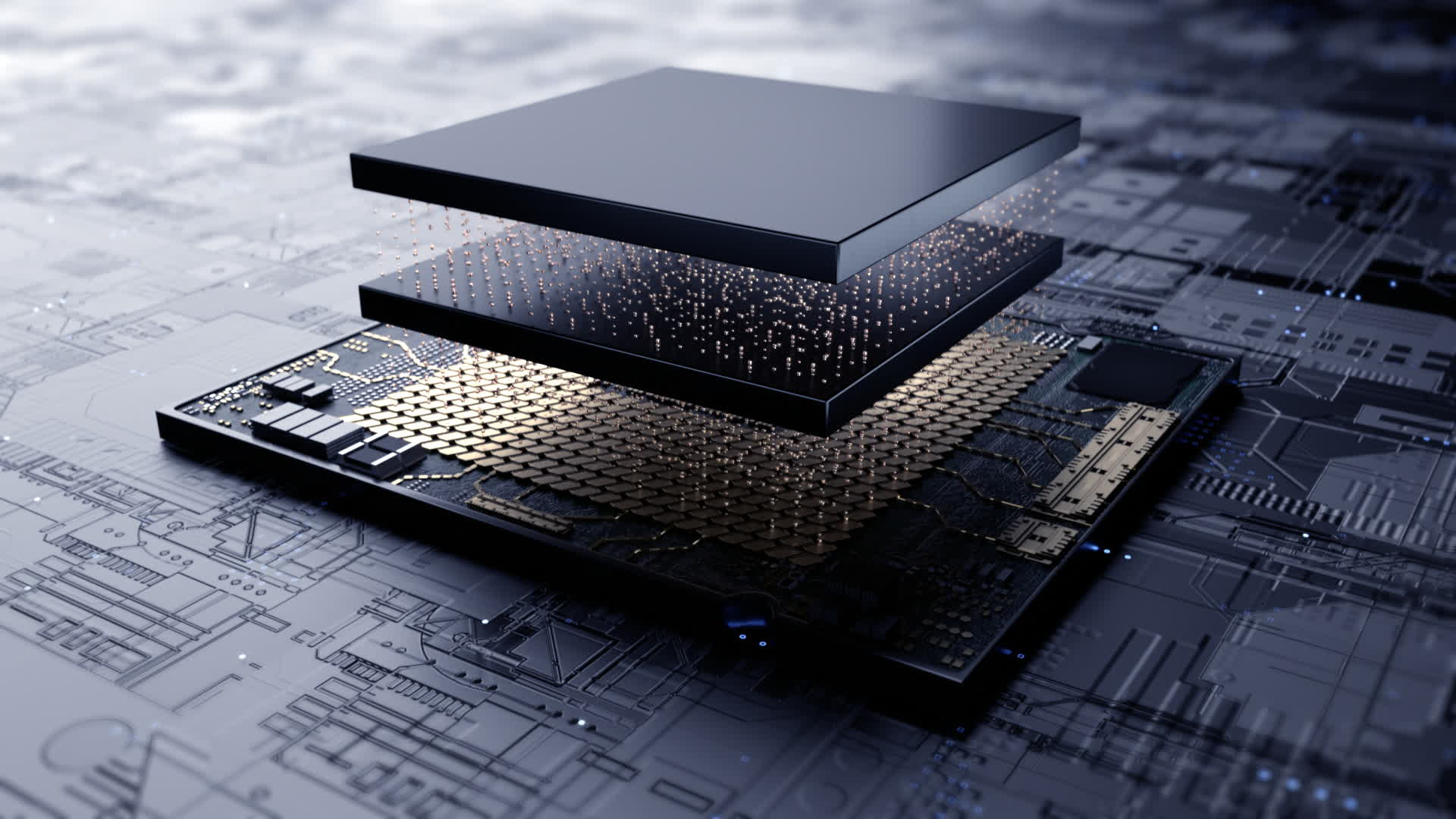

The big picture: Samsung has big plans for the future, and to that end, the company is investing a whopping $206 billion from its coffers. Chief among the tech giant's ambitions for the next three years are the strengthening of its semiconductor business and the acquisition of engineering talent, but the South Korean firm has its eyes set on several other areas.

Samsung today announced it will invest no less than 240 trillion won ($206 billion) over the next three years in order to expand its presence in areas like semiconductors, robotics, artificial intelligence, and biopharmaceuticals. The end goal of this effort is to propel the company to new heights, as it intends to become a leader in what Samsung believes are "strategically important industries."

This new capital expenditure is significantly larger than the 180 trillion won ($154 billion) spent over the past three years. A significant chunk of the 240 trillion won investment will be allocated towards acquiring more talent in South Korea. Specifically, Samsung wants to dedicate 75 percent of the money to hire 40,000 employees through 2023, as the company needs to adapt to "great changes in industry, international order, and social structure expected after the Covid-19 pandemic."

The news comes a little over a week after Samsung's vice chairman walked out of jail to return to his office, as country officials decided his parole was a matter of national interest. Samsung recently surpassed Intel to become the world's top semiconductor supplier and has a $151 billion plan to build more production capabilities over the next ten years.

Semiconductors are a big safety net for South Korea, and Samsung says chips accounted for over 19 percent of the country's exports in 2020. It recognizes the strategic threat from Intel and TSMC, both of which are currently engaged in reinvention and expansion of their foundry businesses. The company has plans to build a $17 billion foundry in the US, and is currently evaluating sites in New York, Arizona, and Texas.

It's also worth noting that subsidiary Samsung Electronics has over $80 billion in cash reserves that it intends to use in mergers and acquisitions. Until recently, the list of potential candidates included NXP, Microchip Technology and Texas Instruments. However, acquiring NXP could easily surpass those reserves and might prove just as difficult to fly to completion as Nvidia's pending acquisition of Arm.

Another area of interest for Samsung is the development of high energy density batteries for grid storage and electric cars, and the company's Samsung SDI subsidiary is currently evaluating several sites in the US to build a battery manufacturing plant.