What just happened? We can add the traditional pay TV industry to the growing list of those that have not benefited from the pandemic. According to market research company eMarketer, 31.2 million households in the US will have "cut the cord" in aggregate by the end of the year. At the going rate, by the end of 2024, fewer than half of US households will subscribe to a pay TV service.

Eric Haggstrom, eMarketer forecasting analyst at Insider Intelligence, said consumers are choosing to cut the cord because of high prices, especially compared to streaming alternatives. "The loss of live sports in H1 2020 contributed to further declines", Haggstrom said.

Even though sports have largely returned, people aren't necessarily returning to their old cable or satellite plans.

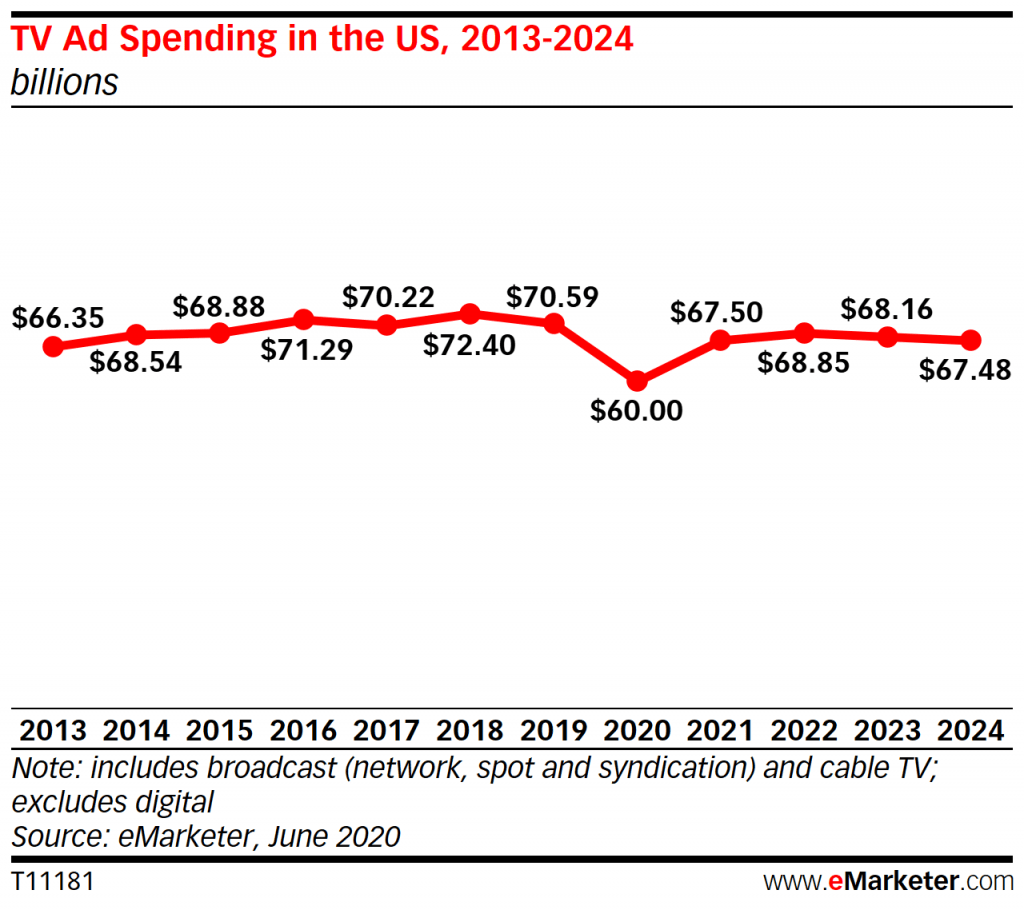

The advertising industry is also feeling the squeeze. eMarketer said total spending on traditional TV ads will drop 15 percent this year to $60 billion, the lowest level since 2011. Things should rebound a bit next year but the firm anticipates spending will stay below pre-pandemic levels through at least 2024.

Some, including Haggstrom, don't think spending will ever return to pre-pandemic levels.

"While TV ad spending will rebound in 2021 with the broader economy, it will never return to pre-pandemic levels," he said.

Indeed, given current trends to move to over-the-top offerings, a general audience erosion and the growth in streaming video platforms, ad money is almost certainly going to continue to move away from traditional TV.

Masthead credit: Kristin Chiasson