In context: Last year, Apple announced new policies requiring app developers to publish "privacy nutrition labels" in their App Store listings detailing their data collections practices. More importantly, the company revealed that it added a feature to iOS that would allow users to opt out of ad tracking for individual apps.

Facebook warned that Apple's App Tracking Transparency (ATT) policies that give users control over how their data is collected would spell catastrophe for its developers and advertisers. It "conservatively" estimated a 50-percent drop in revenue from its Audience Network platform.

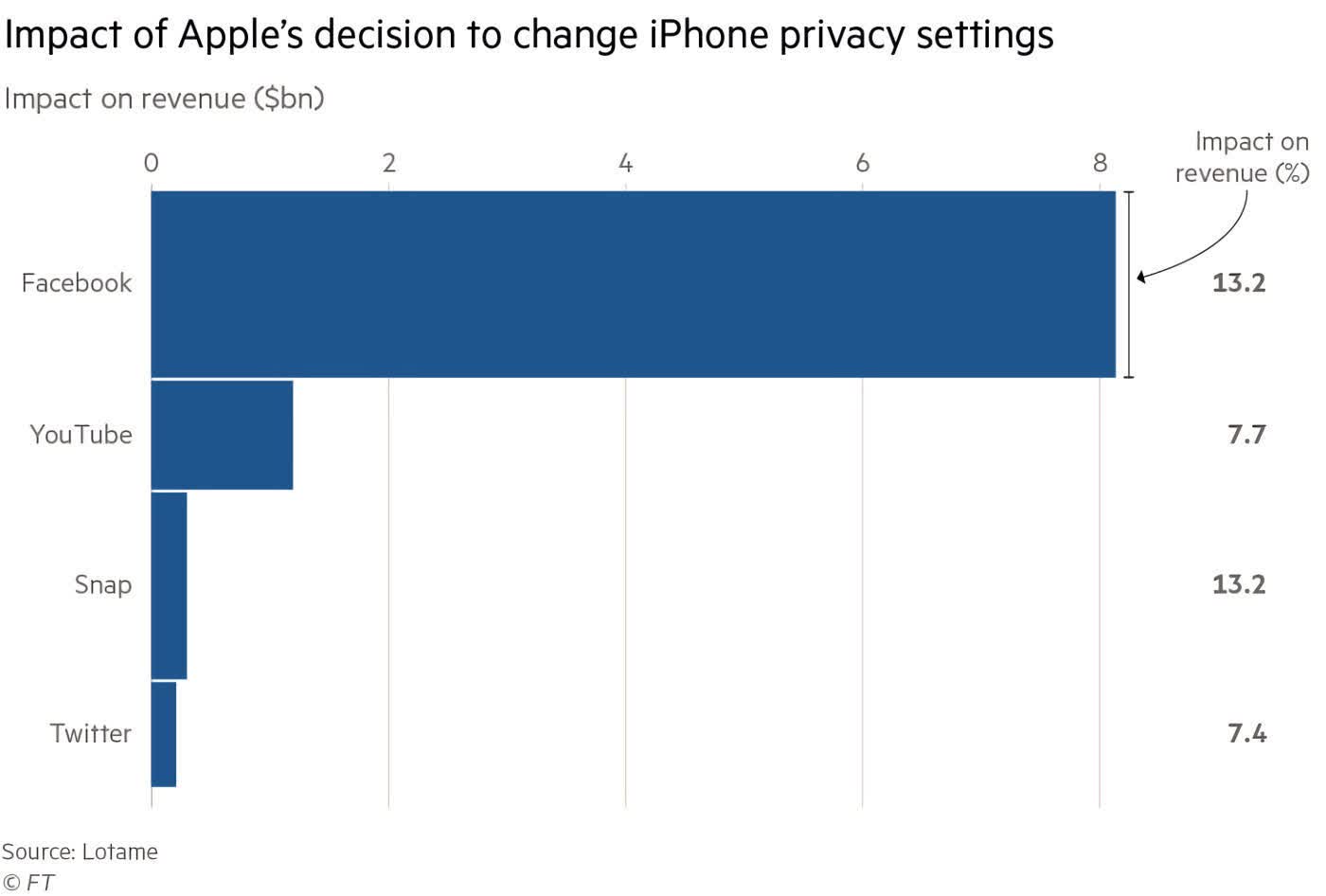

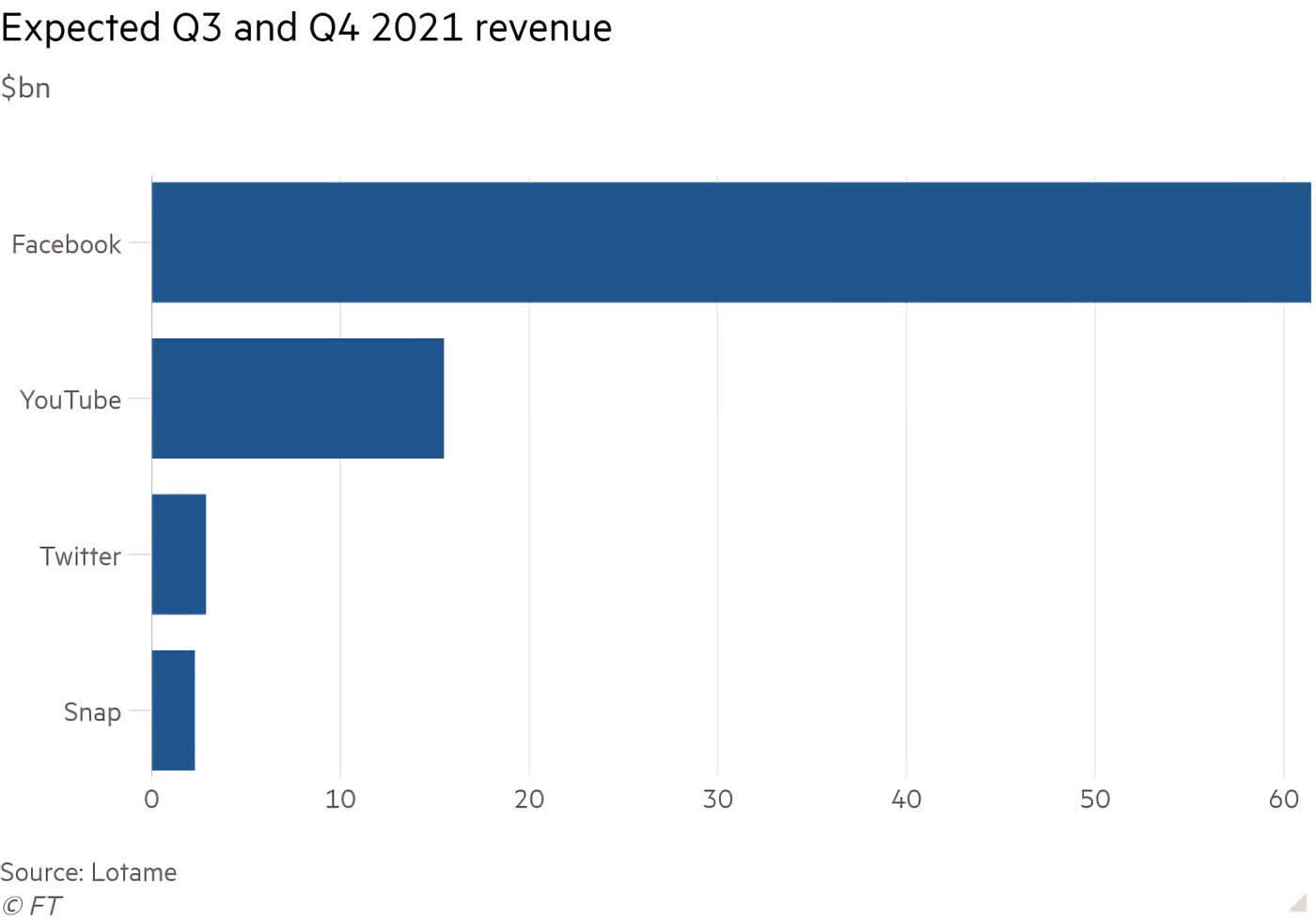

The Financial Times reports that Facebook, Snapchat, Twitter, and YouTube lost a combined $9.85 billion in the two quarters following the full implementation of Apple's ATT plans in April. While nearly $10 billion is a significant decline, it is nowhere near the 50-percent adpocalypse Facebook was shouting about in full-page newspaper ads.

According to adtech company Lotame, by nature of its size, Facebook owns the vast majority of the ad revenue share, so it took the biggest monetary hit. However, it was only a dip of 13.2 percent. Snapchat also suffered a 13.2-percent blow and is a much smaller company, so it probably felt the effects even worse. YouTube and Twitter saw smaller ad revenue declines of 7.7 and 7.4 percent, respectively.

Of course, the median 12-percent drop for these social media platforms does not necessarily translate to an equivalent loss for the smaller companies who advertise with them. Lotame's COO Mike Woosley points out that, depending on the company, individual advertisers can lose close to 50 percent of their advertising power. He illustrates this with an example of a men's underwear line buying a $5 ad targeted at 1,000 men.

"Well, now to get 1,000 men, you have to show it to 2,000 people because all of a sudden you don't know who is a man and who is a woman," Woosley explained. "And you still only have $5 for those 2,000 impressions. So your acquisition costs doubled, and the lost yield is 50 percent."

It's worth noting that there is a difference between bang for your buck and lost revenue. Even still, Lotame's estimates might lean to the conservative side. Adtech consultant Eric Seufert claims that Facebook alone could have lost $8.3 billion since April. He also says that losses are likely to continue as advertising groups adjust to a new "privacy-centric paradigm."

"Some of the platforms that were most impacted---but especially Facebook---have to rebuild their machinery from scratch as a result of ATT," Seufert said. "My belief is that it takes at least one year to build new infrastructure. New tools and frameworks need to be developed from scratch and tested extensively before being deployed to a high number of users."

In the meantime, many companies are finding that Facebook is no longer a viable advertising platform because of its continually increasing costs and the now diminished ad power. Wayflyer CEO Aidan Corbett said that many advertisers have been moving to TikTok because the cost per 1,000 impressions is much lower.

This shift in advertising budgets is the reason these big platforms are seeing declines. It's not that companies have cut their ad spending. They have simply moved it from poorly performing venues to more effective ones. So it's hard to determine how much individual advertisers have been affected overall.

Twitter and Google said the effects of Apple's ATT policies were minimal. Twitter claims its ad sales climbed about 41 percent last quarter. The company says its ad platform relies less on tracking users' mobile habits and more on "context and branding." Alphabet says that it has enough first-party data that it does not need to track users across third-party apps. The exception would be YouTube, but Google claims even the effects of ATT on YouTube were "modest."

Unsurprisingly, Apple has faired well since implementing its transparency policies. Last month, the App Store's Search Ads platform tripled its growth over last year. Where it once held only 17 percent of the iPhone's advertising market share, it now stands at 58 percent. Of course, a significant part of that growth reflects the market's atrophy as advertisers shift more funds to other platforms.