What just happened? While stock analysts give very little weight to market cap valuations, companies like to tout the numbers as a measure of growth. Only a handful of companies have reached $1 trillion and Alphabet is the latest.

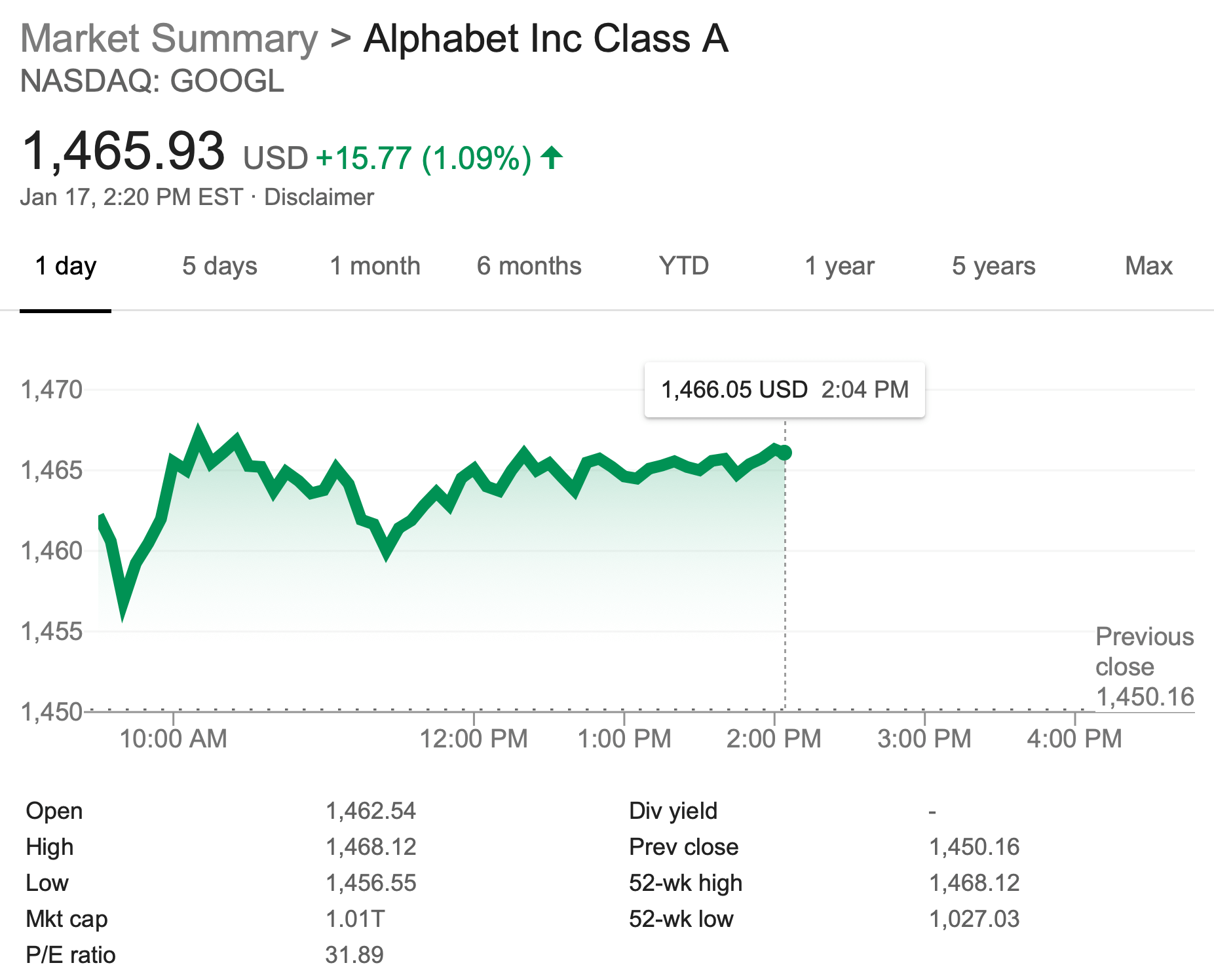

On Thursday, Google’s parent company Alphabet closed trading at $1,450.16 per share and breaking a $1 trillion market cap. The company will be reporting its fourth-quarter earnings next month, and Motley Fool analysts predict around 20-percent growth year-over-year with revenue of $46.9 billion.

Alphabet it the fourth US company to break the trillion-dollar barrier — $1.01 trillion as of this writing. Apple was the first in 2018, followed by Amazon. However, the online retail giant quickly dipped back under the mark (now at $924B). Microsoft hit the threshold last year and has maintained its cap along with Apple valued at $1.27T and $1.38T, respectively.

PetroChina was the first to reach the valuation in 2007, if only briefly. CNN Business notes, Saudi Aramco hit $2 trillion last December but has taken a deep dive down to $119 billion. Both companies have struggled to maintain valuation after their IPO due largely to a shaky and unstable oil market, showing that market caps are not necessarily a good gauge of a company's financial health.

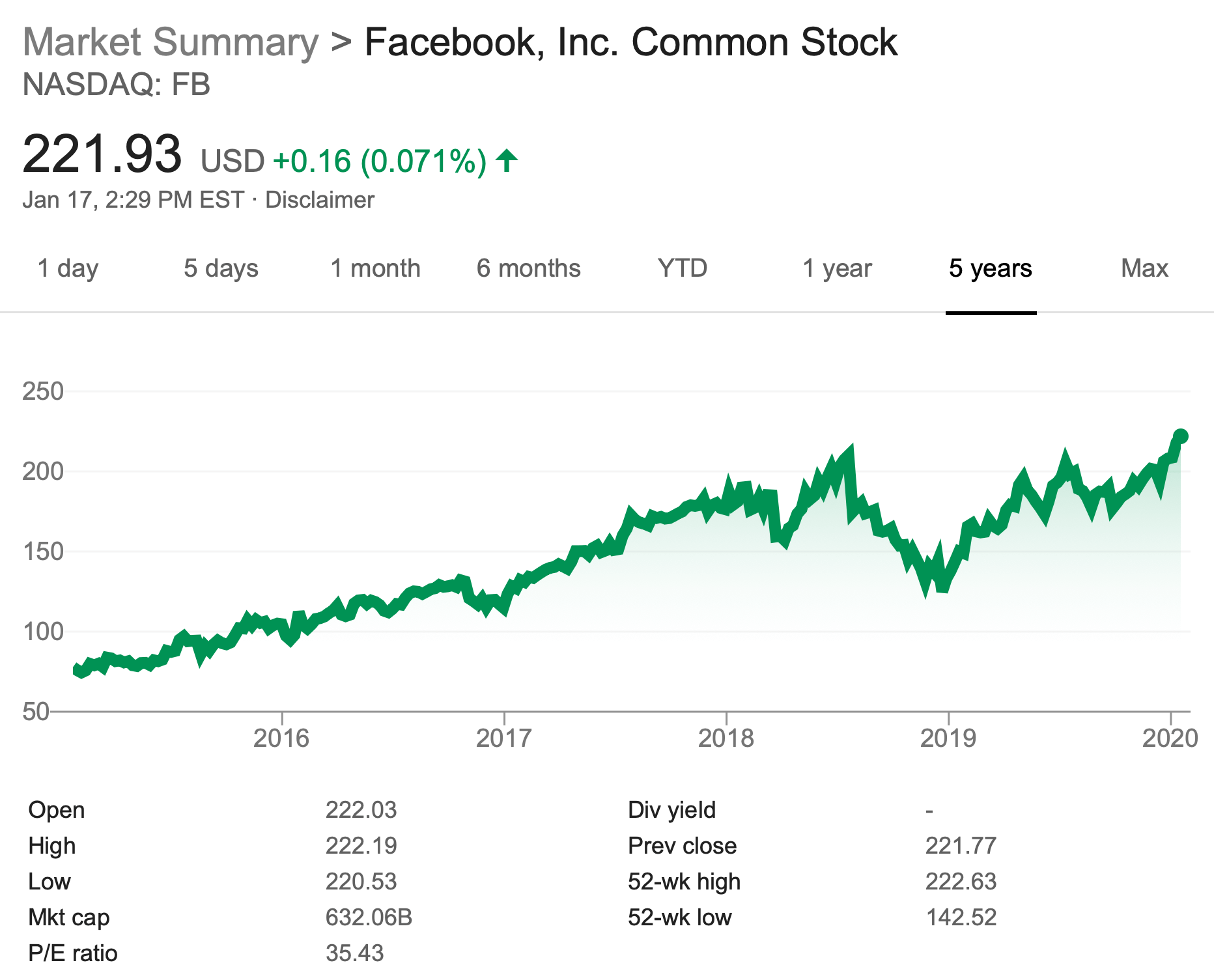

Facebook is another company poised to break into the trillion-dollar club. Its current market cap sits at $632 billion, although it is hard to predict how long it will take to reach $1T.

While its growth has been steady, trading in Facebook stock has been volatile in the short term. Shares plummeted more than 40 percent in the last half of 2018 in the wake of the Cambridge Analytica scandal, and it is just now reaching its previous levels.

With only a small margin over the trillion-dollar cap, it’s hard to say whether Alphabet can hold on to its valuation. However, with Google making headway with its Stadia platform, including a partnership with BT to bundle the service with broadband packages, further growth seems all but guaranteed.

Image credit: Alphabet site under magnifying glass by dennizn

https://www.techspot.com/news/83603-alphabet-becomes-fourth-us-company-hit-1-trillion.html