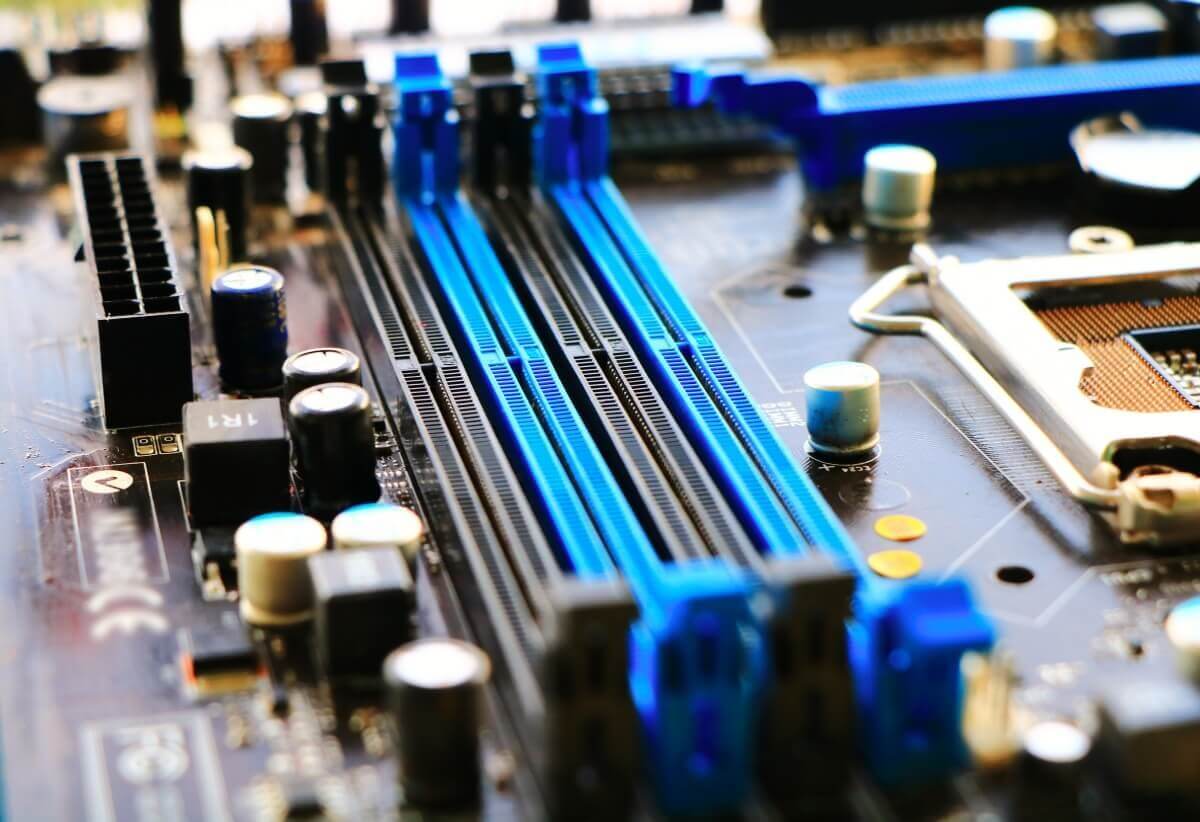

The big picture: The memory price drops we've been enjoying could flat-line in Q2 2019 and swing upwards in Q3 2019 as memory makers are anticipating increasing shipments and recovering demand for DRAM and NAND. The looming iPhone refresh and typical high season in the third quarter should also pad out memory makers' profit margins, which Digitimes reports were mixed for the first quarter of the year. If you've been window shopping for that perfect DDR4 kit, now might be a good time to get it.

A recent Digitimes report suggests that memory makers are anticipating a rebound of sorts. In the second half of the year memory module shipments are expected to increase while price declines will slow.

Memory prices have seen sharp declines, providing much needed relief for consumers. This price cuts have led to mixed first quarter results for memory makers. Samsung's somewhat unprecedented warning ahead of its Q1 2019 earnings certainly paint that picture clearly.

The memory market has been in a state of oversupply, with retail channels sitting on a glut of inventory as demand has been sluggish. However, memory makers are expecting sales to improve as demand for NAND and DRAM is expected to increase – especially as we approach Q3, the typical high season. Furthermore, the price free fall is expected to somewhat stabilize.

Digitimes also notes that while the current state of the memory market has put much pressure on the big memory makers (SK Hynix, Samsung, and Micron), the lesser known vendors have been able to take advantage and claw away some market share and profit. Team Group saw its first-quarter revenues increase 3.78 percent, a nine-year high. Meanwhile, Adata Technology also notched a six-quarter high on profits.

Team Group is gearing up to make moves in an attempt to gain more market share; it recently completed compatibility and validation testing with its series of T-Force gaming memory and will be looking to ramp shipments.