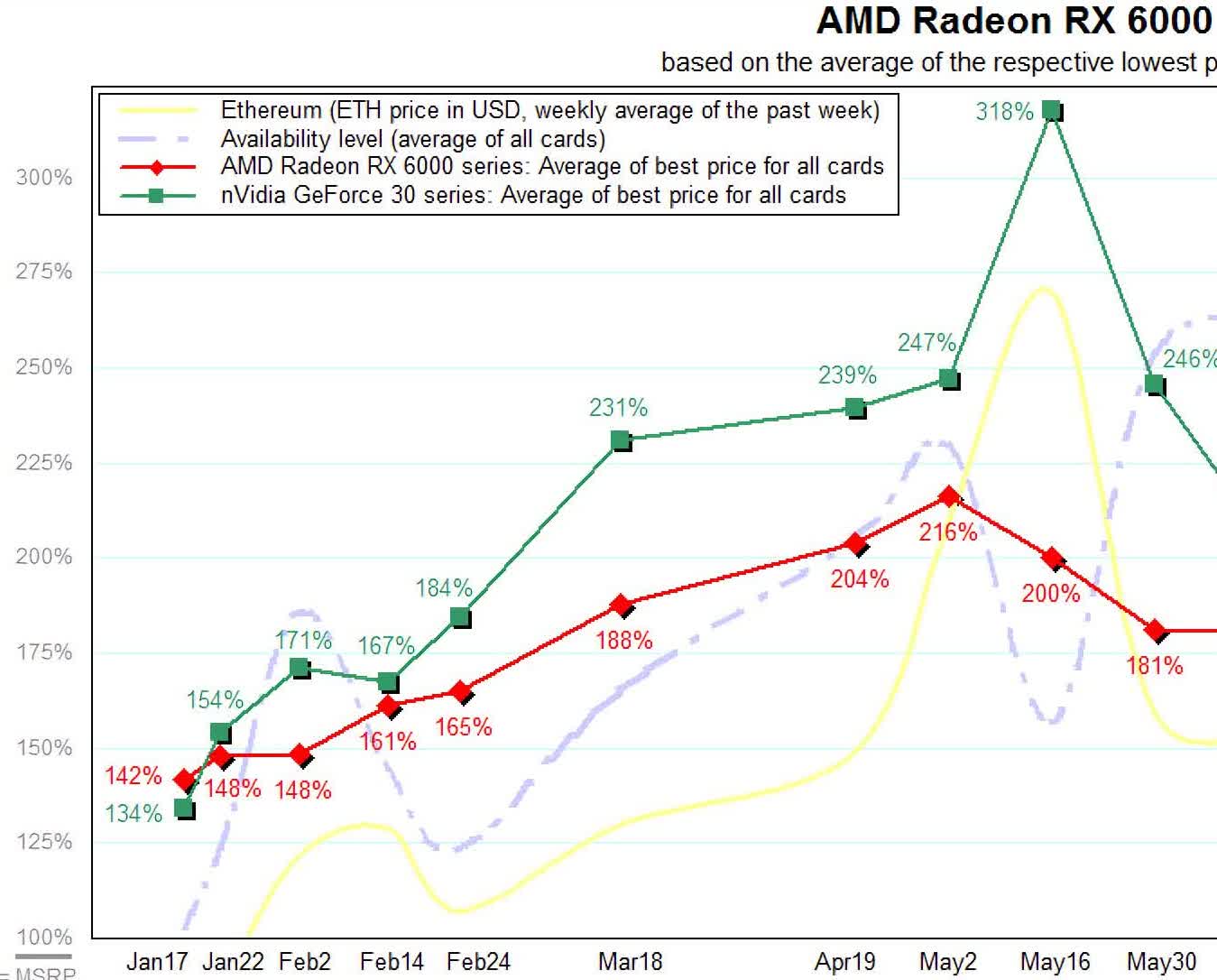

In brief: GPU prices have caused gamers a great deal of pain over the past year, but rising mining difficulty and tumbling Ethereum value are once again putting downward pressure on the ridiculous retail price of both Nvidia and AMD graphics cards.

Last week, we learned Nvidia decided to increase the price of its Founders Edition GPUs in Europe. One possible reason for the change is the recent strengthening of the American dollar against the Euro, but since MSRPs have been rendered meaningless by insatiable demand it's easy to dismiss it when looking at the big picture.

However, 2022 started with some really good news for gamers and enthusiasts, as industry watchers hadn't noticed any significant retail price change in over two months. According to a new report from German publication 3DCenter, there's even more reason to be optimistic as the first weeks of January saw prices trending downward, particularly in the case of AMD's Radeon RX 6800 and RX 6800 XT.

Falling cryptocurrency prices and news of imminent country-wide cryptocurrency bans have made GPU mining less profitable, and now AMD cards sit at an average of 67 percent above MSRP. Nvidia GPUs still maintain a larger premium at 77 percent over MSRP, but they've at least returned to October 2021 levels. Newer graphics cards like the Nvidia RTX 3050 and the AMD Radeon RX 6500 XT aren't attractive to miners, but they're also relatively low value for gamers.

Elsewhere in the supply chain, it looks like material and component shortages may also be easing. According to DigiTimes, the supply of Ajinomoto Build-up Film (ABF) substrates will slowly improve in the coming months, and by the second half it will allow AIB companies like ASRock and TUL (PowerColor) to greatly scale up their graphics card shipments. ASRock president Lung-Iuen Hsu recently said the company expects to post a double-digit surge in shipments and profits this year.

Still, tackling the chip shortage is a complex problem that won't be solved by simply improving the supply of ABF substrates, but rather by rendering GPU mining obsolete. Ethereum mining difficulty continues to grow every month and if all goes well we should see a transition to Proof-of-Stake this year. Other Proof-of-Work cryptocurrencies that can be mined using GPUs have nowhere near the scale or value of Ethereum, meaning most miners would be forced to sell off graphics cards to recoup some of their investment.