In brief: The electric vehicle industry has undergone a dramatic transformation in battery technology over the past 15 years, with costs plummeting as a result. These trends are predicted to continue, with estimates suggesting that by 2027, EV production costs could fall below those of gas-powered vehicles. However, the financial calculus for potential buyers is complicated by predictions of rising costs in other areas of electric vehicle ownership.

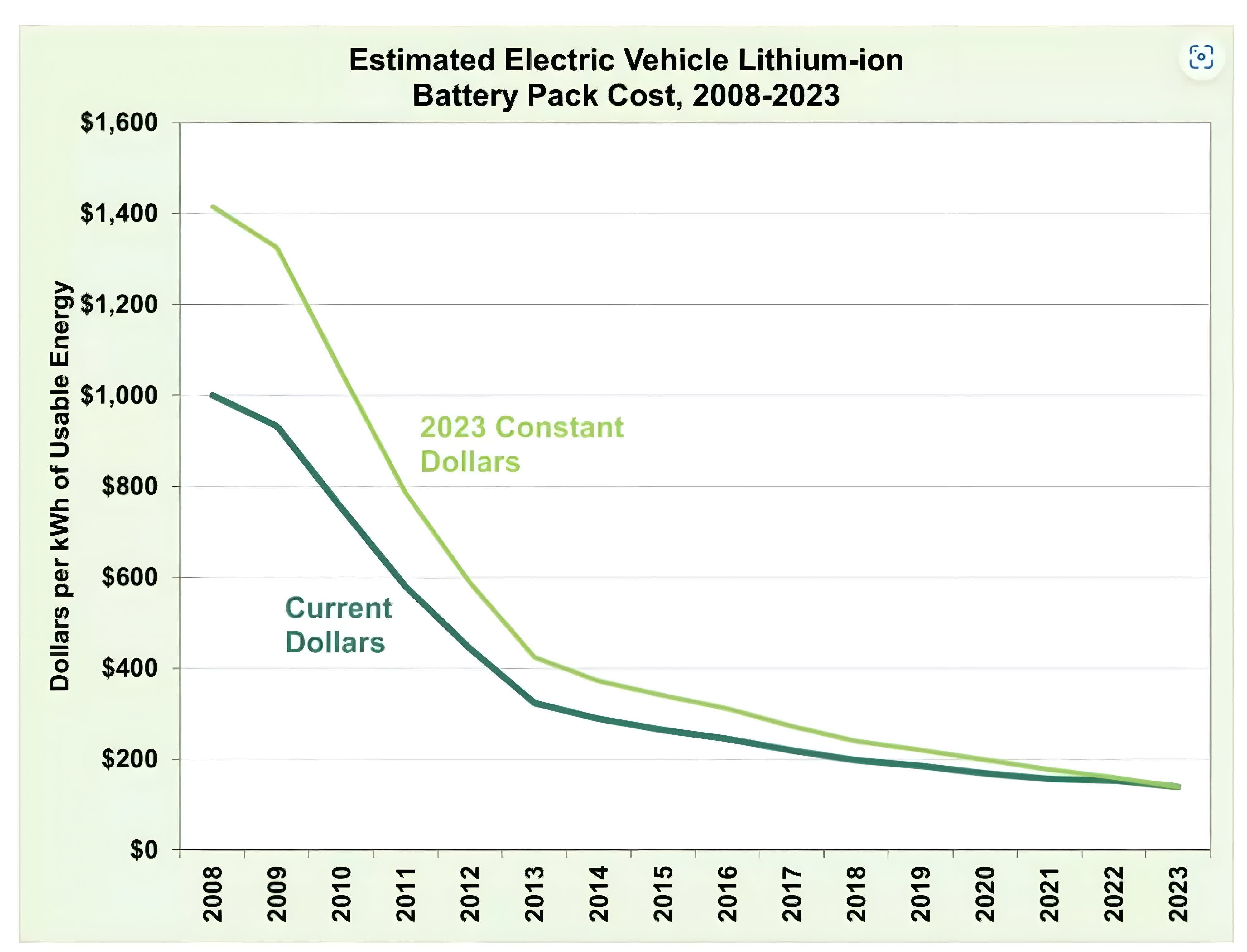

According to the Department of Energy's Vehicle Technologies Office, lithium-ion battery pack costs for EVs have plummeted by an astounding 90% from 2008 to 2023, when adjusted for inflation. In 2023, the estimated cost stood at $139 per kilowatt-hour (kWh) for large-scale production, a dramatic decrease from $1,415 per kWh in 2008.

This substantial cost reduction is having a profound impact on the overall expense of electric vehicles, with research firm Gartner anticipating that by 2027, EV production costs could potentially undercut those of gas-powered vehicles.

Several key factors have contributed to this decline. Technological advancements have led to higher-energy-density batteries, allowing EVs to store more power in a compact space. The introduction of new battery chemistries, such as Lithium Iron Phosphate (LFP), has further reduced costs, with major automakers like Tesla, Rivian, and Ford already incorporating LFP batteries into some models.

Additionally, manufacturing innovations, including centralized vehicle architecture and gigacastings, have streamlined production processes, reducing both manufacturing costs and assembly time.

Economies of scale have played a crucial role as well. As production volumes increase, the cost per unit decreases, with the DOE's estimate based on an annual production scale of at least 100,000 units. Moreover, the increasingly competitive EV market has driven manufacturers to find innovative ways to cut costs.

The declining prices of raw materials and components have also been contributing factors. BloombergNEF's annual battery price survey confirms this trend, revealing that lithium-ion battery pack costs fell by 14% in 2023, reaching a record low of $139 per kWh. The survey provides further nuance to the battery market, noting that growth in the space has fallen short of industry expectations.

This unexpected softening of demand prompted many electric vehicle and battery producers to reassess their production targets, further influencing battery prices. Additionally, the lithium market, which saw peak prices at the end of 2022, has since stabilized, with prices now on a downward trajectory.

"In the many years that we've been doing this survey, falling prices have been driven by scale learnings and technological innovation, but that dynamic has changed," said Evelina Stoikou, energy storage senior associate at BNEF and lead author of the report. "The drop in prices this year was attributed to significant growth in production capacity across the value chain in combination with weaker-than-expected demand."

Looking ahead, BloombergNEF projects further reductions to $113/kWh by 2025 and $80/kWh by 2030.

While this trend in battery costs is encouraging, it's important to consider other factors that may impact the overall cost of EV ownership. Gartner predicts a 30% increase in EV repair costs by 2027, particularly for serious accidents involving the body and battery. This could potentially lead to higher insurance premiums or difficulties in obtaining insurance for certain EV models. Indeed, perceived higher costs are a significant reason why fewer Americans want to buy an EV today compared to four years ago.

The cost of EV battery packs has dropped an astounding 90% in the last 15 years