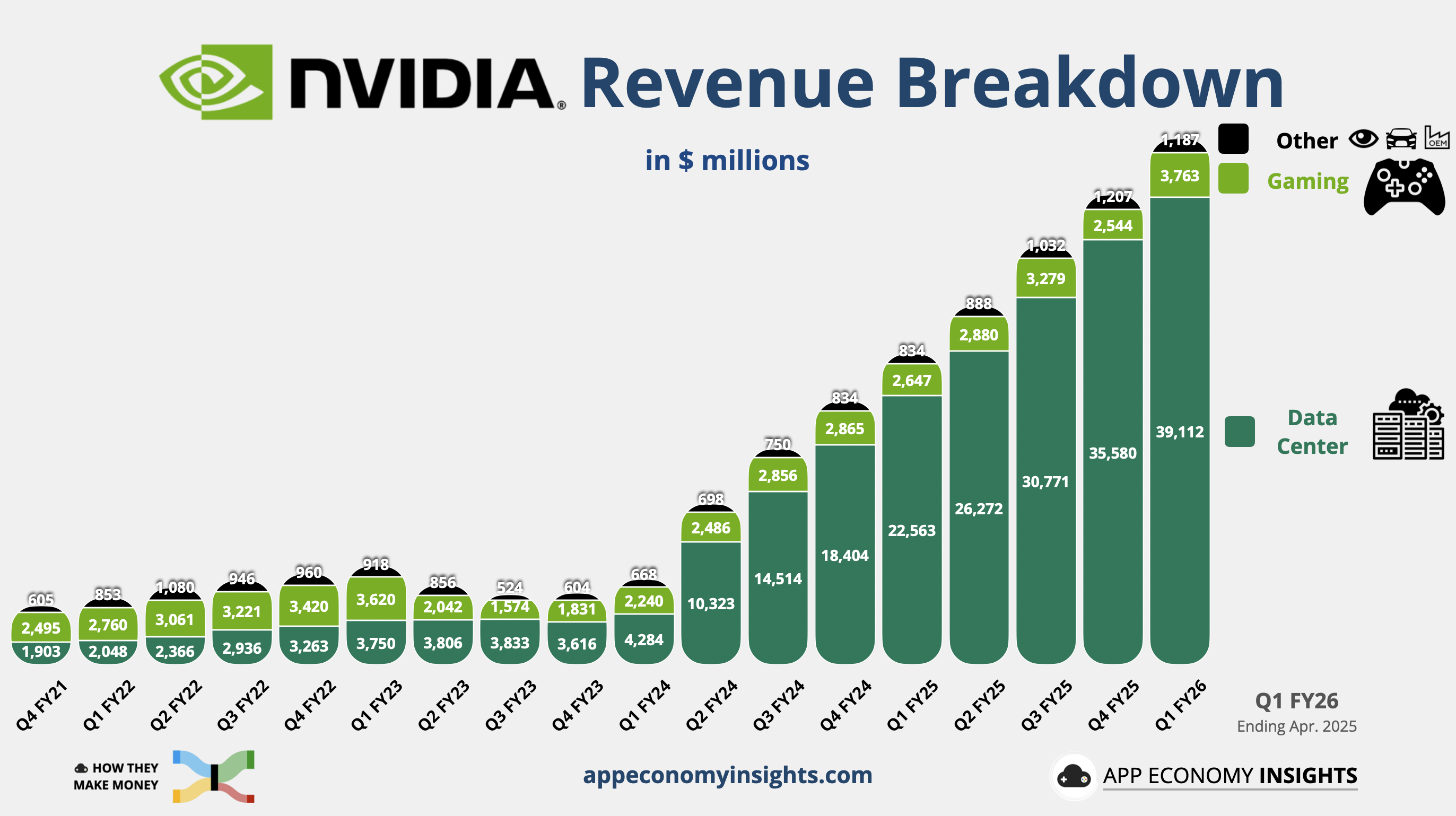

During recent coverage of Nvidia's quarterly financials, the company's gaming revenue (PC graphics cards) surged to a record $3.8 billion, up 42% year-over-year and 48% quarter-over-quarter. That's the fastest growth rate the gaming GPU segment has seen in years.

However an "overlooked" factor behind gaming revenue growth may be the increasing diversion of high-end consumer GPUs into small-scale AI operations. As demand for AI compute spreads beyond large data centers to startups and independent developers, some gaming-class GPUs – especially higher-end RTX cards – are being repurposed for machine learning workloads.

To AMD's credit, their latest Radeons finally caught up to Nvidia in ray tracing performance and upscaling image quality after trailing for several GPU generations. That triumph, alongside larger VRAM pools in some products, has allowed the $600+ Radeon 9070 XT to outpace its direct competitors and touch the $1,000 RTX 5080 in certain scenarios.

Upcoming quarterly reports will shed more light on the battle between mainstream GPUs such as the RTX 5060, RX 9060, and possibly the Intel Arc B770. While AMD scrambles to increase production, Nvidia may scale back consumer GPU output to refocus on its true revenue driver: AI chips.