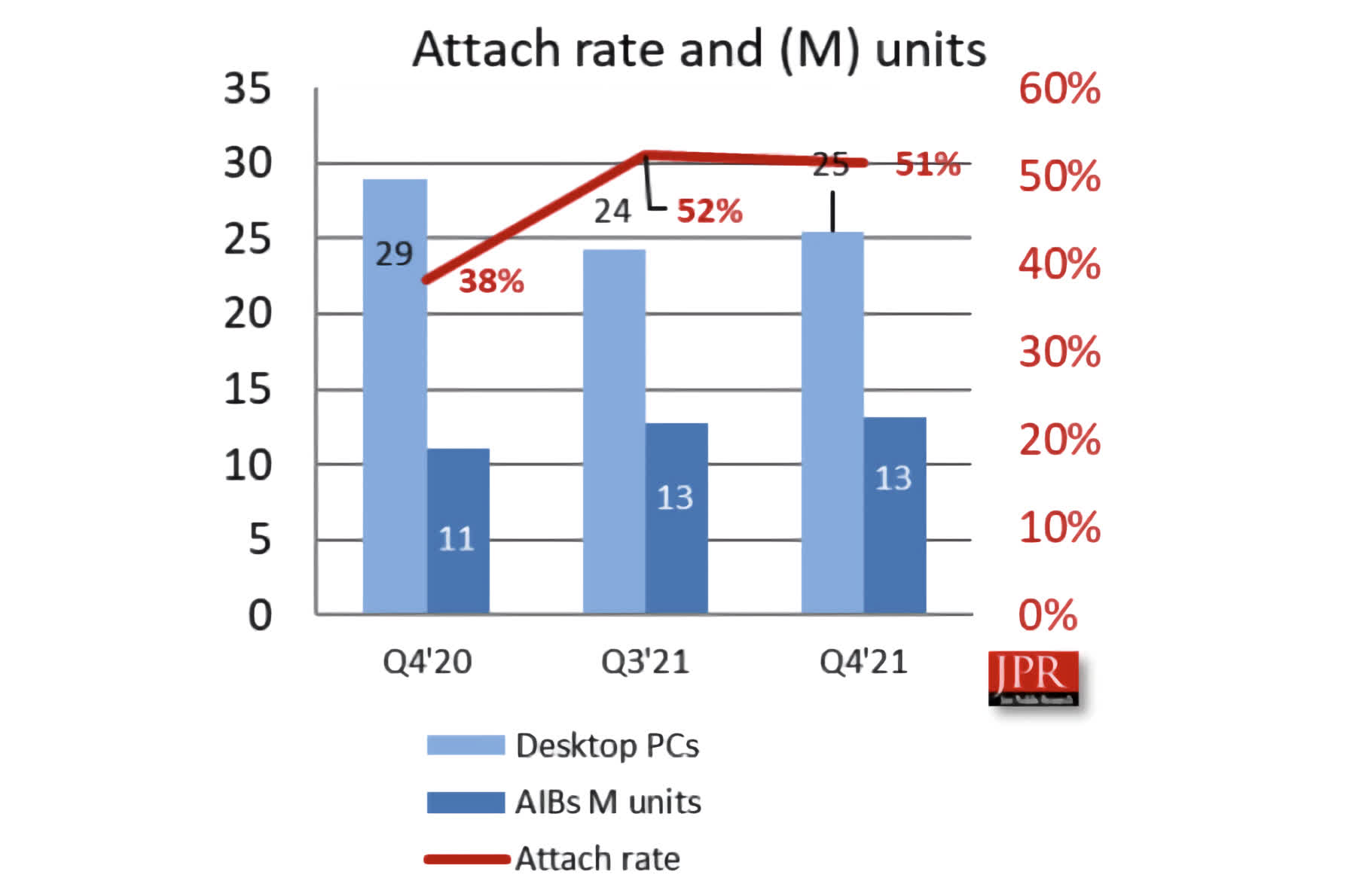

The big picture: The latest report from Jon Peddie, who closely monitors the graphics card industry, shows a dramatic increase in GPU shipments towards the end of last year compared to late 2020. Some interesting nuggets include that the record volume for add-in graphics card was reached in 1998, when 116 million units were sold. That's down to 42 million shipped in 2020, and 50 million AIBs in 2021. The GPU market is now a $51 billion/year business according to JPR.

A report released on the AIB market for the quarter ending December 2021 shows that manufacturers shipped a total of 13.1 million discrete GPUs for the quarter, a 29.5 percent jump from the same quarter in 2020. That's also a 3 percent jump from the 12.7 million units shipped in the quarter ending September 2021.

AMD's desktop GPU shipments in Q4 grew by 12.4 percent from the previous quarter and by 35.7 percent year-over-year. Nvidia's shipments went up by 0.5 percent quarter-to-quarter and 27.7 percent compared to Q4 2020, maintaining dominance with a 77.2 percent market share.

A few key factors are set to impact the add-in graphics card market in 2022. Intel's entrance into the sector with its Arc line is an important one, though we probably won't see those in volume until the end of the year. Intel Arc laptop editions have already launched, with desktop variants set to arrive in the next few months. Intel's attempt to shake up the effective duopoly between AMD and Nvidia has been highly anticipated.

The second factor facing GPUs in 2022 is the recent downward trend in prices – and mining profitability. According to our own tracking data, graphics card prices have been slowly dropping since the new year.

Towards the end of 2021, they were nearly 200 percent over MSRP, but more recently have fallen to ~50% percent over MSRP depending on the exact model. After over a year-plus of grossly inflated GPU prices, the light at the end of the tunnel may finally be in sight.