In a nutshell: Real estate listing aggregator Zillow reportedly has a housing surplus and wants to bulk-sell up to 7,000 homes. It is looking to recover about $2.8 billion after reportedly buying up too many properties over the summer.

Zillow's primary form of business allows users to search for available housing to rent or purchase. Most people are unaware that the company has a "Homes" division that is essentially a house-flipping business. Its "Zillow Offers" program buys properties for cash up-front, makes renovations, then puts them back on the market for a profit.

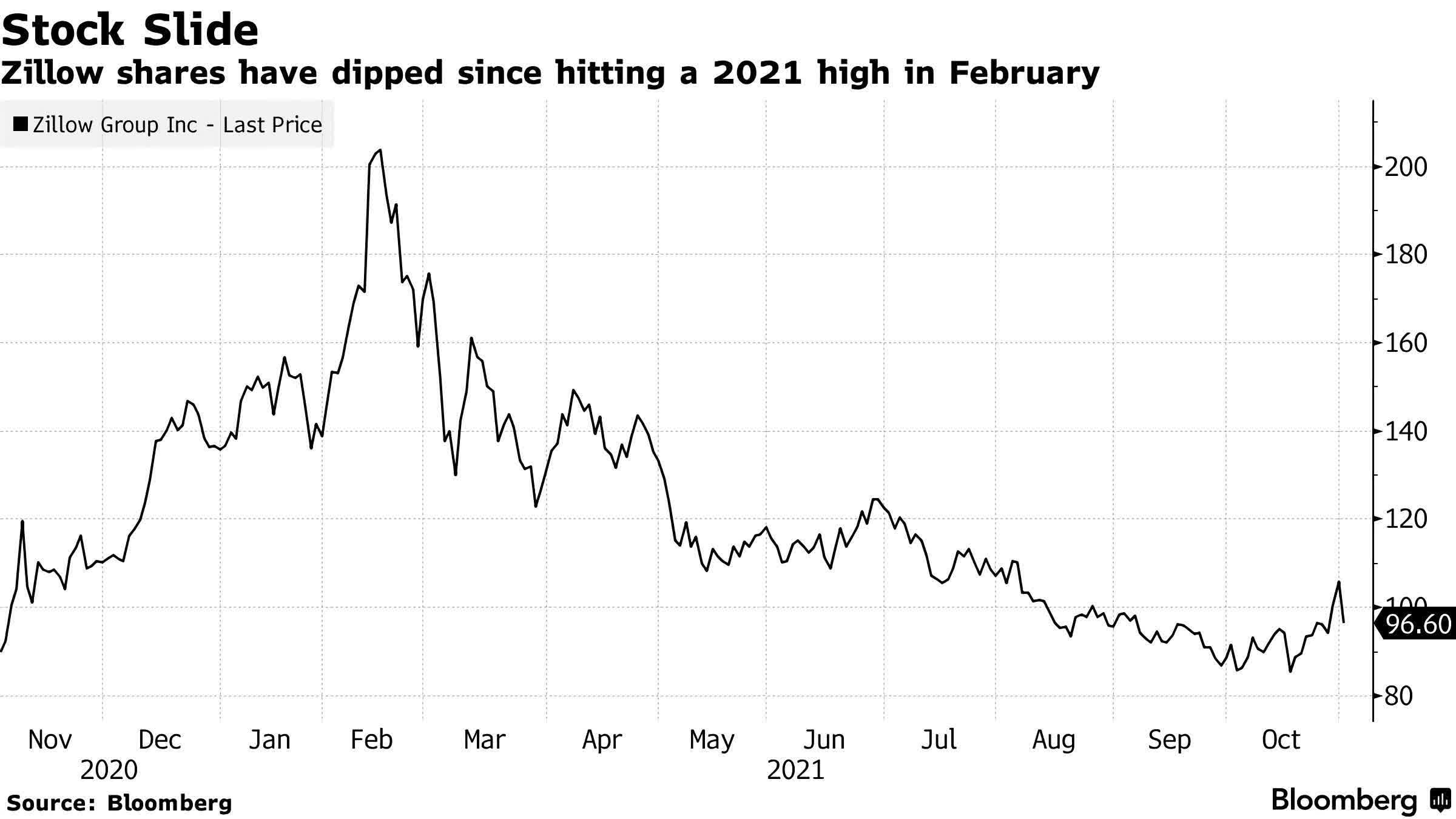

Over the summer, several tech companies, including Zillow, snatched up real estate as housing prices in the US began ballooning. In August, Vice reported that the company participated in a housing "arms race" with other tech companies like iBuyers and Opendoor. The company told investors it planned to expand its Homes division into a billion-dollar business and would purchase thousands of homes throughout 2021, despite the company's stock being on a steep downward trend since February.

The housing market slowed down by the end of summer, and Zillow put a freeze on purchases. Last month, it told investors that a labor shortage in construction and renovation was the cause of the halt. However, insiders told Bloomberg that the company is pitching the properties to "institutional investors" in multiple home bundles. It hopes to make at least $2.8 billion from the sale of around 7,000 homes, estimated to be around seven-eighths of the properties it acquired in Q3 2021.

It remains unclear if the bulk sales will result in an overall profit or loss. According to Zillow, the current home value index is $308,220. The average asking price of the bundles would be $400,000 per unit. That's a markup of nearly 30 percent. However, there is no guarantee that Zillow will recoup as much as it hopes. With real estate investors becoming bearish, it is unlikely the company will get its initial asking prices for the bundles.

KeyBanc Capital Markets reported that an analysis of 650 Zillow-owned properties showed the Homes division listed two-thirds at an asking price lower than what the company paid.

"I think they leaned into home-price appreciation at exactly the wrong moment," KeyBanc analyst Ed Yruma told Bloomberg.

YipitData analysts noted that the company put a record number of homes on sale in September with the lowest markups since 2018. Additionally, Zillow reduced the prices on nearly half of the properties it listed in the third quarter. The analysts speculate a surplus is forcing Zillow to ask for less.

Image credit: Binyamin Mellish