In brief: South Korea's semiconductor industry has been dealing with excess stock these last six months. It's caused YoY production levels to fall for the first time in four years as demand shrinks and inventories remain high. Once again, the finger of blame is being pointed at the global economic downturn, especially the slumping electronic goods market.

As reported by Bloomberg, the South Korean semiconductor industry saw year-on-year output fall by -1.7% in August, marking the first YoY decline since January 2018. It comes as inventories reach 67.3% and factory shipments decline (-20.4%) for a second consecutive month.

This isn't the first sign of a sector under pressure. The largest US maker of memory chips, Micron, yesterday forecast quarterly sales that were almost $2 billion below Wall Street estimates, while Japanese NAND giant Kioxia said it is reducing output and will lower production by 30% over the coming months.

Samsung also warned that the second half of 2022 was going to be a tough one. According to IC Insights, the DRAM market halved in size between May and July, and the pattern isn't about to change.

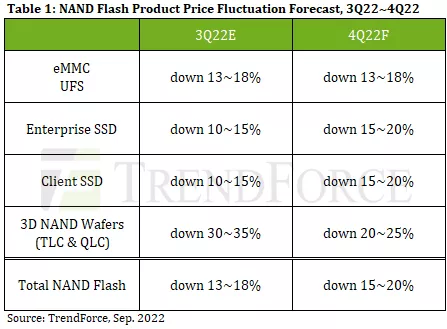

A recent report from TrendForce predicts that NAND flash prices will drop by 15 - 20% in the fourth quarter of the year. 3D NAND fell 30 – 35% in Q3, and analysts predict another 20 – 25% decline in Q4. But it's good news for consumers looking to buy products such as solid-state drives, which are going to experience further price drops.

While the current global economic situation is a big part of the problem, much of what we're seeing now is the post-lockdown effect. The beginning and height of the pandemic saw demand for electronic items skyrocket as most of the world worked, learned, and played at home. Companies couldn't keep up with consumers, which contributed to low availability and high prices at the time. But the end of the lockdowns and cooling demand left many chip companies with excess stock.

In related news, gaming monitor shipments just fell for the first time ever, and Apple has cut back iPhone 14 production.

https://www.techspot.com/news/96156-south-korean-chip-production-falls-first-time-since.html