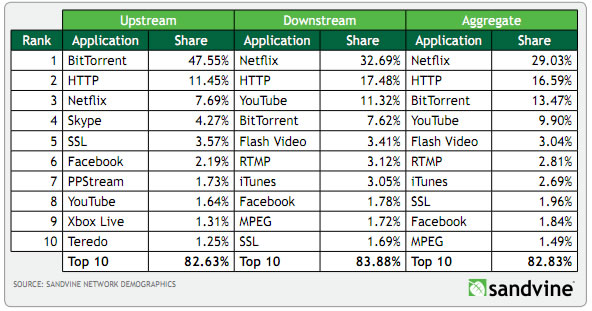

Despite losing 800,000 members, Netflix still accounts for a whopping 32.7% of all North American peak fixed access downstream traffic, according to Sandvine's fall 2011 Global Internet Phenomena Report. That's up nearly 10% since spring 2011 and almost double the peak traffic of the next largest source, HTTP at 17.5%.

Netflix pumps nearly three times as much bandwidth as YouTube and it accounts for 29% of peak aggregate traffic, ahead of HTTP's 16.6% and BitTorrent's 13.5%. In fact, the only statistics not dominated by Netflix are upstream-related. It's responsible for 7.7% of upload traffic, behind HTTP's 11.5% and BitTorrent's 47.6%.

As evidenced by its loss of nearly a million subscribers, Netflix has been treading some harsh water in recent months following several unpopular decisions. While this has prompted many to question the company's future, Sandvine doesn't foresee a significant decline in the service's traffic because it's so widely available.

"With so many Netflix-capable devices, the addressable market of the service is already enormous and will only increase, so it's hard to envision a scenario in which absolute levels of Netflix will decline," the report said. "However, Netflix is facing increased local competition, and as a result new services might grow at a faster rate."

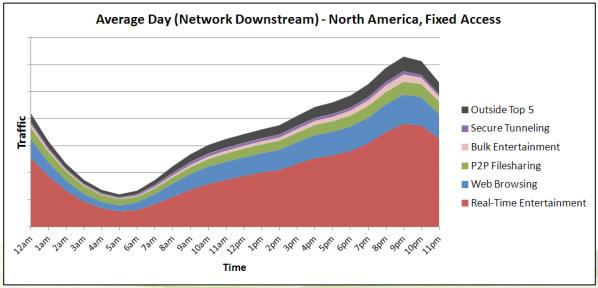

You'll notice the chart above is largely comprised of entertainment services and most of that traffic is destined for televisions – be that directly to smart TVs or through an external device such as a game console. The remaining 45% is downloaded to desktops and laptops, but even some of that is inevitably displayed on TVs.

Sandvine believes the increasing consumption of on-demand entertainment is partly because consoles are striving to serve as home theater hubs. The Xbox 360 alone offers video from many Web services such as Netflix, not to mention separate deals with conventional content providers like Bravo, Comcast, HBO, BBC and more.

The research outfit also drew attention to a shift in usage behavior. While people are consuming about the same bandwidth as measured earlier this year, they're doing it in an increasingly smaller duration. Sandvine says this is worrying for Internet service providers as network traffic becomes more concentrated, i.e. less efficient.

"In a perfectly efficient network, the daily usage 'curve' would actually be a flat line. In reality, all the whitespace in Figure 1 (above) corresponds to inefficiency – time during which there is available, but unused, capacity." Providers are seeking methods to balance usage patterns, but Sandvine believes monthly caps are ineffective.

While monthly bandwidth restrictions only have a minimal impact on peak network demand, implementing quotas that differentiate between peak and off-peak usage might work. For instance, instead of giving users 200GB to use for the entire month, they'd have 200GB to use during peak hours while off-peak would be unlimited.

"As an added benefit, the user would perceive a higher value of service (again, if 'value' is directly associated with data consumption) due to increased overall usage, without the network operator incurring additional cost to deliver the off-peak bytes. Higher subscriber value and flat operator costs? Sounds like a classic win-win."

There's plenty more information in the study, which can be downloaded free here. In somewhat related news, it's interesting to note that as on-demand entertainment traffic is on the rise, Time Warner Cable shed 128,000 subscribers to its video services this quarter, though the company is reluctant to admit the loss is due to cord-cutting.