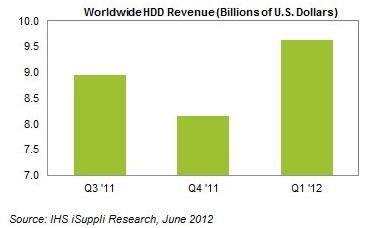

Last week IHS iSuppli published a report on the state of the hard drive market. In it, they chronicled how mechanical drive prices soared following the October 2011 floods that ravaged Thailand where key manufacturing plants exist for Seagate and Western Digital. The research firm concluded that prices will remain inflated until at least 2014 but a new report out today outlines just how much revenue is coming in via inflated drive prices.

Revenue reached record heights of $9.6 billion in the first quarter, led of course by higher prices and growing (but still low) shipments. The previous revenue record was $9.3 billion set in the first quarter of 2010. Furthermore, only 145 million units shipped in the first quarter of this year compared to 174 million that were moved in the third quarter last year before the floods. Shipment levels aren't expected to recover to pre-flood levels until the third quarter, or nearly a year after the natural disaster.

Among individual hard drive makers, Seagate has the largest share of revenue at 46 percent, good for $4.45 billion in the first quarter. This figure includes the recent acquisition of Samsung's hard drive division. This doesn't come as a huge surprise since Seagate has been the market leader in hard drive revenue for the past decade. Western Digital also ranks pretty high with a 32 percent share while Hitachi and Toshiba each represent 11 percent of revenue.

The average selling price will remain high through 2014 in an effort to make up for some of the losses that occurred directly after the floods.