In brief: Earlier this year, IDC said global PC shipments dipped by 28 percent in 2022. The PC workstation market, however, is a completely different beast that managed to grow despite the downturn.

The latest numbers provided by International Data Corporation (IDC) are depicting a bittersweet snapshot of the PC workstation market. The sector grew in 2022, experiencing "strong momentum" at the beginning of the year while concluding the last quarter facing saturation and a harsher economic reality.

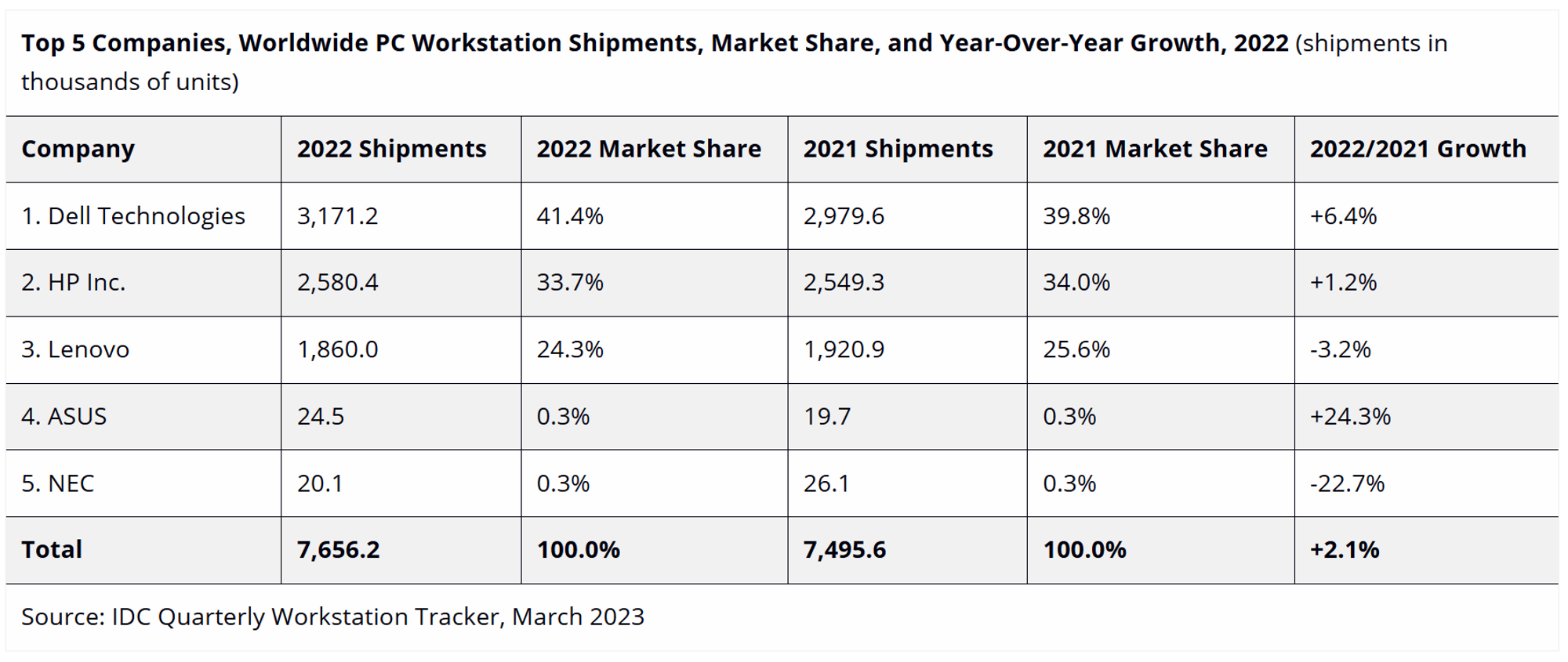

For the entire year, IDC said, the market experienced 2.1 percent growth with nearly 7.7 million units shipped - a record-breaking result compared to the 7.5 million units shipped in 2021. Unlike the previous year, when remote and home working pushed for an unprecedented mobile workstation adoption amid the Covid-19 pandemic, the 2022 gains came from a "desktop workstation recovery" (due to employees coming back to the office) while the mobile side of the business fell flat.

Between the third quarter of 2021 and the second quarter of 2022, the PC workstation market experienced four consecutive quarters with shipments exceeding the two million units mark, IDC research manager Jay Chou said. A result "well above historical norms" which ultimately proved "unsustainable in the face of tightened budgets and ongoing inflation," Chou said.

IDC also provided data for the five largest companies in the workstation market, with Dell keeping the top spot and a 41.4 percent market share. At the end of 2022, the Texas-based corporation grew by 6.4 percent, shipping around 3,1 million workstations thanks to a "measured approach" to inventory management. HP Inc. was number two (+1.2 percent year-over-year) with a continued focus on mobile form factors, while third-place vendor Lenovo experienced negative growth (-3.2 percent) due to the slowing demand for its premium and value-tier models.

Taiwanese company Asus overtook NEC for the fourth spot to maintain its smaller niche in the desktop workstation space (+24.3 percent YoY for a 0.3 percent market share), while Japanese corporation NEC suffered the worst business results (-22.7 percent, 0.3 percent market share) to end up in fifth place.

After the pandemic hangover and the return to office momentum, IDC is forecasting a global shipment decline of 4.2 percent for 2023. The workstation market needs to cool down while companies are shifting their focus on inventory clearing and "budget discipline," IDC said. Shipments should, however, return to a solid recovery in 2024 and 2025, the market research company concluded.