The big picture: Mark Zuckerberg's Metaverse ambitions continue to look like a money pit, costing Meta tens of billions of dollars over the last two years. The company's 2022 year-end financial statements compound prior heavy losses from Reality Labs, but Meta's leadership remains committed to the venture.

Meta's financial statements for Q4 2022 show that its VR division's losses increased compared to its serious money burn from prior quarters in the year. However, that didn't stop Meta's stocks from experiencing one of their best days.

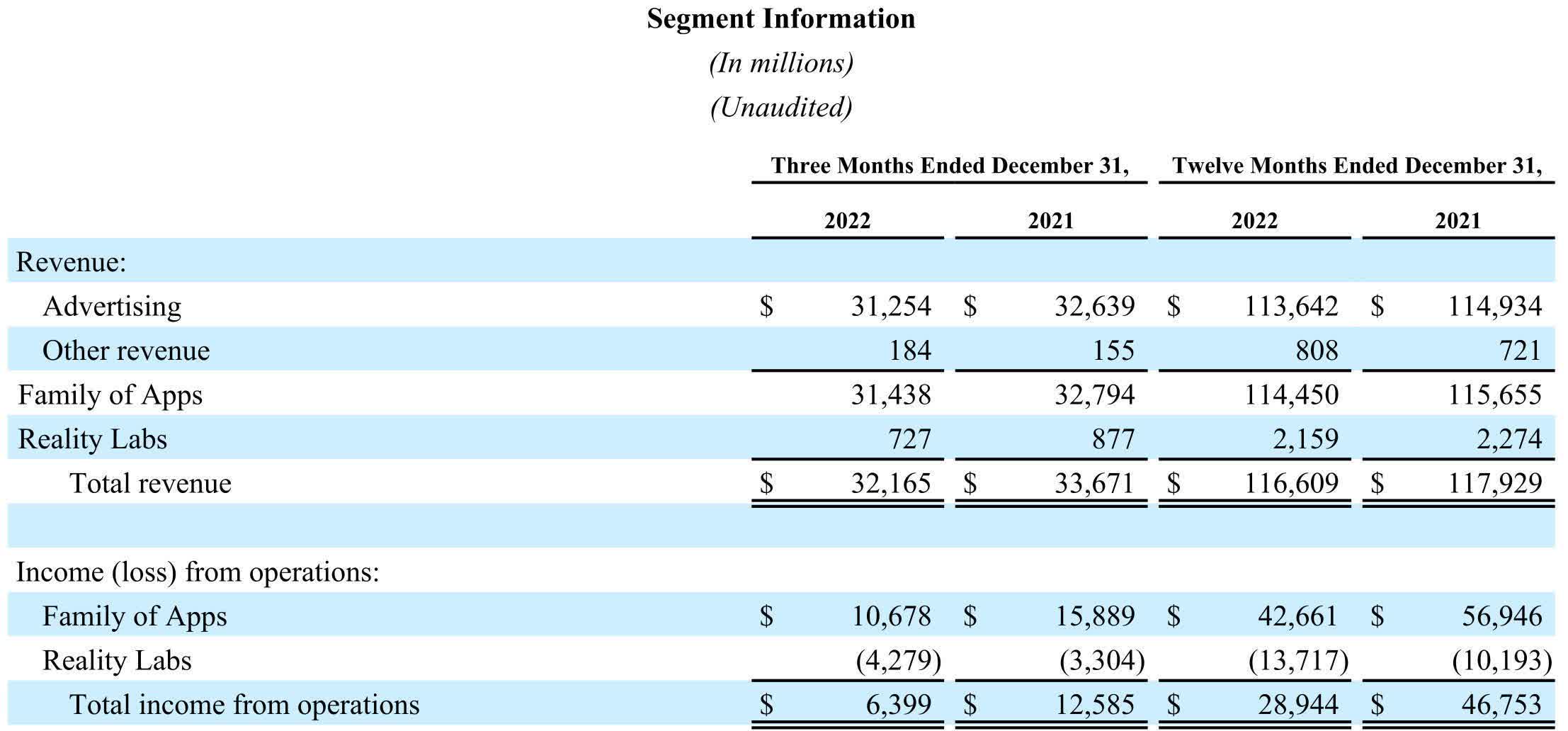

Reality Labs hemorrhaged $4.3 billion in Q4 2022. Including the $3.7 billion burnt in Q3, the $3 billion sunk in Q2, and the $2.96 billion thrown away in Q1, Meta's Metaverse division losses for 2022 total $13.7 billion. That number follows the $10.2 billion Reality Labs lost throughout 2021.

As the costs mounted last year, CEO Mark Zuckerberg maintained that the company's efforts would pay off in the next decade and that thinking hasn't changed. In the Q4 earnings call, CFO Susan Li said Meta expects Reality Labs to lose more money in 2023 but will continue what it considers a long-term investment.

Last year, Meta released its latest VR headset for enterprise operations --the $1,500 Quest Pro. The company expects to release a cheaper consumer-oriented model this year to succeed the Meta Quest 2. However, VR headset sales and shipments were down in 2022 compared to 2021, casting doubt over Meta's focus in the sector.

Meta's VR division also lost legendary programmer John Carmack last year. In December, he left the company after repeatedly expressing concern over inefficiencies in its approach to building the Metaverse. Meta also laid off 11,000 employees the previous month --about 13% of its staff.

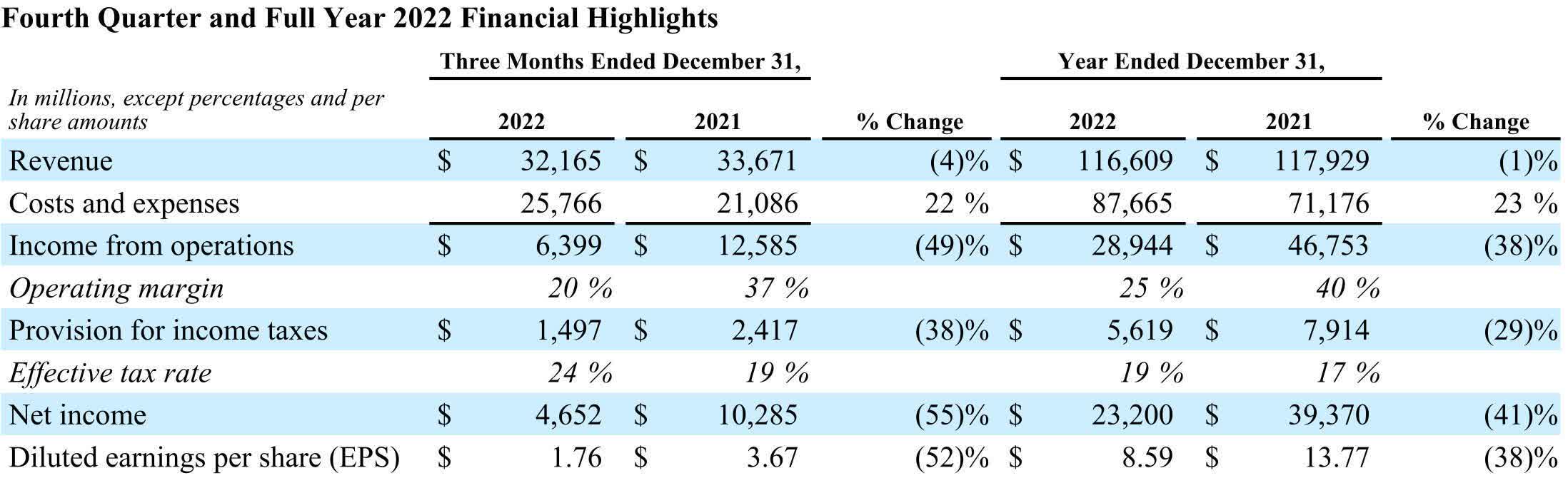

The stark numbers from Reality Labs accompany Meta's annual and Q4 income and revenue losses. Fourth quarter revenue fell by 4 percent to $32.2 billion, while net income for the quarter was down 55 percent at $4.7 billion. Total 2022 revenue was down 1 percent for the year at $117 billion, and net income for the year fell 41 percent to $23 billion.

Although the numbers look dreary, they exceeded analyst expectations. Due to that glass-half-full outlook and Meta's announced $40 billion in share buybacks, the company's stocks rallied this week. Meta's market cap rose 27 percent in one day, a better than $100 billion jump.

Although the company's stock saw its best day in a decade this week, that only returns it to where it was last June. Meta hasn't begun to regain the half a trillion dollars of value it has lost since late 2021.

https://www.techspot.com/news/97478-meta-reality-labs-lost-14-billion-last-year.html