Renowned chipmaker Broadcom has been scooped up by rival Avago Technologies in a cash and stock deal valued at $37 billion. Specifically, Avago will fork over roughly $17 billion in cash and dole out the remaining balance in its own stock.

Avago will fund the cash portion of the deal using $9 billion in new debt; the rest will be paid with cash it already has on hand. Existing Broadcom investors can receive $54.50 per share in cash or about 0.44 shares in the new company.

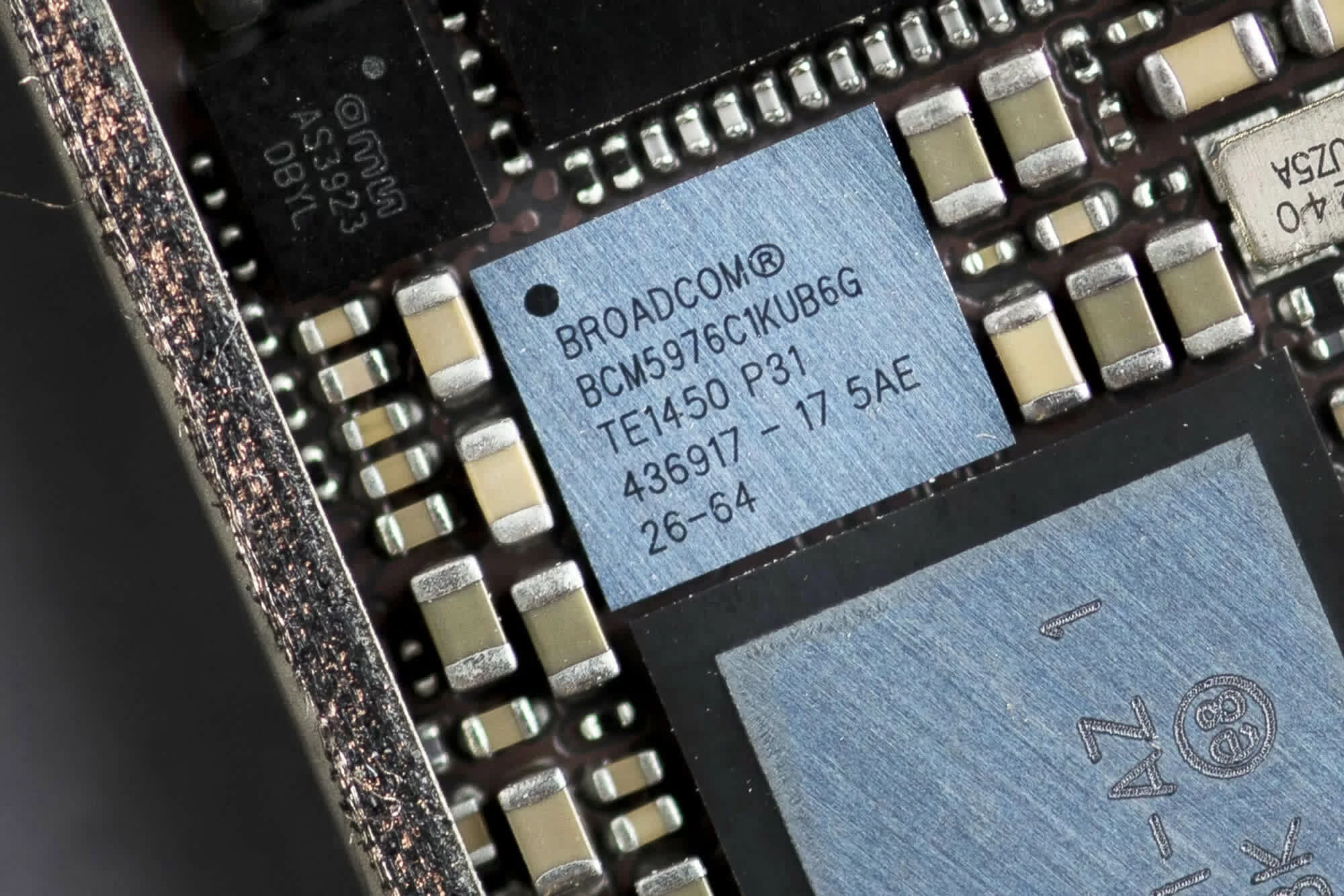

Avago and Broadcom are key cogs in the smartphone and tablet business although neither company has the kind of market dominance that others like Intel and Qualcomm enjoy.

Once the deal is complete, the combined company will adopt the name Broadcom Limited. Avago's existing president and CEO Hock Tan will assume the same positions at the new company. Combined, they'll have an enterprise value of $77 billion with annual revenues of approximately $15 billion and may stand a better chance of competing with larger rivals.

Avago has been on a spending spree as of late, acquiring five different companies over the last two years alone including another well-known rival, LSI Corp. In total, it spent around $8 billion for those companies but as evident by the value alone, Broadcom is by far its biggest haul.

The deal is expected to close by the first quarter of 2016.