In context: Chip foundries play a crucial role in the technology industry by transforming CAD designs into actual silicon components for integration into computers, smartphones, and other digital devices. Recent data confirms that the chip foundry business is thriving and expanding.

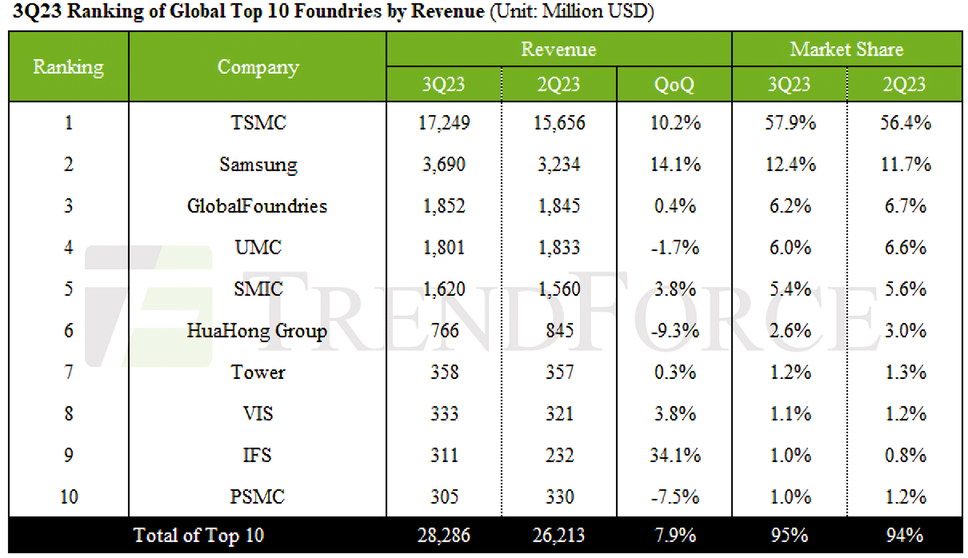

The latest research from TrendForce provides interesting insights into the chip foundry industry. The market intelligence company released the results for the third quarter of 2023, highlighting how collective revenues have grown to $28.29 billion, reflecting a 7.9 percent increase compared to the previous quarter.

TSMC solidified its position as the leading company in the industry, according to TrendForce, with $17.24 billion in revenue and a 10.2 percent increase QoQ. The Asian corporation now commands 57.9 percent of the entire chip foundry market, driven by growing demand across various electronics industries, including PCs and smartphones.

TSMC recently commenced actual production and shipment of 3nm chips for Apple devices, constituting six percent of the company's total revenue. Other advanced manufacturing nodes accounted for almost 60 percent of sales during the quarter.

Samsung retains its position as the number two foundry corporation, boasting a total revenue of $3.69 billion and a 14.1 percent increase QoQ. The Korean company highlighted growing demand for advanced manufacturing processes, but TrendForce cautiously noted that the majority of its revenue comes from Qualcomm's 5G products and 28nm-based ICs for OLED displays.

GlobalFoundries held steady between the second and third quarters, reporting $1.85 billion in revenue (+0.4 percent). Chinese company SMIC secured the fifth spot with a 3.8 percent revenue increase QoQ. Other minor players had mixed results, with a notable new entry in the top 10.

Intel Foundry Services, the new foundry service provided by the x86 chipmaker to third-party companies, generated $311 million in revenue, experiencing a substantial QoQ increase of 34.1 percent. Santa Clara's third-quarter results were primarily driven by chips manufactured for Amazon Web Services, which is expanding its Graviton4 and Trainium2 system-in-packages shipments.

TrendForce noted that with positive results from TSMC, Samsung, SMIC, and IFS, the global foundry industry is now on an upward trajectory. The fourth quarter of 2023 is anticipated to confirm the healthy state of the industry, with increasing demand for smartphone components manufactured with both leading-edge and more "trivial" chip production nodes.