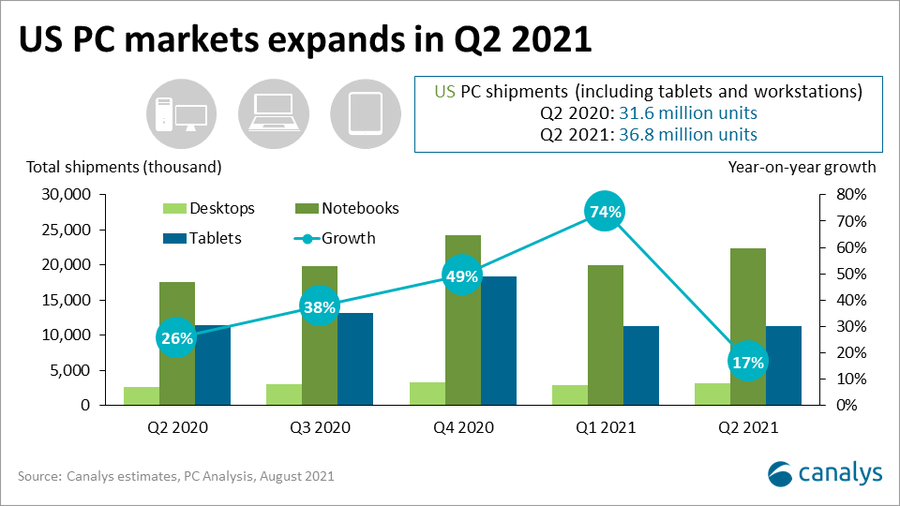

In brief: With the pandemic altering many people's working lives from in-office to at-home or hybrid, the PC market continues to flourish. According to a new report, second-quarter sales were up 16.6% compared to the same period last year, reaching a total of 36.8 million shipments. But while it's good news for PC makers, tablet sales have stagnated.

The latest quarterly figures from market research firm Canalys show that total shipments for desktops, notebooks, tablets, and workstations saw annual growth of almost 17% YoY, with notebooks the best performer of the group, managing a 27% increase. Desktops weren't that far behind, with a 23% jump over Q2 2020.

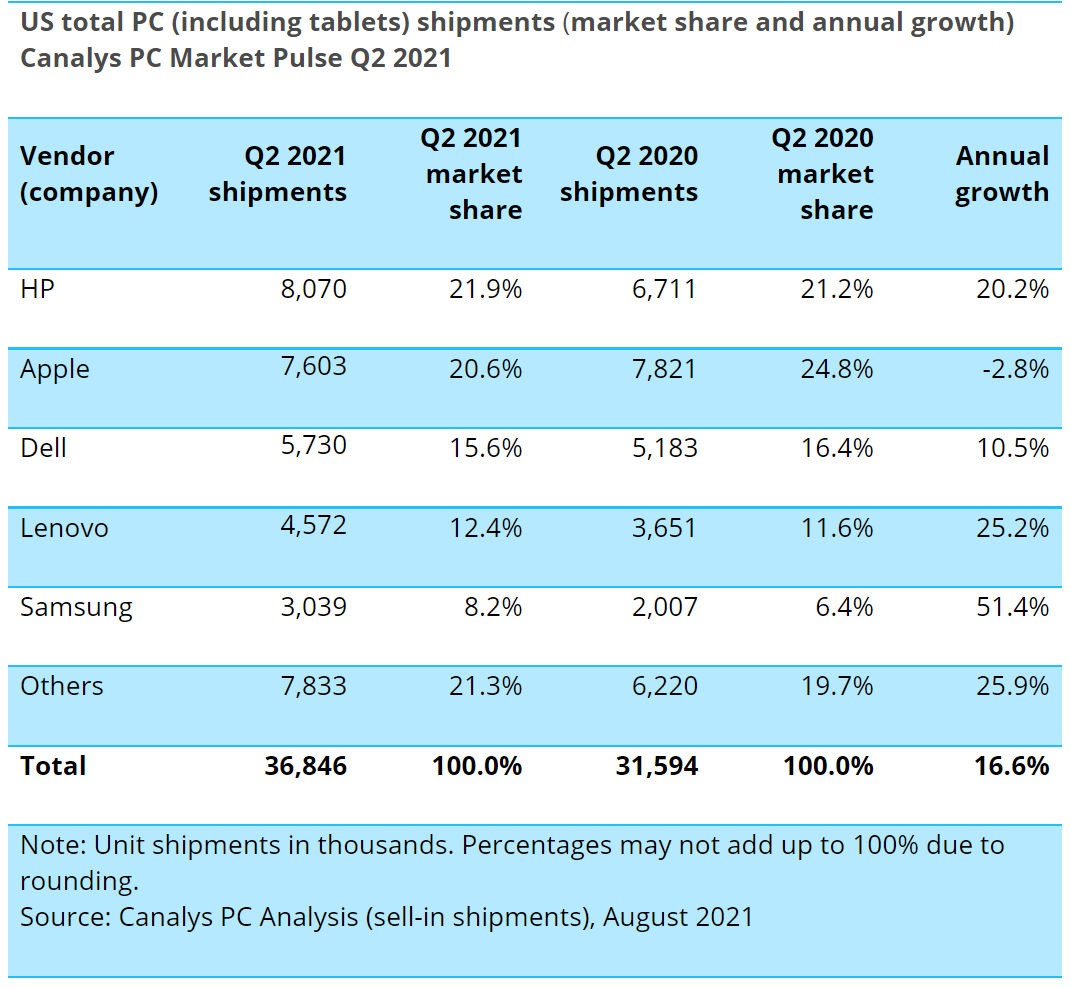

Four of the top five companies experienced annual growth in double figures. The only exception was second-place Apple, which declined -2.8% in the quarter. Its notebooks, however, were up 24%, helped by the popularity of the M1-powered MacBooks.

Elsewhere, HP led the way with a 21.9% market share, up 0.7% compared to Q2 2020, followed by Apple, Dell, Lenovo, and Samsung, the latter of which enjoyed the most significant yearly growth: 51.4%.

"It is clear now that pandemic-related use cases will extend well into the future," said Brian Lynch, Research Analyst at Canalys. "This points toward a significant refresh opportunity in the future - fantastic news for PC vendors and their channel and ecosystem partners. The commercial and education segments have exploded, triggering tremendous refresh potential. The US economy has bounced back well from its pandemic woes and small businesses are recovering, which will lead to a wave of purchasing from the segment."

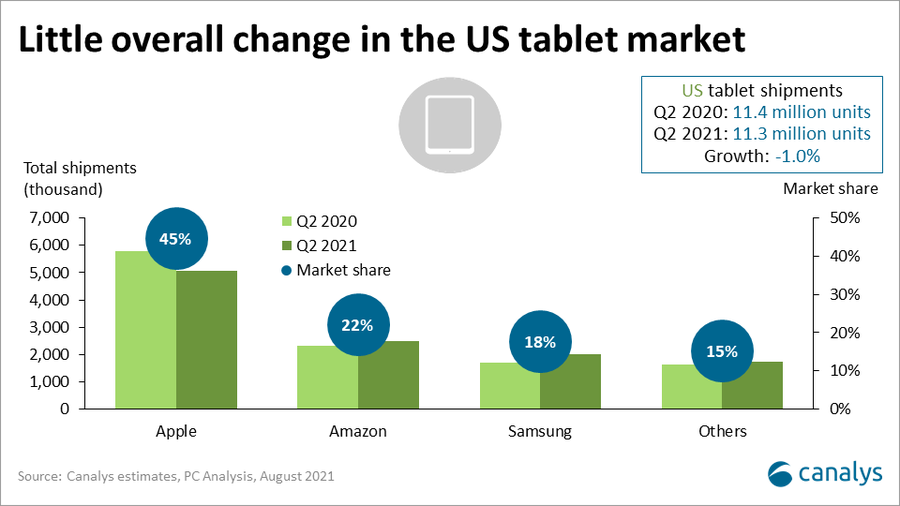

The news wasn't as good for tablets. The fourth quarter of 2020 was the segment's best in six years, thanks to a 40% YoY increase in shipments (19.2 million), but Q2 2021 saw the tablet market contract by -1% YoY to 11.3 million. Apple led the pack, as always, with a 45% share, followed by Amazon (22%) and Samsung (18%).

We've seen more companies, including Apple and Facebook, delay their planned "return to the office" dates as a result of the Covid Delta variant, leading to extra demand for PCs. "The US PC industry is set for a bright future. Whether it be work, school or leisure at home, PCs are in users' hands more than ever. The integration of devices into everyday life points toward a rosy future for the market," said Lynch.