TL;DR: Tesla's first-quarter earnings for 2021 are in, and they look good. Revenue, margins, and vehicles delivered exceeded the company's expectations and analysts' predictions. Tesla projects growth for 2021 to be 50-percent higher year over year.

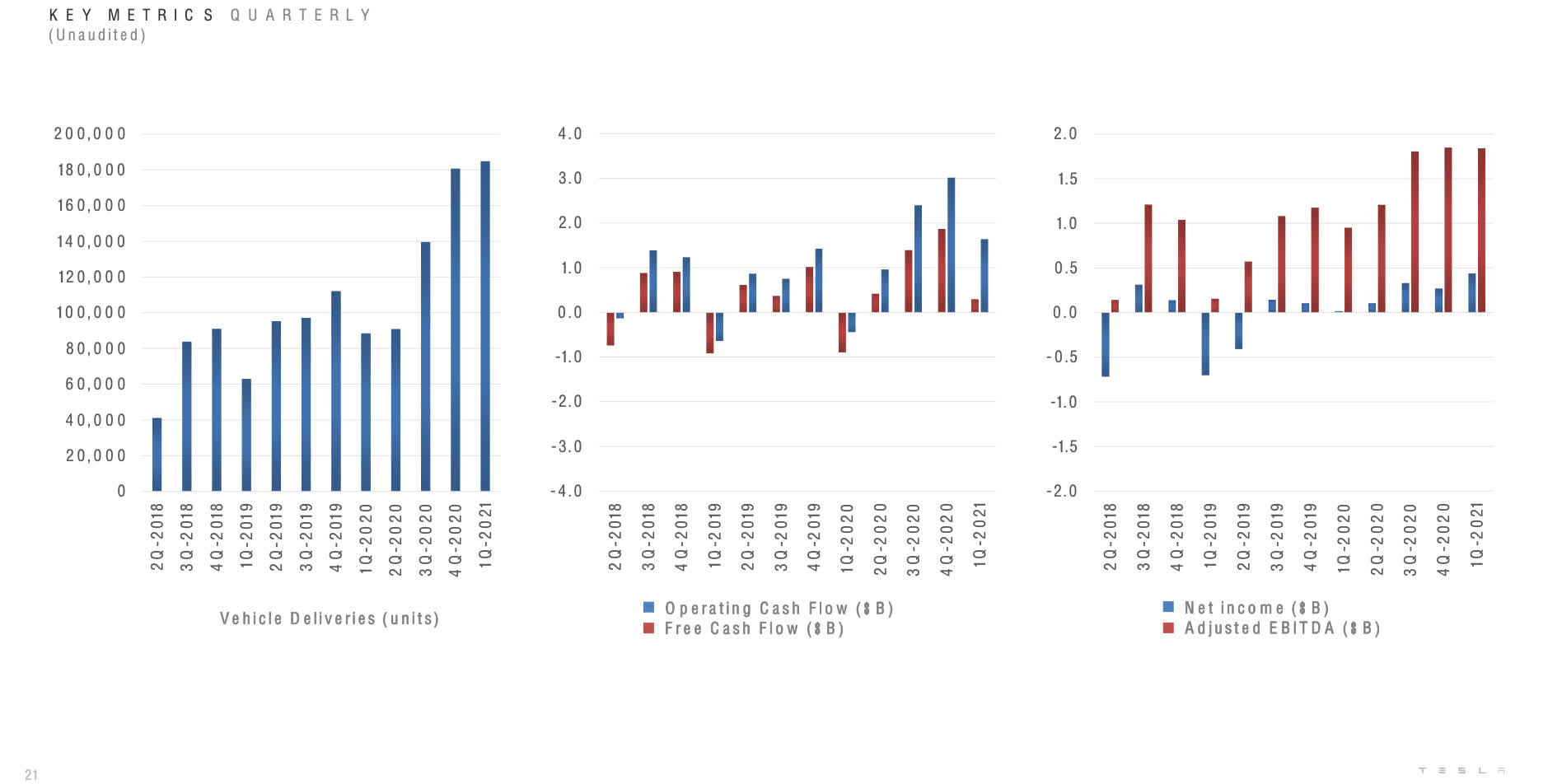

Total revenue was $10.39 billion, which is $100 million more than the company forecasted and 74-percent higher than last year's revenue. Of that, $518 million came from sales of regulatory credits, and $101 million was made on the exchange of bitcoin received from sales. It also shattered a record for net income during a quarter earning $438 million in Q1 2021.

In the earnings call with investors, Musk reported that Tesla moved more than 184,000 Model 3 and Model Y electric vehicles in Q1. It also sold 2,020 Model S and Model X SUV units from last year. The newer Model S Plaid was supposed to ship in March, but Musk and CFO Zachary Kirkhorn said that the company could not overcome supply-chain issues. It has been pushed back to May.

Click to enlarge

That said, EV sales were still up 100 percent over last year. Tesla expects year-end totals to yield a 50-percent growth rate over 2020. That equates to more than 750,000 units compared to last year. Although the execs expect to face the same supply chain issues in 2021, they aim to produce 2,000 vehicles per week starting later this year.

CNBC notes that the optimism stems from the fact that the chip shortage has forced the company to pivot "extremely quickly to new microcontrollers, while simultaneously developing firmware for new chips made by new suppliers." Subsequently, the new Model S and Model X SUV are now slated for delivery next month.

Tesla's battery business boomed as well, nearly doubling over Q1 2020 figures. However, first-quarter earnings took an almost $200 million dive going from $787 million in Q4 of 2020 to $595 million in Q1 2021.

Image credit: Ivan Marc

https://www.techspot.com/news/89467-tesla-sets-q1-earnings-record-438-million-net.html