Facepalm: The SEC issued a $5.5 million fine to Nvidia after determining it failed to declare critical sales data in its 2017-2018 revenue reports. The slap-on-the-wrist penalty was accompanied by a formal statement that Nvidia did not disclose cryptomining as a significant source of its revenue growth during the period in question, thereby depriving potential investors of crucial information.

The Securities and Exchange Commission's (SEC) May 6 press release cited Nvidia for "Inadequate Disclosures about Impact of Cryptomining." The SEC alleges that Nvidia did not report their increased crypto-based sales as required by Form 10-Q, instead attributing the increase to gaming-related growth.

The omitted sales information and fluctuations left investors with an incomplete picture of the company's performance, which is key to analyzing business risk and investment potential. Nvidia did not confirm or deny the allegations of improper disclosure and agreed to a cease-and-desist order accompanied by a $5.5 million penalty.

Brent Wilner, a member of the SEC's Crypto Assets and Cyber Unit, led the investigation into the company's filings and history. The news comes on the heels of the SEC doubling the size of the enforcement unit, which focuses on crypto assets, exchanges, crypto lending, decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and stablecoins. Wilner found that Nvidia violated Section 17(a)(2) and (3) of the Securities Act of 1933 and the disclosure provisions of the Securities Exchange Act of 1934.

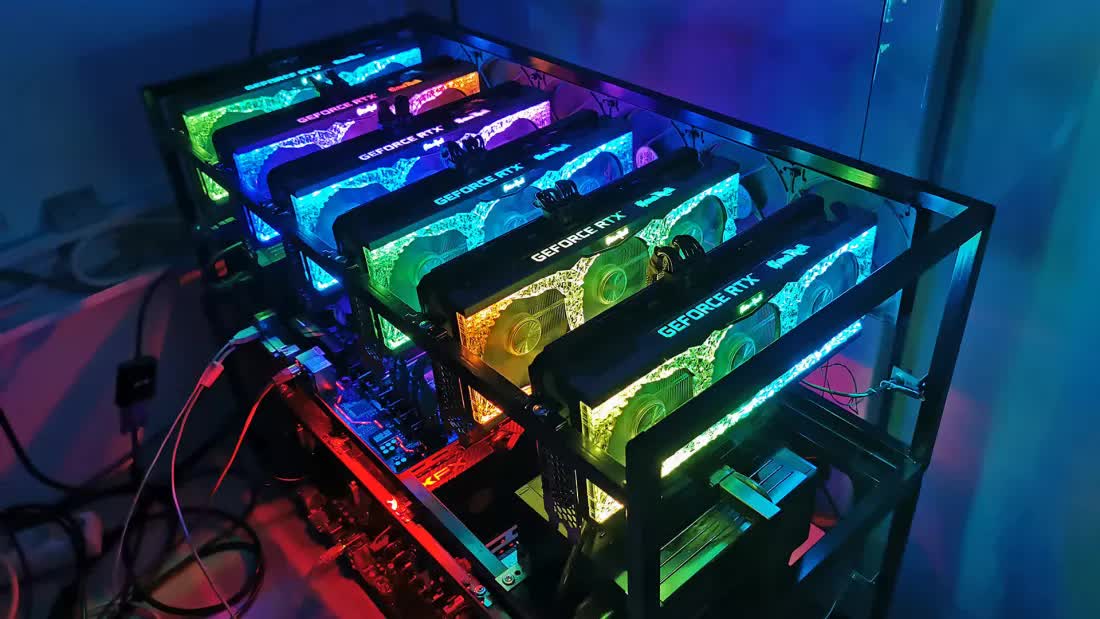

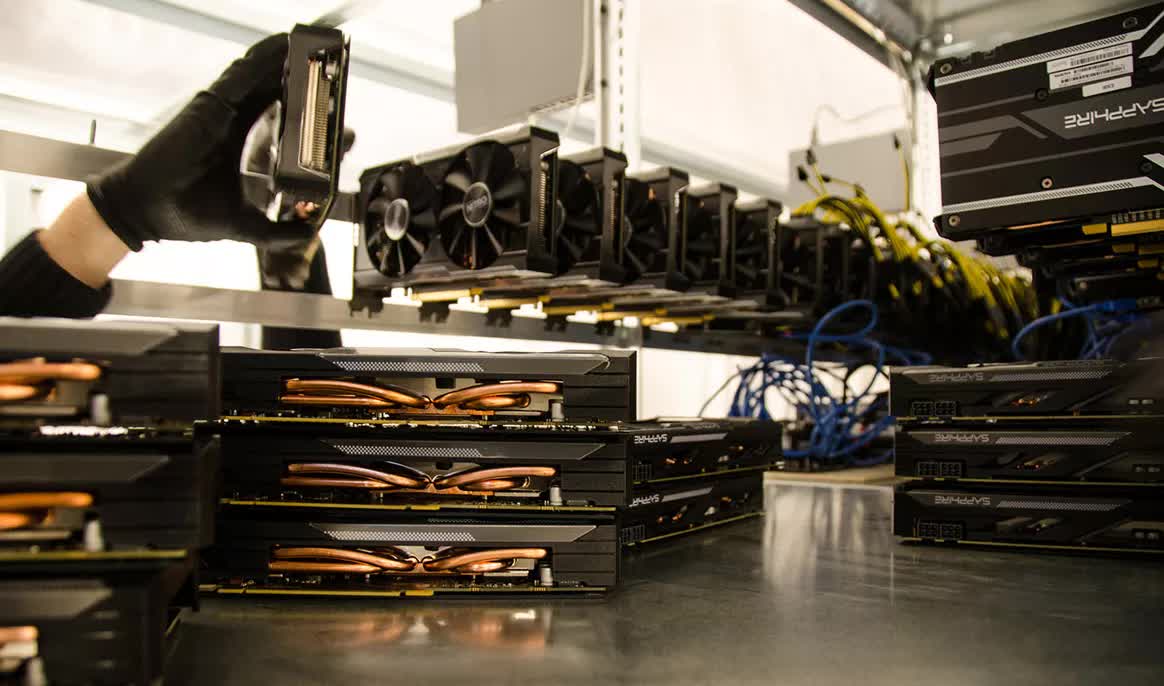

The enormous increase in gaming revenue across as little as a single fiscal quarter was an obvious red flag for investigators. Nvidia's 2018 filings supported the regulator's determination. That year the company reported $9.714 billion in revenue and attributed approximately half of that total to gaming. What does this all mean in plain English? Nvidia started making money hand over fist during the 2017/2018 mining boom, and they weren't forthcoming about "how" they made it.

While the investigation appears to be a win for consumers and investors who expect transparency from companies they support, the multi-million-dollar penalty is not likely to curb Nvidia's current plans or overall operations. Earlier this year, Nvidia released its financial results for the fourth quarter and fiscal year 2022. The green giant recorded quarterly revenues of $7.64 billion (a 53% increase) and record-breaking revenues of $26.92 billion (a 61% increase). Based on those numbers, the company can absorb the barely noticeable $5.5 million settlement payment without batting an eye.