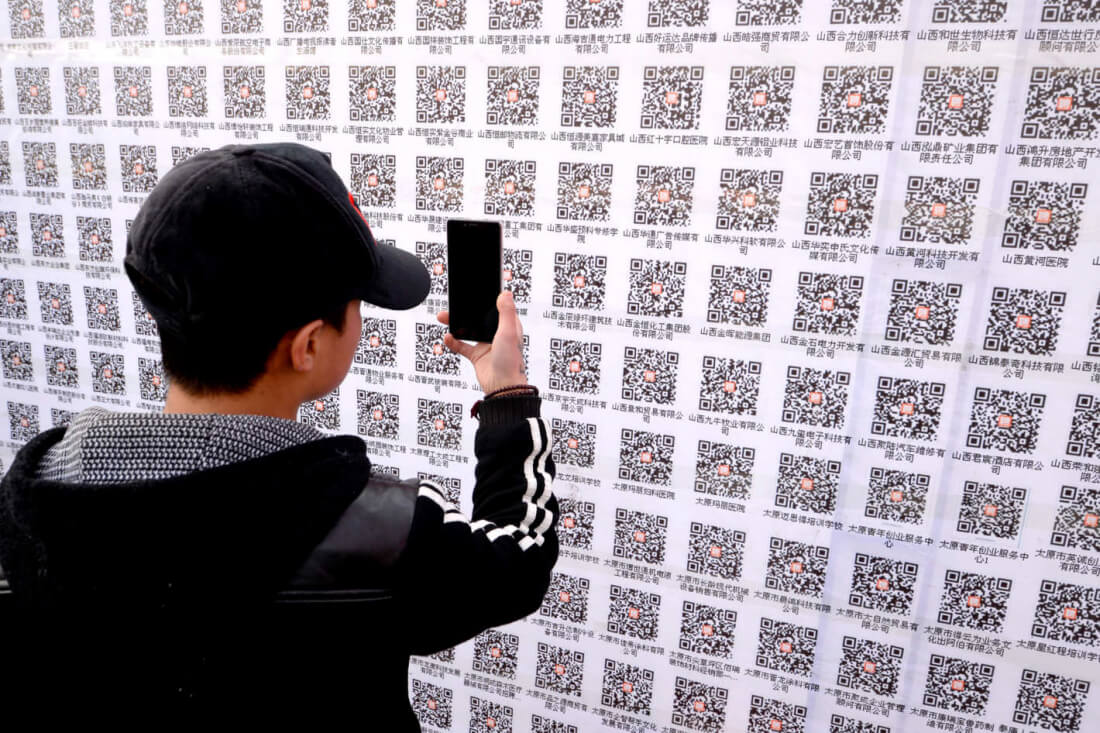

QR codes are just about everywhere in China. They're used throughout social media, to make purchases and even to unlock bicycles across the country. With such widespread adoption, it was perhaps inevitable that criminals would find a way to get a cut of the action.

Back in March, reports of multi-million dollar QR code scams in China surfaced on the Internet. The South China Morning Post (SCMP) claimed that roughly 90 million yuan ($13 million) had been stolen in China's Guangdong province by fraudsters.

Scammers reportedly pull these tricks off by replacing otherwise legitimate QR codes with fake ones, many of which are embedded with a virus designed to latch onto the scanner's smartphone and subsequently drain their bank account. This sort of scam is especially common at restaurants where "fixed codes" are the norm. Due to their static, unchanging nature, these codes are easy targets for thieves.

The risks of letting something like this go unchecked are significant and the People's Bank of China has already come up with a few solutions. To begin with, the bank will be instituting regulations that set an upper limit on the amount any given citizen can spend via QR codes in a single day. These limits start at 500 yuan ($76) but can be increased to 5,000 yuan if certain authentication procedures are followed.

Furthermore, the central bank will require all payment institutions to obtain a license before they can legally offer QR code payment services to customers.

If two of China's top payment processors – Alipay and Tencent – are disappointed by these new regulations, they certainly haven't shown it. Both platforms have come forward to offer their full support for the regulations, with 86 Research financial tech analyst Wang Hanyang claiming that the companies will ultimately benefit from these new rules.

"In the long run, WeChat Pay and Alipay will benefit," Hanyang noted. "Fee rates won't come down, and the price war will probably fade out."