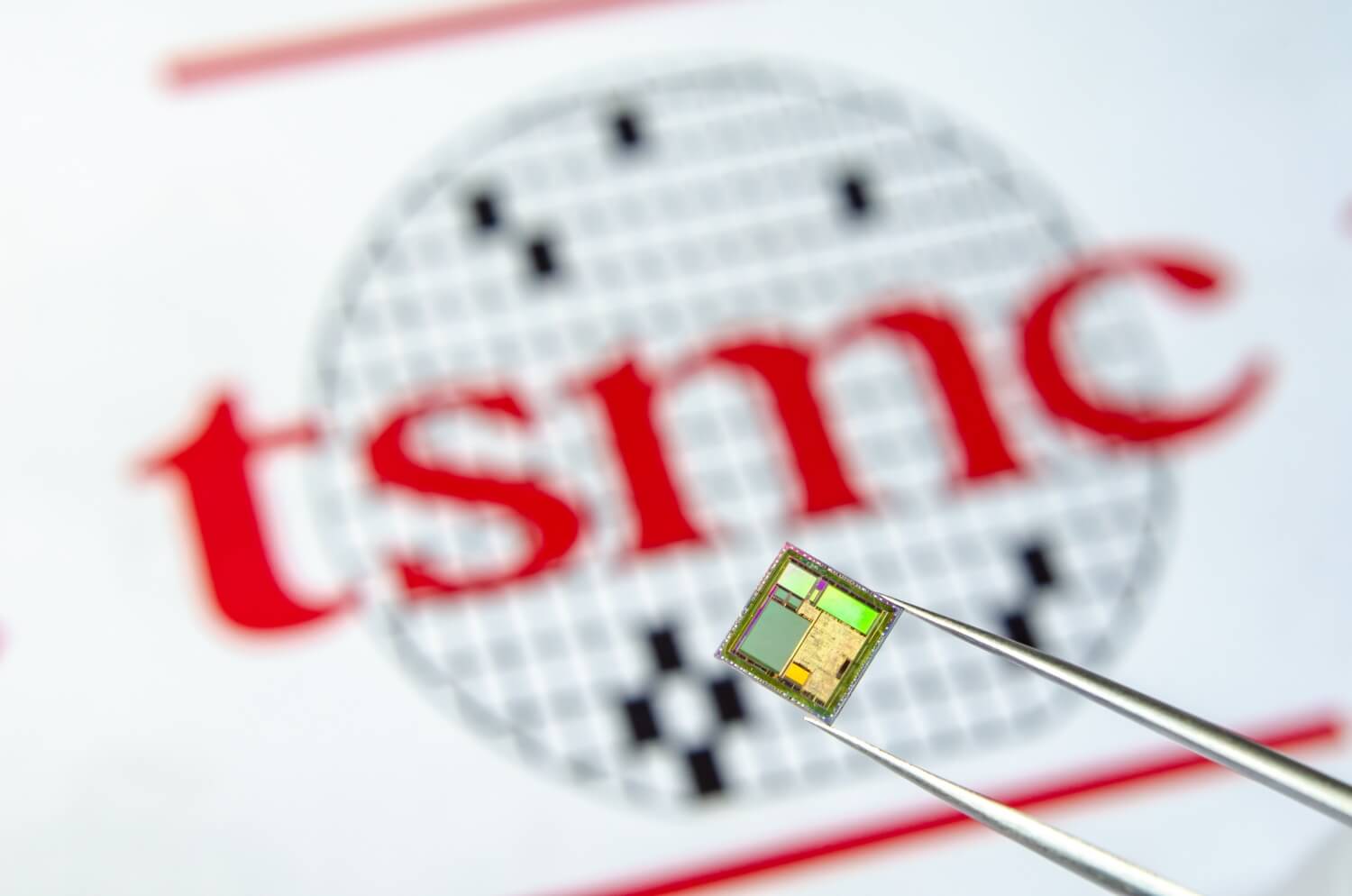

In brief: American legislation against Huawei has spread from locking the company out of the US to cutting it off from new advancements altogether. A recently enacted law will require any company that uses American tools or designs to apply for a license to sell to Huawei, which appears to extend to multinational TSMC. The Taiwanese manufacturer previously constructed the majority of the processors and cellular equipment used in Huawei devices.

TSMC chairman Mark Liu announced at an investor's conference that TSMC is complying with new US legislation, and did not take any new orders from Huawei after May 15. Their final shipment to Huawei will have been completed by September 14. He didn't say if TSMC will apply for a license, but did indicate that they've already secured customers for Huawei's previously reserved portion of production capacity.

TSMC does not expect the new legislature to inflict them much harm. Development into 7nm, 5nm, and 3nm technologies has yielded multitudes of eager new customers. AMD and Nvidia will utilize TSMC for large batches of upcoming products. Apple is also reportedly interested in partnering with TSMC to manufacture upcoming ARM products for Mac. And although mobile sales are down, the need for expensive 5G equipment is expected to increase sales in that sector, too.

Huawei's outlook is not as rosy. TSMC manufactured several billion dollars' worth of equipment for Huawei every year, including the Kirin processors that are in all their smartphones. Huawei has very few places they can turn to for processor manufacturing, because they're similarly cut-off from Intel, Samsung, and GlobalFoundries. Unless one of these companies can attain a license, Huawei will be reliant on smaller Chinese foundries that are likely, in the near future, to struggle to catch up to the advancements made by bigger competitors.

In May, it was revealed that Huawei had spent $23 billion on stockpiles of "essential components," that included a huge number of processors and other types of chips. Huawei will likely have enough equipment to keep sales ticking over for a year or two. If they don't find a solution by then, they'll start teetering off the edge of profitability.

Image credit: Karlis Dambrans, Ascannio