AMD's Future

Merger, buy out, cash infusion? Unlikely. A great deal of AMD's worth comes from its x86/x86-64 intellectual property. A buyout from another larger player would likely void the x86 license obtained from Intel, so income in this market would be solely reliant upon the royalty payments it can collect from the license granted to Intel for the 64-bit extension.

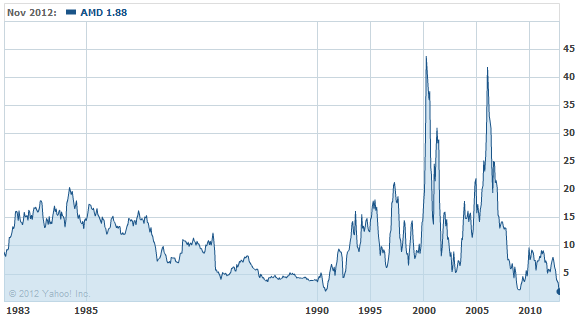

There is no single event responsible for ousting AMD from its lofty position in early 2006. The company's decline is inextricably linked to its own mismanagement, some bad predictions, its own success, as well as the fortunes and misdeeds of Intel.

A merger seems unlikely since the merger candidate would need a use for the x86 instruction set and most of the players in the market seem happy enough with the ARM architecture. A potential buyer (if possible) or merger partner would also have to contend with what put AMD in its current position to begin with: Intel.

Lastly, a cash infusion from a large stockholder such as Mubadala, which owns 15% of AMD, doesn't appear to be forthcoming, since they have so far been disinclined to invest further. Given that Mubadala's assets are approaching fifty billion U.S. dollars and the fact that the development company is owned by the Abu Dhabi government – and by extension the Al Nahyan family, one of the seven ruling families of the United Arab Emirates – it would seem that funds aren't an issue.

So, assuming AMD is on their own for the foreseeable future, what does that future hold?

The company's board of directors, via CEO Rory Read, have made AMD's future direction relatively clear as an overall concept: to pare down and restructure. Withdraw from those markets that they cannot remain viable in, whilst maximizing their resources and IP in emerging markets with (hopefully) a more level playing field. This restructuring is a gamble in itself, but remaining as its former self was basically death by a thousand cuts, so some hard decisions are required. A further round of job cuts in 2013 is expected as AMD works to financially break even by Q3 2013.

One bright area for AMD will almost certainly arise from the next generation of gaming consoles. The company should derive steady and on-going income from processors (or APUs) for some time given the lifecycle of consoles. Theoretically this would also entail a boost for AMD's graphics since there should be some considerable knock-on effect as console and PC gaming convergence becomes more of a reality.

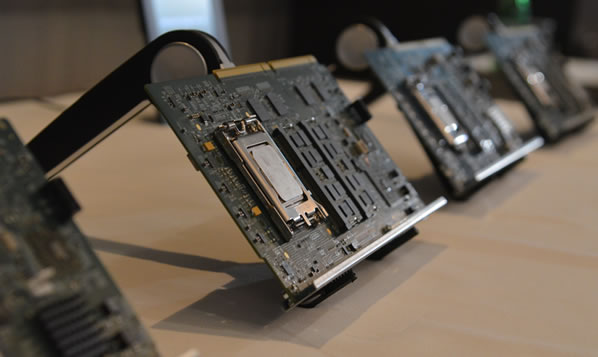

Given AMD's ability to execute in the discrete graphics market, it also seems assured that the Radeon line should be a continuing feature of the restructured company. Both AMD and its main competitor Nvidia are bound by the same constraints – they are limited to the same process node with the same silicon wafer costs and overhead. If game development works to continue increasing the level of image quality, and if higher resolution panels become more mainstream, then the discrete market should remain viable in the face of integrated graphics' rising adoption for budget machines.

AMD's next discrete graphics series, code named "Sea Islands", is due in late Q1 2013. As a second generation 28nm product, it's tipped to be more of a tweak of the existing Southern Islands (Radeon HD 7000) architecture than a radical redesign. General performance gains are expected to be around 10-15%, with efficiencies from a more mature process translating into slightly higher clock speeds or reduced power draw. A higher shader core count also seems like a given.

Large scale performance gains would require a larger die area and/or increased power usage if maintaining the same process – 28nm will remain the process of choice until TSMC moves to 20nm in 2014. Given AMD's cut-to-the-bone strategy it would be difficult to imagine that they would contemplate increasing the die size to any great extent, if at all.

Conventional CPUs seem to be an area AMD is looking to withdraw from in the long term. The company is likely to prolong the current architecture for as long as possible. Steamroller, which was initially due to see the light of day in 2013 is now a 2014 release, meaning the Excavator series will almost certainly slip another year as well (assuming it remains viable at all).

Piledriver will now soldier on through 2013, with a possible update sometime during the year.

One casualty of the Steamroller delay has been the debut of the Kaveri APU – intended as Trinity's successor in 2013. Kaveri was expected to have combined Steamroller logic with GCN (HD 7000 series) graphics. That seemed to be the plan as recently as June this year, when AMD was publicizing Kaveri's strengths at the AMD Fusion Developer Summit in Seattle. Leaked roadmaps, four months later paint a much bleaker picture, however.

Kaveri is now missing from the roadmap, either gone for good or more likely re-jigged for a smaller 20nm process in 2014 onwards. The chip was supposed to debut on Globalfoundries' 28nm HKMG bulk process. In its place now resides Richland, which seems to be little more than a revised Trinity APU allied with a slightly more feature laden chipset dubbed Bolton.

AMD's 2013 is shaping up as an year of no significant product releases aside from Kabini - the embedded Brazos successor expected midyear, alongside possibly Temash, the sub-5 watt SoC.

With the arrival of the Bolton D4 chipset for Trinity APUs (8 x SATA 6GB/s, 4 x USB3.0, 14xUSB2.0, 4 PCI-E lanes for chip interconnect), AMD and its board partners can look forward to at least some marketing hype. The glaring vacant space where the 1090/1070 chipset boards should sit could make for a lean year for AMD-centric motherboards.

While the desktop segment will likely remain static, and likely lose more ground once Intel's Haswell arrives, the mobile computing options for APUs presently available via OEMs make for an encouraging reading.

All that said, AMD's 2013 is shaping up as an year of no significant product releases aside from Kabini - the embedded Brazos successor expected midyear, alongside possibly Temash, the sub-5 watt SoC. With steady growth of the tablet and notebook markets, there should be opportunities for some design wins, although Intel's Avoton Atom (rumored 8 cores with out of order execution and due in the same timeframe) and ARM Cortex-A15/A50 designs should ensure stiff competition.

AMD itself is looking toward ARM designs. The company has pledged to add 64-bit ARM-based Opteron server CPUs to its product range in 2014, a move that is seen as a natural extension of its SeaMicro acquisition in March of this year. Again, AMD is in for some heated competition.

While SeaMicro can deliver ARM based servers now, they aren't AMD products, and what SeaMicro can do, Dell, HP, Penguin, System Fabric Works, and Boston are already doing with Marvell, Calxeda and AppliedMicro ARM chips. What remains to be seen is what kind of implementation of the stock ARMv8-A architecture AMD has planned. What's certain is that the company will not be alone in using the core, as Nvidia's "Logan" Tegra and a myriad of other vendors of the Cortex-A50 series will also enter the market.

The company has made a couple of astute hires in recent months in Jim Keller and John Gustafson, but it's disconcerting to see the staff turnover passing out of AMD's roost. In recent years the company has seen two CEOs part, Hector Ruiz and Dirk Meyer, along with many other senior executives including Eric Demers (CTO of graphics), Rick Bergmann (products group GM), John Bruno (chip architect), Thomas Seifert (CFO), Bob Feldstein (VP-Strategic Development), Emilio Ghilardi (chief sales officer), Carrell Killebrew (GPU strategy architect), Chris Cloran (Manager Client Product Development), Godfrey Cheng (Dir. Client Technology Unit), and the staff of the Operating System Research Centre (OSRC).

Ultimately, AMD's success resides as much in its future vision as it does in its competitors' performance.

This article was contributed by Graham Singer, better known in TechSpot's community as dividebyzero. We are very grateful for Graham's contribution and more than anything it makes us proud to show off our reader's clever insights into the tech industry.