The big picture: The memory market is beginning to stabilize after a period of rapid price increases. Prices for DDR5 and NAND flash are cooling, particularly in the consumer segment. However, enterprise storage remains hot, driven by continued investment in AI infrastructure.

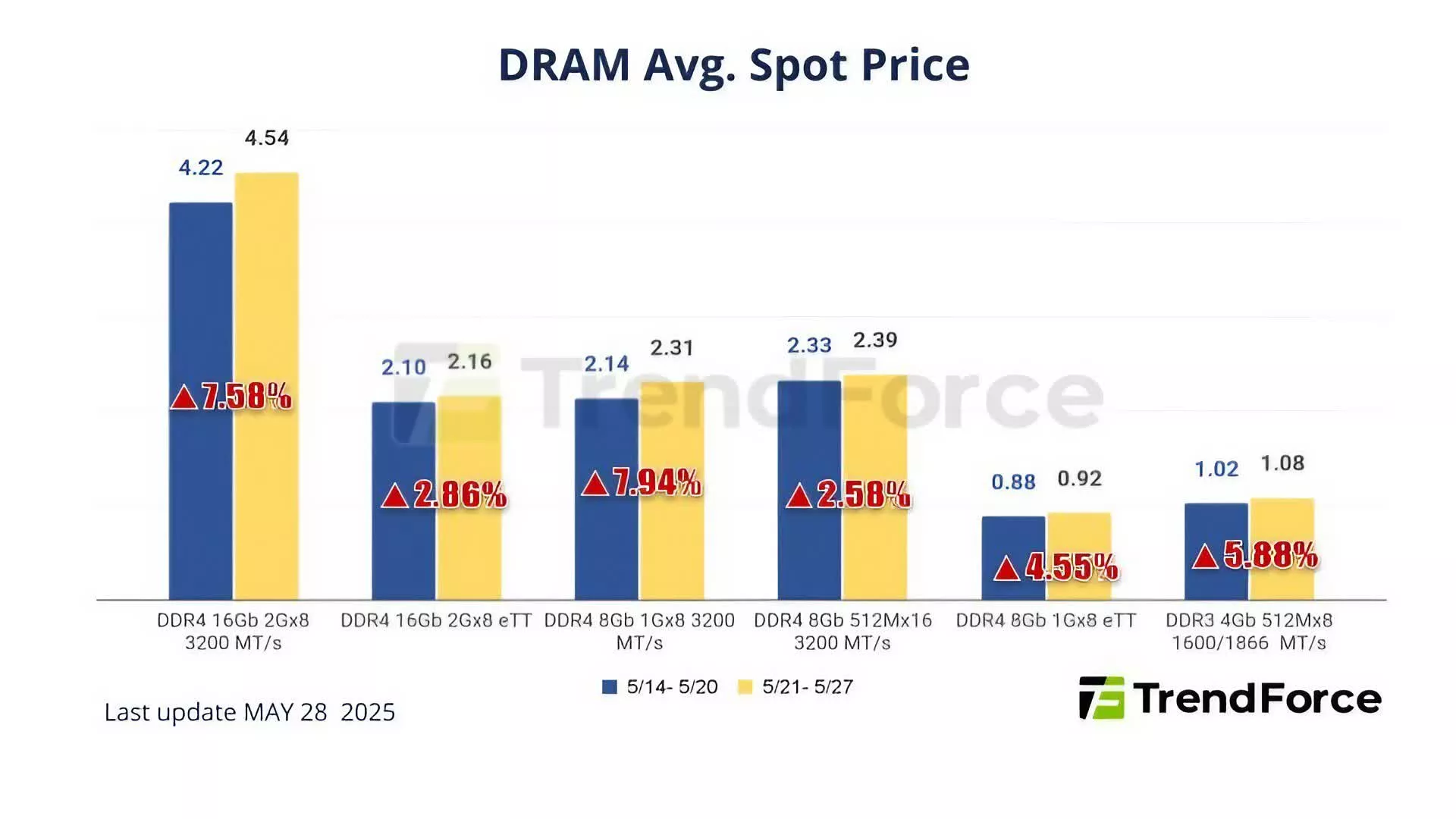

DRAM prices have been rising steadily for months, but new data from TrendForce suggests that the trend is beginning to slow – particularly for DDR5. The latest spot price report indicates a more stable market as we head into the third quarter of 2025.

In an unusual shift, some DDR5 spot prices have even surpassed contract prices. As a result, buyers and traders are increasingly turning their attention back to DDR4, which offers more stable pricing and is currently seen as a safer investment.

That shift is also reflected in the numbers. A popular DDR4 chip – 1Gx8 3200MT/s – j umped from $2.18 to $2.46 in just one week, marking a 12.8 percent increase. Even with this spike, experts say there is limited room for further price hikes. Spot prices are expected to rise more gradually in the coming months, with contract prices likely to catch up, narrowing the gap between the two.

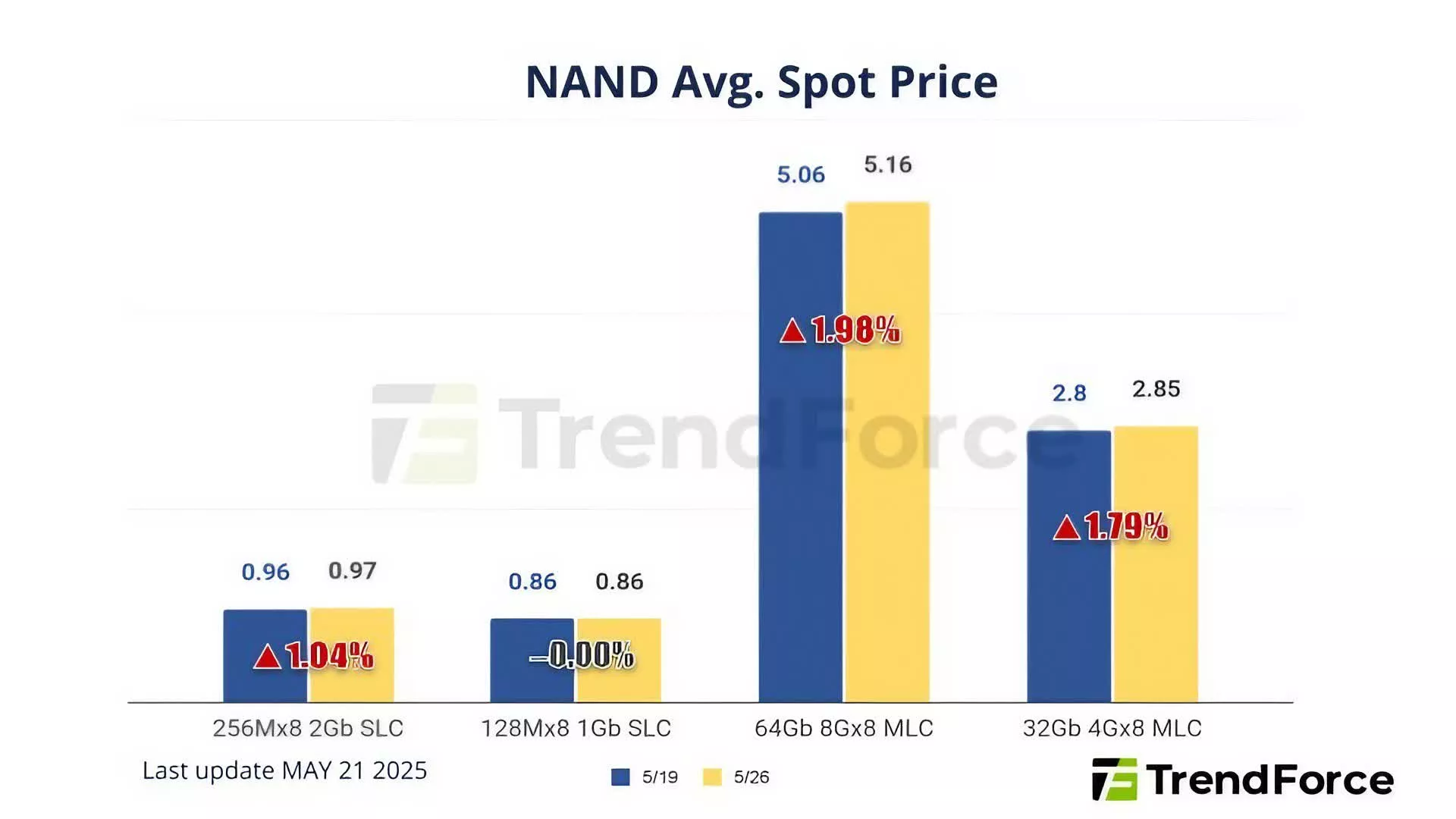

On the NAND flash side, the trend is similar. After prices began climbing in late February, spot prices have now reached elevated levels. This week, prices for 512Gb TLC wafers slipped slightly by 0.18 percent, down to $2.73. Buying interest is fading, and the market is showing signs of hesitation. Suppliers have also been pushing more inventory into circulation, which is dampening demand.

Still, not all segments of the memory market are slowing down. A previous report by TrendForce highlighted that enterprise SSDs are receiving a strong boost from rising AI demand. Major North American cloud providers are ramping up investments in AI servers, which is driving increased SSD usage in data centers. The firm expects this demand to push enterprise SSD prices up by as much as 10 percent in Q3 2025. Inventory remains tight, and supply may struggle to keep pace with demand.

Last year, DRAM prices were projected to decline in early 2025 across the PC, server, and GPU markets, driven by inventory adjustments and cautious procurement strategies by OEMs.