In brief: Apple might be in the middle of a mess of antitrust investigations and lawsuits right now, but that has not stopped investors from flocking to the firm. Once the low man on the totem pole, Apple has become the top dog. Today, it is the most valuable company in the world, and the only publicly traded US corporation to break a $2 trillion market cap.

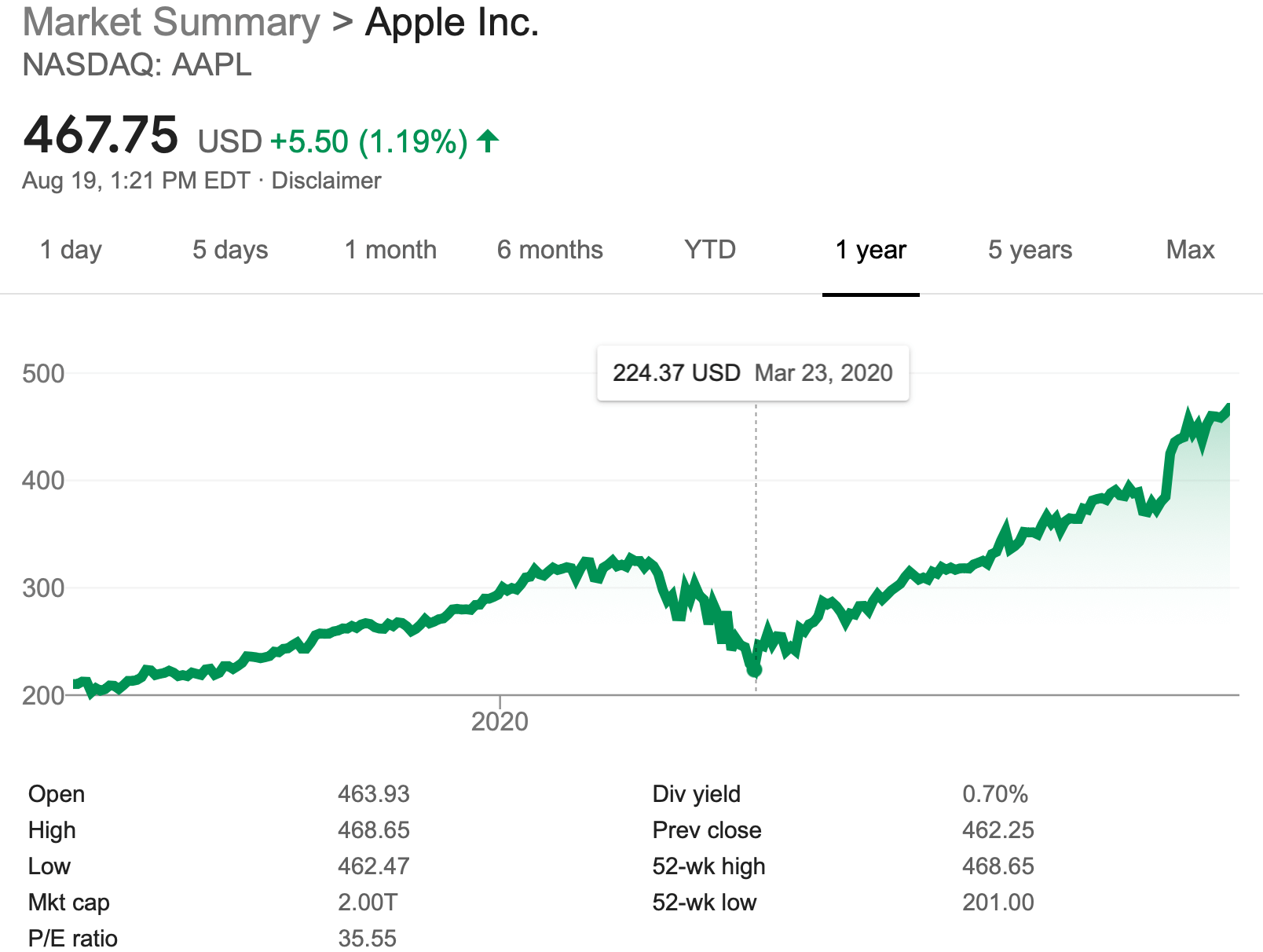

On Wednesday, Apple became the first US company to hit $2 trillion in market value. The tech giant's stock shares climbed 1.2 percent this morning, reaching $467.78 per share, enough to put it over the 2T mark.

Apple hit the $1 trillion milestone only two years ago after 42 years in the business. More amazingly, all of its second trillion in valuation came in just the last five months. After peaking at $327.20 in February, shares took a plunge with the coronavirus outbreak, falling nearly 100 points, and returning valuation to sub-1T levels.

The astronomical rebound makes the Cupertino-based powerhouse the world's most valuable traded company. Amazon, Microsoft, Google, and Facebook round out the top five companies with the most market value with all but Facebook ($767B) worth over $1 trillion.

The pandemic-fueled recession appears to have no hold on Big Tech as the valuations of those five firms has skyrocketed by more than $3 trillion since March 23, 2020. S&P Global notes that this growth is close to that of the next 50 companies in the S&P 500 combined.

Analysts think the explanation for Big Tech's resilience during this plague-driven recession is that investors believe these companies are powerful enough to ride out the storm. Those looking to protect their investments see tech firms as having the resources and flexibility to provide stability.

Additionally, most of Big Tech deals, at least partly, with digital goods and services that people use from home. This dynamic creates a hard to resist option to shift funds into these firms when nobody seems to know when things will get back to normal.

Image credit: Primakov