In brief: The world's largest contract manufacturer of consumer electronics wants to be a key player on the EV market by 2025. Foxconn's latest move in that direction is to set up several facilities in Taiwan where it will produce battery cells and build electric buses.

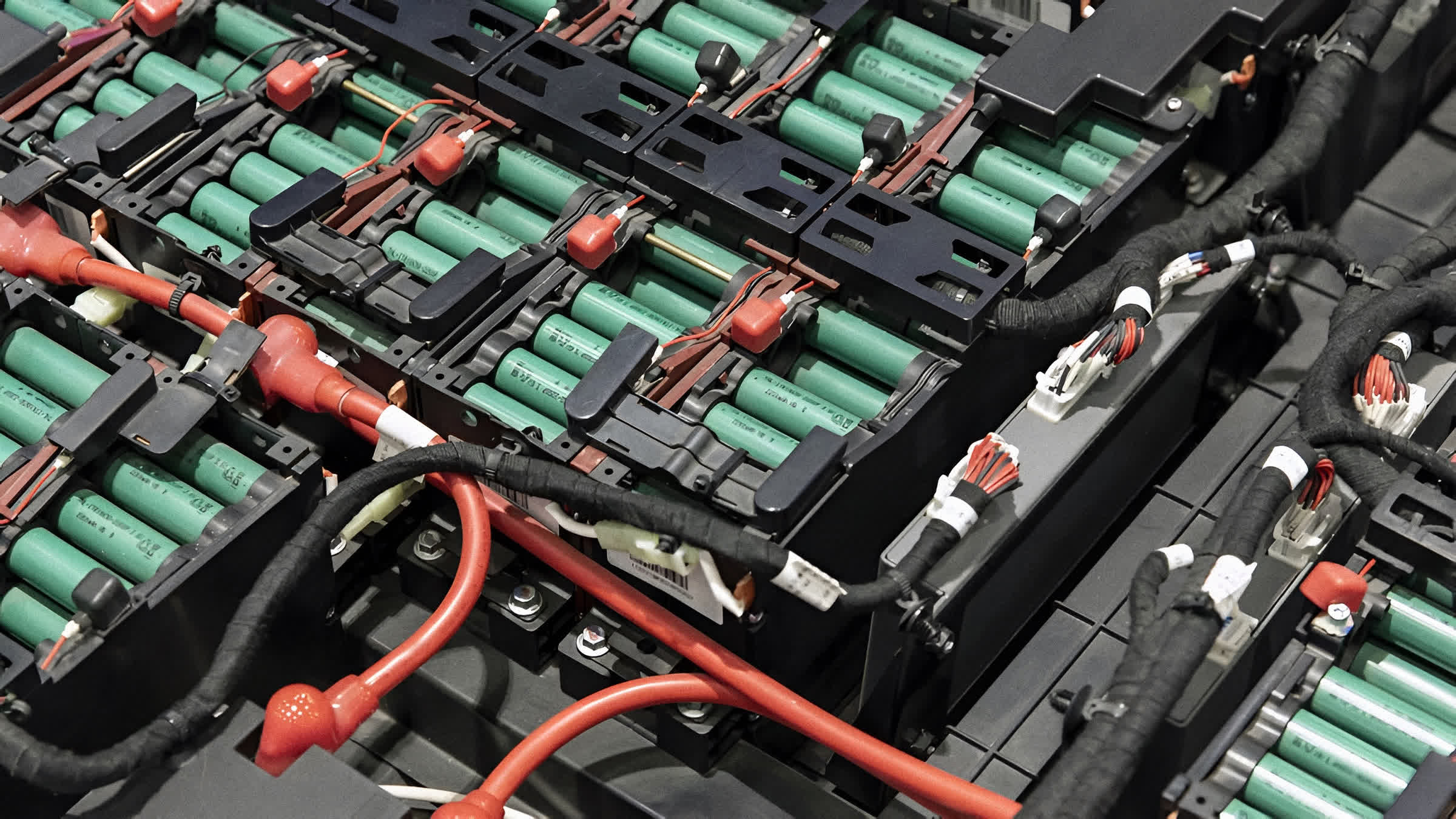

Foxconn today announced plans to manufacture batteries in the near future as part of its strategy to become the Android of the EV industry. Apple's largest supplier says it wants to build new facilities in Taiwan where it will make battery cells, battery packs, and grid energy storage systems.

As governments around the world push for the electrification of everything, the company seems determined to diversify its business and become a major supplier of key components for the auto industry as it transitions away from internal combustion engines.

Its ambitions don't stop at making batteries, however, as the new facilities may also be used to design and assemble electric vehicles. During a press conference in Kaoshiung, Taiwan, Foxconn chairman and CEO Young Liu explained that "our goal is to formulate a complete ecosystem for electric buses in the city and then we can export the solutions outside of Taiwan."

Liu says Foxconn has plans to build several EV factories in Europe, India, Mexico, and South America in the coming years, depending on where it will be easier to set up close partnerships with local governments and companies. Last month, Foxconn set up a joint venture with Vedanta in India for a chip manufacturing plant. The new facility could be used to manufacture microcontrollers needed by car manufacturers, as demand far outstrips supply.

Last year, the Taiwanese manufacturing giant acquired Lordstown Motors Corp.'s electric truck factory in Ohio for $280 million, but its main focus in this area remains on further developing cheap barebones EV platforms that big brands and startups can customize and sell as their own.

Foxconn isn't the only company that wants a share of the growing EV pie. Luxshare is also looking to tap into the EV industry by partnering with Chinese automaker Cherry Group, Ford and Panasonic are both building massive EV and battery cell factories in the US, and Arm is working on the software smarts of next-generation electric vehicles.

Liu isn't concerned about the growing competition and consolidation going on in the EV space. He has promised investors that he will ensure Foxconn's EV designs and components will be in five percent of the global EV market by 2025, and generate over $35 billion in revenue by 2026.