In a nutshell: The pandemic boom for the PC market has come to an end as evident by the latest market report from IDC. Global shipments of traditional PCs slid to 67.2 million units in the fourth quarter of 2022. That's down 28.1 percent versus the same period in 2021 and is comparable to the fourth quarter of 2018 when Intel was strolling with its supply of processors.

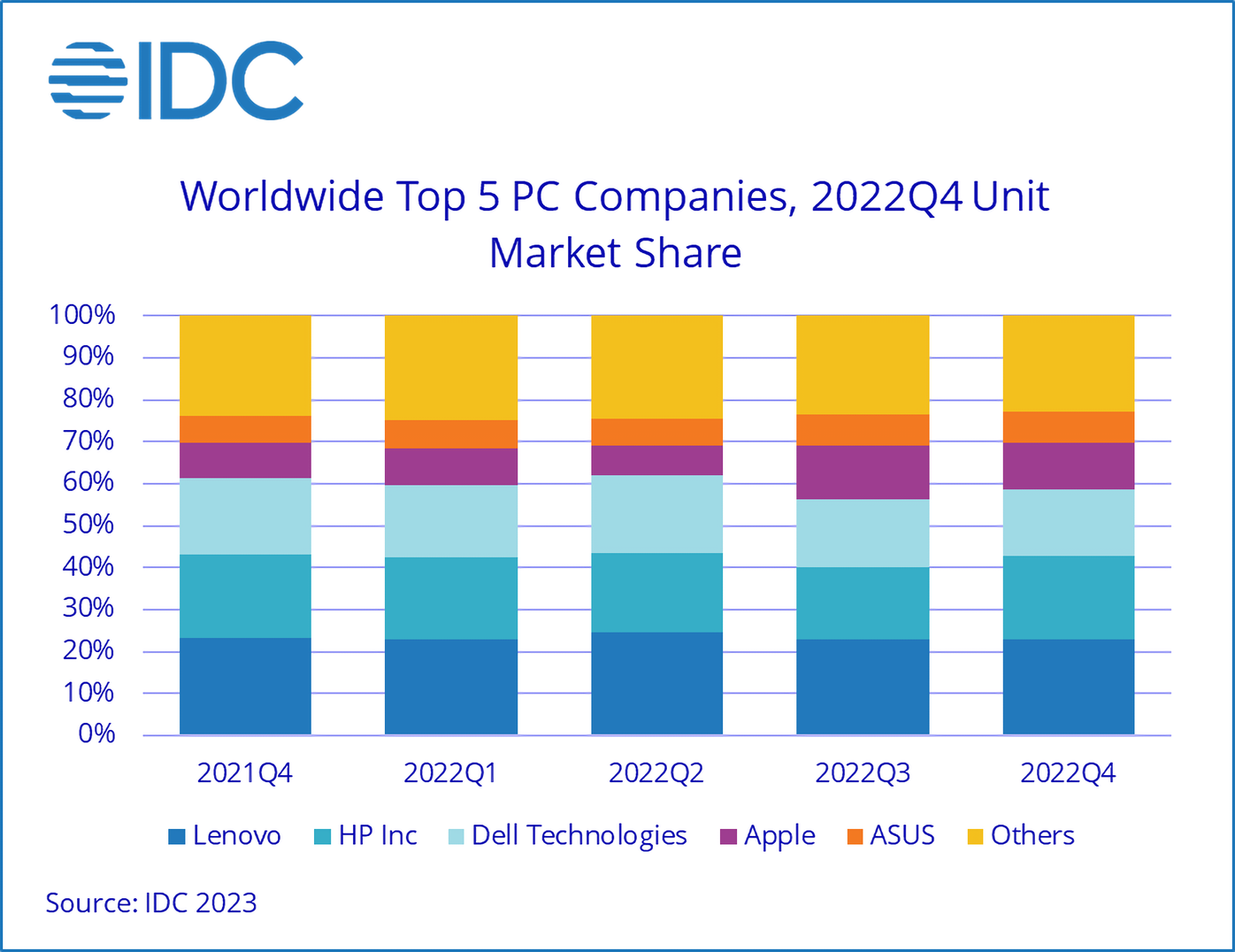

Lenovo led the way in Q4, shipping 15.5 million PCs followed by HP with 13.2 million units. Dell placed third with 10.8 million systems shipped during the holiday quarter while Apple moved 7.5 million Macs over the same period. All experienced negative growth compared to Q4 2021.

With 292.3 million units shipped for the full year, the market is well above pre-pandemic levels. Still, there's reason for concern as IDC points out that many users have relatively new PCs and the global economy isn't in great shape.

As Adobe noted in its recent holiday shopping analysis, retailers turned to discounts in the fourth quarter to spur demand. The PC industry wasn't immune as average selling prices (ASPs) across several channels fell in hopes of moving excess inventory.

IDC Research Manager Jitesh Ubrani noted that despite the efforts, inventory management will remain a key issue in the coming quarters and could continue to impact ASPs.

According to the market research firm, the general consensus is that segments of the PC market could return to growth by the end of 2023 with a broader market recovery to follow sometime in 2024.

Microsoft ended support for Windows 7 and Windows 8 earlier this week, which could drive sales in the near term. Windows 7's global market share sat at 11.2 percent as of December 2022 according to StatCounter while Windows 8 was installed on just 0.66 percent of machines worldwide.

Windows 10, with a market share of nearly 68 percent, isn't too far away from reaching end of life status either. Microsoft has set a date of October 14, 2025, for its retirement.

Image credit: Mart Production