In brief: A combination of factors have wreaked havoc on supply chains, with many companies in the tech and auto industry facing a shortage of chips that is forcing them to scale back production and increase prices for end customers.

By now it's no secret that the world is experiencing a shortage of chips as a result of several compounding problems such as a trade war, drought, snowstorms, cryptocurrency mining, not to mention an ongoing pandemic. It also doesn't help that demand for chips has grown to unprecedented levels, driven by digitalization efforts as well as an increasing variety of products that depend on semiconductors for some or all of their functionality. And the situation could get worse before it gets any better.

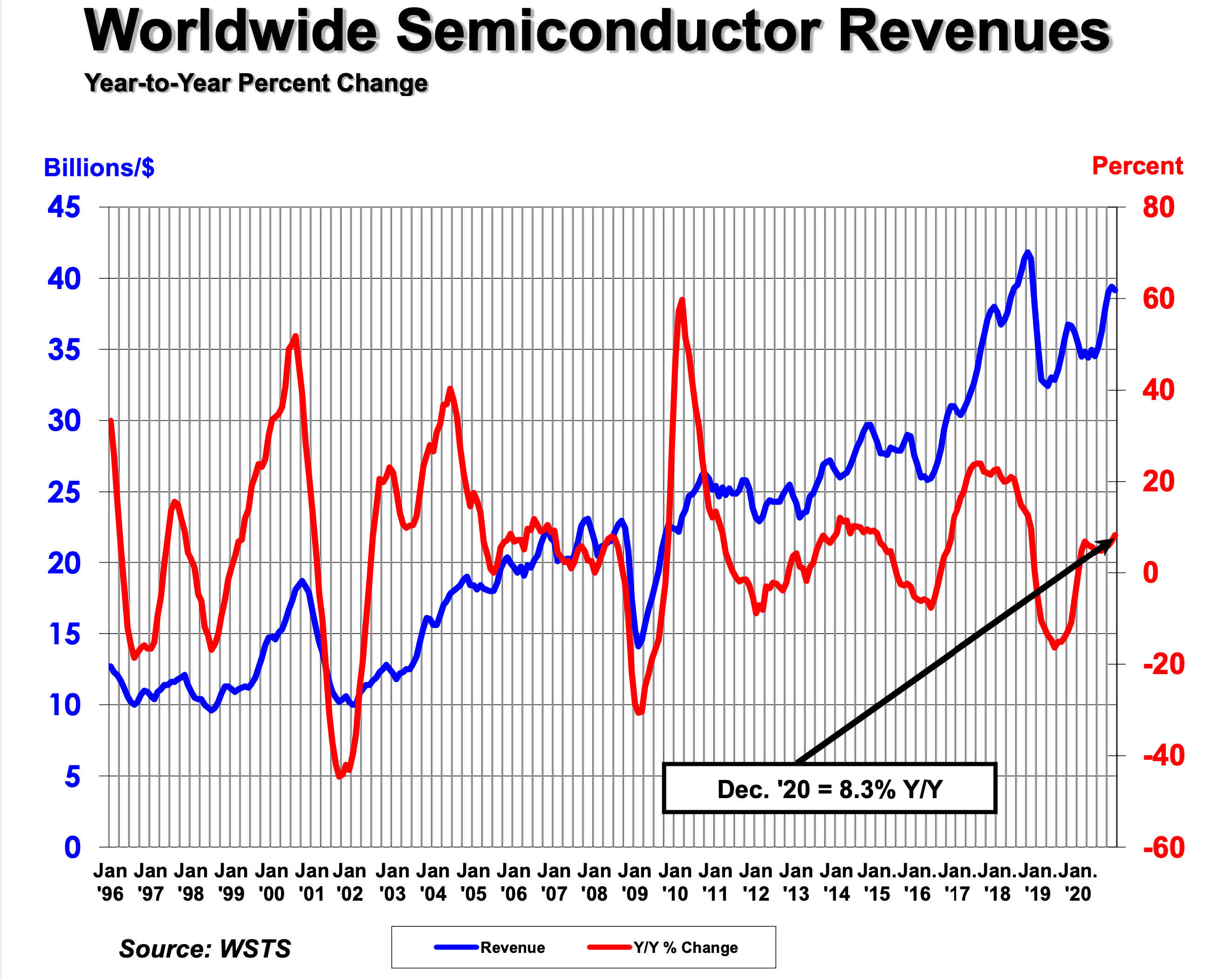

According to the Semiconductor Industry Association (SIA), global semiconductor sales for the month of January alone were $40 billion, which is a 13.2 percent increase over the same month in 2020. Total sales in 2020 were $439 billion, and China accounted for $151.7 billion of that, while the American market saw the largest year-over-year increase of 19.8 percent. The total figure is expected to rise more than 8 percent this year.

Last year, the pandemic-induced lockdowns forced factories to either close or scale back production, which was only seen as a temporary setback. However, that was quickly proven wrong by the delayed launch of Apple's iPhone 12 lineup and paper launches of new graphics cards from Nvidia and AMD.

Microsoft and Sony both launched new gaming consoles, only to find that they couldn't manufacture them fast enough to meet the demand, which was further exacerbated by scalpers managing to grab large amounts of retail inventory. This is why the two companies have started revising their revenue expectations for the coming quarters.

Earlier this year, automakers found themselves in a similarly difficult position, which prompted a reduction in manufacturing output that persists to this day. Even as chip production in foundries went back to normal, car companies like Ford, Nissan, Volvo, and General Motors have had trouble securing the necessary silicon, and are now projecting billions of dollars in losses this year as a result. As a stopgap solution, some companies are opting to make vehicles without fuel economy modules.

Wafer capacity leaders

| Company | Monthly wafer manufacturing capacity | Total global capacity share |

| Samsung | 3.1 million | 14.7% |

| TSMC | 2.7 million | 13.1% |

| Micron Technology | 1.9 million+ | 9.3% |

| SK Hynix | ~1.85 million | 9% |

| Kioxia | 1.6 million | 7.7% |

| Intel | 884,000 | ~4.1% |

Industry insiders recently estimated that demand for silicon would outweigh supply until at least the end of summer, but some did point out that ongoing supply constraints and increased material costs could stretch that well into 2022. TSMC says its semiconductor industry is well prepared to deal with the ongoing drought, but it only accounts for 13.1 percent of the global wafer capacity.

Samsung, who is now ahead of TSMC as the world's leading wafer manufacturer, is nowhere near to being able to satisfy demand for its memory products or for Nvidia's Ampere graphics cards. Just as PC shipments saw the highest growth in ten years, manufacturers are suffering low stock levels at a time when chips, displays, and passive components are harder to come by.

This is all contributing to a steady rise in prices for a number of consumer electronics as their availability dwindles. The Biden administration has stepped in to try and address the problem at the supply chain level, but it's not clear if anything can be done in the short term. The Consumer Tech Association estimates that demand for consumer tech is only going to increase this year, potentially driving retail sales revenues of $461 billion in the US thanks to a renewed interest in smart home products, connected health, and tech that keeps us all connected.

The Semiconductor Industry Association, who represents several industry giants like AMD, Intel, Nvidia, and Qualcomm, believes the Biden administration should prioritize bringing chip manufacturing to the US, an effort that is estimated to cost $50 billion. Last month, the President said he would push for $37 billion towards that goal, while provisions in the most recent National Defense Authorization Act will allow the government to provide billions in incentives for companies that rise up to the task.